What's Really Going On In China

Authored by Charles Hugh Smith via OfTwoMinds blog,

Losses will be taken and sacrifices enforced on those who don't understand the Chinese state will no longer absorb the losses of speculative excess.

Let's start by stipulating that no one outside President Xi's inner circle really knows what's going on in China, and so my comments here are systemic observations, not claims of insider knowledge.

Many western observers have noted the centrality of Marxist-Leninist-Maoist doctrine in President Xi's writings. This is somewhat akin to invoking America's Founding Fathers to support one's current policies: if you're trying to modify state policy in China, you have to explain it in the context of the Chinese Communist Party's history and doctrines. Never mind if the ideals were not met; what's important is establishing continuity and resonance with the history of China, the core doctrines of Chinese Communism and the CCP's leadership based on those doctrines.

That said, we should be careful not to read too much into doctrinal evocations such as common prosperity, which are useful conceptual anchors and slogans but not the full story.

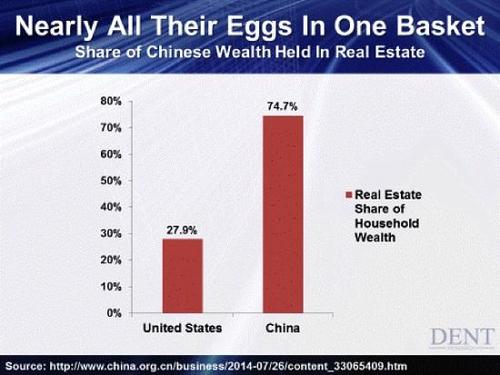

What's actually happening in China isn't Marxist or Capitalist--it's plain old non-ideological human greed, hubris and magical thinking manifesting as moral hazard running amok.. Moral hazard-- the separation of risk and consequence, as speculators make increasingly risky bets because they know any losses will be covered by the state--is effectively the new State Religion in China: everyone is absolutely confident that every punter, especially all the rich, powerful, well-connected speculators--will be bailed out by the central government.

Greed knows no bounds when a speculator is insulated from risk, for people have an insatiable appetite for risky bets when the gains will be theirs to keep but any losses will be covered by the government.

This is the fundamental story of Evergrande: the implicit backstop of the Chinese government enabled near-infinite moral hazard which then fueled an explosion of debt-funded speculation with essentially zero connection to real-world risks, sales, return on capital, etc.

Both the U.S. and China have been a utopian Paradises of moral hazard for the past 30 years. In the U.S., the Federal Reserve would bail out any losses / declines in the debt-asset bubble orgy.

In China, the implicit policy was that the structural losses in state-owned enterprises (SOEs) and the speculative excesses of rapid development would be tolerated as long as real growth in employment, wages, profits and lifestyles was strong. Creating vast amounts of debt-money was necessary to support growth, and that it also supported speculative excesses was accepted as part of the price of explosive progress, much like environmental damage.

After 30 years, the equation in China has changed: debt in the official banking sector and in the informal shadow-banking sector has soared along with purely speculative excesses while "good growth" has stagnated. That's the problem with incentivizing moral hazard: the profits from speculation, corruption and fraud far outweigh the puny profits earned by legitimate enterprises. So where do you put the borrowed billions? In Evergrande and other conglomerates of speculation.

Something else changed in 30 years of rapid development: inequality skyrocketed, and since inequality and corruption are mutually-reinforcing, corruption also reached new heights as inequality skyrocketed.

A third factor emerged after 30 years of touting technology and speculation: the power of Chinese Big Tech and financiers began encroaching on the control of the Communist Party.

All three factors inflated a debt-asset-speculative bubble of profound proportions, and President Xi grasped what the clueless Federal Reserve and other western central banks have not: Either pop the bubble when you still have some control over it or let it expand and pop when you've lost all control.

In systems terms, when risk and fragility reach unstable levels in tightly-bound systems, there's no controlling the supernova-like implosion of the system.

Xi observed the skyrocketing power of Big Tech, moral-hazard-incentivized financiers and cryptocurrencies and concluded that the state must move decisively to crush these rivals, regardless of cost. This separates China from the American state, which is incapable of enforcing any sacrifices, limits or costs on the parasitic elite which dominates its economy and political order.

Xi saw the danger of Big Tech and financiers being able to buy whatever influence they needed from corrupt CCP and state officials, and he realized that this is the crucial moment in history: either crush Big Tech and the financiers / speculators or risk losing control to their interests.

Control is something the CCP and Xi want to retain, regardless of the cost to the nouveaux riche, the parasitic elites, the aspirational middle class and even the Party regulars who have supped too often and too gloriously at the corruption / moral hazard trough.

Losses will be taken and sacrifices enforced on those who don't understand the Chinese state will no longer absorb the losses of speculative excess. Those who don't understand the reign of parasitic private-sector elites and excessively corrupt party officials in China is over might profitably ponder this Chinese proverb: "Whoever gets mixed up with garbage will be eaten by pigs."

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

My recent books:

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World (Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

https://ift.tt/3lWAbkp

from ZeroHedge News https://ift.tt/3lWAbkp

via IFTTT

0 comments

Post a Comment