Hedge Fund CIO: There's A Growing Consensus The Fed Will Keep Going Until The Market Breaks

By Eric Peters, CIO of One River Asset Management

“Let me now say a few words to those countries who are currently sitting on the fence, perhaps seeing an opportunity to gain by preserving their relationship with Russia and backfilling the void left by others. Such motivations are short-sighted,” said America’s Treasury Secretary on April 13th. “Going forward, it will be increasingly difficult to separate economic issues from broader considerations of national interest, including national security,” continued Yellen, confirming our suspicions.

The era of monetary policy dominance - when the actions of central bankers dominate the economy, markets, and indirectly, politics – has passed. Politicians and politics are now ascendant.

The impact from this on fiscal policy, domestic politics, and geopolitics will be as profound as it will be long-lasting. Buckle up.

“Let’s be clear. The unified coalition of sanctioning countries will not be indifferent to actions that undermine the sanctions we’ve put in place,” explained Janet. China’s renminbi has been falling ever since. Naturally, the market must price the possibility that Beijing will suffer sanctions too.

And if Germany now regrets strengthening Russia by buying Putin’s gas for all these years, in this new era, is it reasonable to expect the US to support China by trading so freely with Xi?

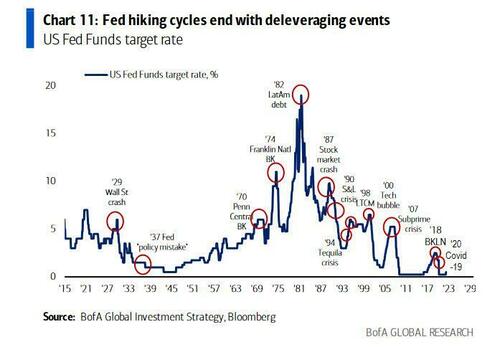

Back in the era of monetary policy dominance, easy money led to debt expansion and market booms, which provoked rate hikes, recession, followed by renewed easing. Rates were set to lower-highs and lower-lows in each cycle, a secular trend. And in each cycle, debt and leverage rose in the aggregate, shifting around sectors like a hot potato.

But the whole process was generally mean reverting. Politics does not exhibit the same kinds of mean reverting properties once politicians awaken, reassert their power.

That process has only just started. And it has begun in a period when the Fed is no longer able to ease policy. It is now caught between trying to engineer either a soft or a hard landing.

The “fragmented political and economic situation” makes supply chains “fragile” and “less globalization means higher inflation and less productivity,” explained Fed Chair Powell, attempting to conduct monetary policy in a world growing increasingly political.

Team Market Chats

“The data looks mixed, but things like the backlog of ships loading and unloading in Shanghai gives me pause,” wrote Chase, pinning a historical graph to the chat that was not the kind of thing you’d want to see if supply chains were unkinking. “The NFIB survey shows small businesses are more pessimistic about the business outlook and about inflation than they were in the 1970s,” wrote Lindsay, pinning a chart going back to 1974. “The internals of the Philly Fed manufacturing survey are flashing recession,” wrote Marcel, pinning a chart of forward demand and prices.

“There are two periods when such a decline in forward orders did not accompany a recession – 1988 and 1995,” continued Marcel in the chat. “In both cases, price pressures moderated sharply, and demand recovered. The 1974 recession is an interesting one where the price moderation was very modest, demand recovered, inflation stuck at a high level, and rolling inflationary recessions followed. The burden of proof is increasingly on those who see an elongated expansion as that is not in the data any longer,” wrote Marcel.

“There’s a growing consensus the Fed will keep going until the market breaks,” wrote Marcel, connected throughout global policy circles.

“High-yield spreads are almost a target variable. They’re not afraid of equity/credit downside,” he wrote. “This has been getting a lot of traction in the past 24-48hrs,” replied Chase.

“Everyone I talk to: Is inflation slowing much/faster than the central bank expected? No.

Are we seeing the growth slowdown that will scare central banks? No.

Are financial assets panicking in a way that will scare central banks? No,” wrote Chase. On our Team Markets Chat.

Choices:

“Discretionary tech will get hammered through year end,” said the CIO. Netflix had reported, its stock in free fall. “Food, energy, and rent are all up more than CPI. Discretionary tech is fun, not needed, and these things get tossed when money gets tight,” he said. “Say 5% needs to come out of your budget, what goes?” he asked.

“I saw this dynamic before the 2000-01 recession, which was more normal, not like 2008-09 or 2020,” he said. “I don’t think we’ll have a recession as companies need every available worker, but inflation will force the average person to make choices, cuts.”

https://ift.tt/0amfc52

from ZeroHedge News https://ift.tt/0amfc52

via IFTTT

0 comments

Post a Comment