Mike Wilson: Inflation Is No Longer A Positive For Earnings Growth... Or Stocks

Morgan Stanley's runner-up in the "Biggest Wall Street Bear" category (to BofA's Michael Hartnett whose weekly Flow Show doom and gloom is now a source of inspiration for bears everywhere) is out with his own weekly dose of pessimism and in his latest US Equity Strategy note, Morgan Stanley chief US equity strategist Michael Wilson writes that "Q1 earnings season will be more disappointing than thought" and that "inflation is no longer a net positive for earnings growth."

Wilson, whose bio and message header speaks for itself, and hints that bulls are now "the greater fool"...

... predicts that "earnings revisions will decelerate amid 1Q reporting season as the MS Business Conditions Index (a survey of industry analysts) just fell further and margin headwinds mount / are not fully reflected in consensus estimates. Stocks should discount this risk via the ERP channel."

Worse, Wilson argues against of the most recurring (and perplexing) arguments spread by the bears, namely that inflation is actually positive for stocks - which it is, to a point - and according to Wilson, that point has now been reached and writes that "inflation is no longer a net positive for earnings growth given the impact on costs that are now showing up in margins."

Wilson also warns that the war in Ukraine has led to a spike in energy and food costs "which serve as nothing more than a tax on a consumer that is already struggling with high inflation." In other words, Wilson thinks the positive effects of inflation on earnings growth have reached their peak and are now more likely to be a headwind to growth, particularly as inflation forces

the Fed to remain "max hawkish."

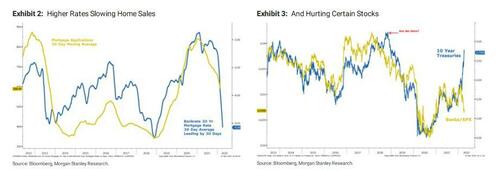

In that regard, the strategist warns that the significant rise in back end rates is having a meaningful impact on interest rate sensitive areas of the economy and market, like housing.

In practical terms, this means bad Q1 earnings and even uglier earnings for the rest of the year. Indeed, Wilson warns that signs are emerging that Q1 earnings season may be more disappointing than thought... particularly from a guidance/forward estimate standpoint. Case in point, earnings revisions breadth for the S&P 500 has resumed its downtrend over the past 2 weeks and is once again approaching negative territory, while the Morgan Stanley Business Conditions Index (a survey of the bank's industry analysts) fell to its lowest level since April of 2020, and echoing a warning he has frequently made in recent months, Wilson cautions that "margin expectations look overly optimistic for the balance of '22given the myriad of cost pressures companies face."

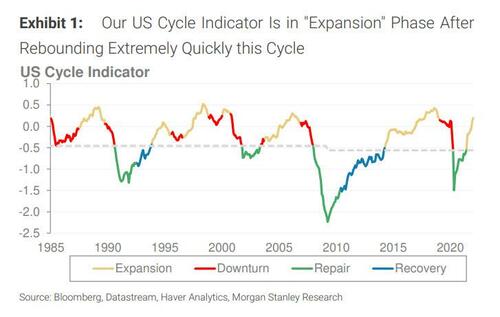

Starting at the top, Wilson first reminds us that last week he explained why stocks are sending different message about growth than bonds, and laid out the case for why stocks are likely to be the most trusted on this messaging and reiterated his preference for late-cycle Defensives... and yes, according to Wilson, the economy is very late cycle now we "Could Be In A Recession 5-10 Months From Now."

Today, Wilson lays out out the inevitable next step, namely the case for why this earnings season may finally bring the downward revisions to NTM EPS forecasts that have remained elusive, thus far. However, before we get into that analysis let's examine if stocks are telling us anything about where earnings are headed.

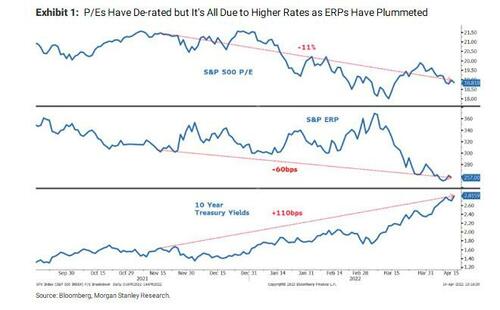

In Wilson's experience, P/Es tend to de-rate significantly when the market no longer believes the forecasts. Perhaps the old adage, "never buy a cheap cyclical stock" summarizes that point the best. Indeed, while P/Es have derated this year as we expected, they remain stubbornly high when taking into account the historically sharp rise in 10 year yields. In short, P/Es are down about 11% since Wilson published his (bearish) year ahead outlook, but that de-rating has come from higher rates, as the Equity Risk Premium has plummeted.

This would suggest that the equity market is not worried about growth at all but just higher rates. In fact, with the equity risk premium now at its lowest level since the GFC and since the financial repression era began, Wilson claims that "it's fair to say the equity market is less worried about growth today than it has been at any other time over the past 15 years."

Wilson then goes back to his point that inflation is no longer a net positive for earnings growth (given the latent impact on costs that are now showing up in margins), and while also warning that the war in Ukraine has led to a spike in energy and food costs "which serve as nothing more than a tax on a consumer that is already struggling with high inflation", the strategist concludes that the "positive effects of inflation on earnings growth have reached their peak and are now more likely to be a headwind to growth, (particularly as inflation forces the Fed to remain uber hawkish) and in that context, the growing rise in back end rates is having a meaningful impact on interest rate sensitive areas of the economy and market, like housing and impacting stocks.

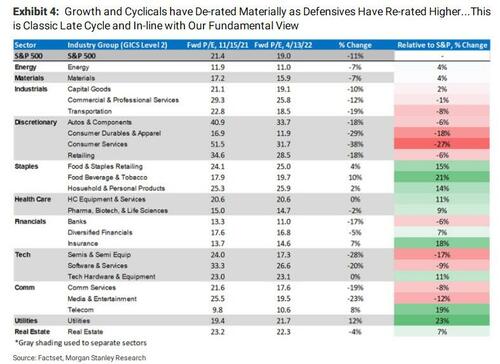

This "peak benign inflation" explains to Wilson why the de-rating has been most severe in the expensive and/or economically sensitive areas of the market while defensive areas have actually seen multiples expand (Exhibit 4). This suggests the market is worrying about higher rates and slower growth even as the overall index remains expensive.

This is in line with MS's view for defensives to dominate in this late cycle environment. However, a stumped Wilson concedes that "the overall index remains a bit of a mystery with the P/E down only 11% in the face of a 120bps move in 10-year yields." He then chalks this up to the incredibly strong flows into equity from asset owners (both retail, pensions and other endowments) who seem to have made a decision to abandon bonds in favor of what is - for now - viewed as the better inflation hedge (stocks).

These flows are keeping the main index bid and more expensive thereby leaving the real message about growth at the sector level. To Wilson, the message is crystal clear and in line with his own bearish view—i.e., growth is slowing and likely more than most forecasts incorporate, especially for 2023 when the risk of recession has increased the most.

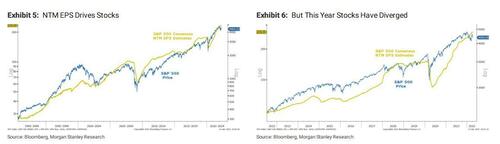

One other reason behind Wilson's chronic bearishness is that, in his experience, whereas stocks tend to go higher so long as forward estimates are rising, this year has bucked that pattern as shown below.

In Wilson's view, there is information in this price pattern "because stocks lead revisions historically by about 3-5 months. In short, stocks don't lie."

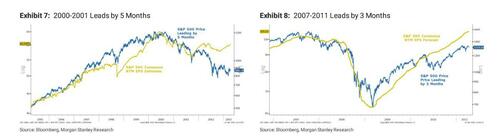

The strategist then goes on to warn that when stocks diverge from the NTM EPS it usually portends a change in trend, something which is shown in the next four charts which are some examples of this lead/lad between stocks and NTM EPS.

Wilson then asks if this year will be another example of us reaching an important inflection point for NTM EPS trend? He thinks the answer is yes, "and is why he also thinks the S&P 500 will eventually see a de-rating more commensurate with the de-rating already witnessed for the more cyclical parts of the market." In other words, equity performance (particularly within Cyclicals) may be sniffing out a forward EPS decline, but that decline is not fully priced. It goes back to the discussion above around not buying a cheap cyclical...waiting for the second or even third round of EPS cuts is typically prudent...and we haven't yet seen one round of cuts.

https://ift.tt/JT07Lmy

from ZeroHedge News https://ift.tt/JT07Lmy

via IFTTT

0 comments

Post a Comment