The Era Of A Financialized Fiat-Dollar Standard Is Ending

Authored by Alasdair Macleod via Goldmoney.com,

In recent articles I have argued that the era of a financialised fiat dollar standard is ending. This article takes my hypothesis further and explains that it is not just the emergence of new commodity backed currencies in Asia that will threaten the dominance of Western currencies, but the Fed’s failing monetary policies and those of the other major central banks. An unstoppable rise in interest rates will in large part be responsible for their demise.

Financial markets in thrall to the state underestimate the forces collapsing the financial bubble. Even the existence of the bubble is disputed by those within its envelope. But financial assets represent most of the collateral securing the banking system, and their collapse triggered by higher interest rates will take out businesses, banks, even central banks and make financing of soaring government deficits impossible without accelerated currency debasement.

Will central banks try to preserve financial asset values to stop the West’s financial system from imploding?

Keynesian theory demands increased deficit spending to counteract the contraction of bank credit.

As long as this is the case, the planners will destroy their currencies - confirmed by the John Law episode in 1715-1720 France. It is from this fate that China, Russia, and the architects planning a new Central Asian trade currency are planning their escape.

End of an era and how it all started

It’s all about interest rates. Rising interest rates undermine financial asset values and falling rates increase them. From 1981 until March 2020, the trend has been for the inflation of prices to subside and interest rates to decline with them. And following Paul Volcker’s interest rate hikes at that time, this is when the era of economic financialisation commenced.

In the early eighties, London underwent a financial revolution with banks taking over stockbrokers and jobbers. It was the end of single capacity, whereby you were either a principal or agent, but never both.

America responded to London’s big-bang by rescinding the Glass-Steagall Act, which separated investment from commercial banking following the 1929—1932 Wall Street Crash. Money-centre banking was about to go all-in on financialisation. Increasingly, manufacturing of consumer goods was moving from America and Europe to China and the Far East. The Wall Street megabanks had less of this business as a proportion of total American and European economic activities to finance. Small, local banks, particularly in Europe, continued to be the financing backbone for small enterprises.

Banking had begun to split, with financial activities increasingly dominating the business of the larger banks. The rise of derivatives, firstly on new regulated exchanges and then in unregulated over-the-counter markets became a major activity. They promised that risk was eliminated by being hedged — there was a derivative to cover anything and everything. Securitisations became all the rage: mortgage-backed securities, collateralised debt obligations and CDOs-squared. So great was the demand for this business that banks were financing it off-balance sheet due to lack of adequate capital, until the Lehman speedbump temporarily knocked the wheels off from under this business. Since then, government spending has dominated financing requirements, providing high quality collateral for yet further credit expansion, much of it in shadow banking, and leading to a veritable explosion in the size of central bank balance sheets.

The decline in interest rates from Paul Volcker’s 20% in 1980 to zero in 2020 drove financial asset values forever upwards, with only brief interruptions. Crises such as in Russia, Asia, the Long-Term Capital Management blow-up, and Lehman merely punctuated the trend. Despite these hiccups the character of collateral for bank lending became increasingly financial as a result. Expanding credit on the back of rising collateral values had become a sure-fire money-spinner for the banks. The aging Western economies had finally evolved from the tangible to ethereal.

For market historians it has been an instructive ride, contemporary developments that have matched or even exceeded bubbles of the past. What started as the emergence of yuppies in London wearing red braces, sporting Filofaxes, and earning previously undreamed-of bonuses evolved into a money bubble for anyone who had even a modest portfolio or could get a mortgage to buy a house.

The trend of falling interest rates has now ended, and the tide of financialisation is on the ebb. Recent events, covid lockdowns, supply chain disruptions and sanctions against Russia provide the tangible evidence that this must be so. You do not need to be a seer to foretell a commodity price crisis and the prospect of widespread starvation from grain and fertiliser shortages this summer. Common sense tells us that the end of the financialisation era will have far-reaching consequences, yet the outlook is barely discounted in financial markets.

With their noses firmly on their valuation grindstones, analysts do not have a grasp of this bigger picture. That is beginning to change, as evidenced by Augustin Carsten’s mea culpa over inflation. Carsten is the General Manager of the Bank for International Settlements, commonly referred to as the central bankers’ central bank, which takes a leadership role in coordinating global monetary policy. The objective of his speech was to assist central banks in coordinating their policy responses to what he belatedly recognises is a new monetary era.

Inflation is not about prices: it’s about currency and credit

One of the fatal errors made by the macroeconomic establishment is about inflation. The proper definition is that inflation is the debasement of a currency by increasing its quantitiy. It is not about an increase in the general level of prices, which is what the economic establishment would have us believe. The reason this is particularly relevant is because governments through their central banks have come to rely on increases in the quantity of currency and credit to supplement taxes, allowing governments to spend more than they receive in terms of revenue. To properly describe inflation draws unwelcome attention to the facts.

Since the Lehman failure in 2008, the combined balance sheets of some of the major central banks have increased from just under $7 trillion to $31 trillion (Fed + ECB + BOJ + PBOC, according to Yardini Research). The steepest part of the rise was from March 2020, when assets for the Fed and ECB soared. While justified, perhaps, by the covid pandemic the effect has been to dilute the purchasing power of each currency unit. And as that dilution works its way into the economy it is reflected in higher prices.

That bit is familiar to monetarists. What monetarists fail to account for is the human reaction to the currency dilution. When the public becomes aware that for whatever reason prices are rising at a faster pace, they will increase the ratio between goods purchased and therefore in hand to that of their available currency resources. That drives prices even higher still and there is then a risk that price rises will escalate beyond the authorities’ ability to control them. This phenomenon has been a particular weakness of American and British consumers, who have a low level of savings priority. When Paul Volcker raised interest rates to a penalising 20% in 1980 it was to reverse the tendency for individuals to dispose of their personal liquidity in favour of goods.

The sanctions against Russia sent a clear signal to western consumers about rising energy costs, and already they are seeing the impact across a wide range of consumer products. Nothing could be more calculated to convince consumers that they should anticipate and satisfy their future needs now instead of risking yet higher prices and shortages of available goods. And we can be equally sure that governments and their central banks stand ready to ensure that no one need go without.

That this has come as a surprise to central banks indicates an appalling failure to anticipate the entirely predictable consequences of inflationary monetary policies. Additionally, central banks have failed to grasp the true relationship between money and interest rates.

The errors of interest rate policies

Central banks use interest rates as their primary means of managing monetary policy. They make the error of assuming that interest rates are no more than the price of money. If they are raised, demand for money is meant to decrease and if they are lowered demand for money is expected to increase. And through demand for money, demand for goods and their prices can be managed. Therefore, it is assumed that inflation and economic performance are controlled by managing interest rates.

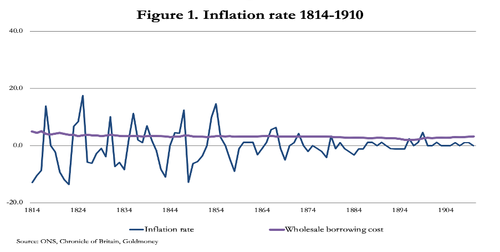

This flies in the face of the evidence, as the chart in Figure 1 shows, which is of the relationship between the rate of inflation and interest rates in the form of wholesale borrowing costs in Britain, before the Bank of England muddied the waters by using interest rates to manage monetary and economic outcomes.

The correlation was between the general price level and interest rates instead of between the rate of change and interest rates. The distinction might not at first be obvious, but the two are entirely different.

Keynes, and all other eminent economists were unable to explain the phenomenon, attributed by Keynes to Arthur Gibson as Gibson’s paradox. The explanation is simple. In his business calculations, an entrepreneur must estimate the price his planned manufactured product would obtain, based on current prices. All his calculations hang on that assessment. It sets the basis of his affordable financing costs, from which he could estimate the profitability of an investment in production after his other costs. If prices were high, he could afford to pay a higher rate of interest and would be willing to bid up interest rates accordingly. If they were low, he could only afford a lower rate. That is why interest rate levels tended to track wholesale price levels and not their rate of change. Thus, it was entrepreneurial borrowers in their business calculations who set interest rates, not, as Keynes assumed, the idle rentier deriving an unearned income by demanding usurious rates of interest from hapless borrowers. If anything, fluctuations in the price level (ie the rate of price inflation) destabilised business calculations.

To an investing entrepreneur, interest is certainly a cost. But the position for a lender is entirely different. When he lends money, its usefulness is lost to him over the term of a loan, for which he reasonably expects compensation. This is known as time-preference. Additionally, there is the risk the money might not be returned, if for example, the borrower defaults. This is the risk involved. And in these times of fiat currency, there is the further consideration of its potential debasement by the end of the loan. Unless all these issues are satisfied in the mind of the lender, the availability of monetary capital from savings for business investment and for cash flow purposes will be hampered.

Under a gold standard, the debasement issue does not generally apply. An indication of the sum of time preference and lending risk can be judged from the coupons paid on government debt, which in the case of the British government in the nineteenth century was 3% on Consolidated Loan Stock issued between 1751 and 1888, subsequently reduced to 2.75% and then 2.5% in 1902.

Even when a currency in which a loan is struck is gold backed, an interest rate of two or three per cent for a prime borrower was shown to be appropriate. For them to go any lower implies, as John Law stated in the quote later in this article, that currency is being expanded with a view to driving interest rates below a natural level.

Not only are central bank interest rate policies founded on a misconception proved by Gibson’s paradox and its explanation, but the entire operation distorts economic outcomes and cannot ever succeed in their objective. And as for distortions taking bond yields into unnatural negative territory as has been the case in Japan and the Eurozone, the unwinding thereof promises to result in economic and monetary catastrophe, because borrowers, including governments, have been hoodwinked into irresponsible borrowing for borrowing’s sake.

The monetary myths shared by Law and Keynes

We know that financial asset values are going to fall, because with consumer and producer prices rising strongly, interest rates and bond yields will continue to rise. So far, the yield on the 10-year US Treasury note has risen from 0.5% in August 2020 to 2.9% this week. The value destruction for this indicator has been over 20% from par so far. But according to government statistics, US consumer prices are rising at 8.5%, and likely to increase at an even faster rate when the consequences of Russian sanctions begin to do their work. Therefore, the yield on US Treasuries of all maturities is set to increase considerably more. Unless, that is, the Fed adopts the policy of the Bank of Japan and intervenes to stop yields rising.

We are witnessing the effect of yield suppression on the Japanese yen, which since 4 March has fallen over 12% against the dollar. The relationship between a central bank rigging financial asset values and the effect on the currency is being demonstrated. In 1720 France John Law similarly tried to stop his Mississippi shares from falling by issuing unbacked livres expressly to buy shares in a support operation. It is worth drawing attention to the similarities of that experience with current developments in markets and currencies.

Like Keynes over two centuries later, Law believed in stimulating an economy with credit and by suppressing interest rates. Keynes formulated his approach as a response to the great depression, despite (or because of) the US Government’s attempts to fix it having continually failed. Keynes in effect started again, dismissing classical economics and invented macroeconomics in its place. Law similarly recommended a reflationary solution to a struggling French economy burdened by the bankruptcy of royal finances. Law proposed to stimulate it by issuing a new currency, livres, as receipts for deposits in coin. The convenience of notes, which would be accepted as settlement for taxes and other public payments, was expected to ensure they would replace coin. Keynes’ version was the bancor, which was not adopted, but the US dollar acted as the vehicle for global stimulation in its place.

Both currency proposals were not overtly inflationary at the outset, nor was the adoption of the dollar in the bancor’s place. But they gave the issuers the flexibility to gradually loosen them from the discipline of metallic money. In October 1715 at a special session at the chateau de Vincennes, Law made his proposal to the Council of Finances, stressing that his proposed bank would only issue notes in return for deposits of coin. In other words, it would be a deposit bank only. The Council turned down Law’s proposal, but in May 1717, he finally got the go-ahead to establish a “general bank”. That became the Royal Bank the following year, a forerunner of today’s central banks. It was then to be merged with Law’s Mississippi venture in February 1720. The Mississippi venture included two other companies which all together represented a monopoly on France’s foreign trade and Law needed to raise funds to build ships.

Having obtained his original banking licence, Law proceeded to inflate a financial bubble to finance his project, and to create sufficient revenues to pay down the royal debts. His appointment to the official role of Controller General of Finance in early 1720 enabled him to finance the bubble by expanding a combination of credit and paper currency without having to clear the expansion of currency through Parliament, which was the procedure until then. In late 1719, Law was already buying Mississippi shares using new currency, an action which foreshadowed today’s quantitative easing.

Central to Law’s strategy was the suppression of interest rates. As early as 1715, he wrote:

“An abundance of money which would lower the interest rate to 2% would in reducing the financing costs of the debts and public offices etc, relieve the King. It would lighten the burden of the indebted noble landowners. This latter group would be enriched because agricultural goods would be sold at higher prices. It would enrich traders who would then be able to borrow at a lower interest rate and give employment to the people.”

Today, we know this as Keynesian economic theory. The expansion of the currency was especially dramatic in early-1720, with an already bloated one billion livres in circulation at the end of 1719 from a standing start in only thirty months. In a desperate attempt to support the shares in a falling market, this had expanded to 2.1 billion livres by the middle of May.

The addition of all this paper and credit led to prices of goods rising at a monthly rate of over 20% by January 1720. Unsurprisingly, Law refused to pay out gold and silver for the supposedly backed livres, and the collapse of the whole scheme ensued. By September, the Mississippi shares had fallen from 10,000L to 4,000L, but the currency in which the shares were priced was worthless on the London and Amsterdam exchanges.

The lessons for today cannot be ignored. Law ruined the French economy with his proto-Keynesian policies. Today, with quantitative easing the same policies are a global phenomenon. Law’s support operations for royal finances are no different from today’s suppression of government bond yields. And now that prices for goods are beginning to rise, in all certainty there will be an even greater crisis for food prices in the coming months, just as there was widespread starvation in France in the summer of 1720.

How to profit from these mistakes

Not only do we have in 1720s France a precedent for today’s economic and financial conditions, but Richard Cantillon gave us a strategy of how to profit from the situation. He showed that it was not sufficient just to sell financial assets for currency, but the currency itself presented the greater danger of losses.

Today, Cantillon is known for his Essay on Economic Theory and the Nature of Trade in General. The Cantillon effect describes how currency debasement gradually progresses through the economy, driving up prices as it enters circulation. Cantillon operated as a banker in Paris during the Mississippi bubble, dealing in both the shares and the currency. He traded both Mississippi shares in Paris and South Sea Company shares in London on the bull tack, selling out before they collapsed. He proved to be an accomplished speculator in these bubble conditions.

As a banker, Cantillon extended credit to wealthy speculators, taking in shares as collateral. From the outset he was sceptical of Law’s scheme and would sell the collateral in the market after prices had risen without informing his customers. When Law’s scheme collapsed, he benefited a second time by claiming the debts owed from the original loans, claims that were upheld in a series of court cases in London, because the shares being unnumbered were regarded as fungible property which like money itself could not be specifically identified and reclaimed by an earlier owner.

His second fortune was from shorting the currency on the exchanges in London and Amsterdam by selling the livre forward for other currencies which were encashable for specie. And it is that action which can guide us through the end of the era of the dollar’s financialisation and the likely consequences for the currency.

Today, the other side of the dollar’s difficulties is the availability of alternatives. Gold is still legally true money in coin form, and it can be expected to protect individual wealth in a livre-style collapse. Today, there are cryptocurrencies, such as bitcoin, but they will never be legal tender and because previous ownership can be traced through the blockchain they can be seized if identified as stolen property. Then there are central bank digital currencies, planned to be issued by the organs of the state that have already made a mess of fiat currencies. Whichever way this question is considered, we always return to gold as the sound money chosen by its users — and that was what Cantillion effectively bought in selling livres for specie-backed currencies.

In the current context the concept that future currencies will relate to commodities and not financial assets is particularly interesting. This thinking appears to be embodied in a new pan-Asian replacement for the dollar as a payment medium.

The Eurasia Economic Union

Russia, China and the members, associates and dialog partners of the Shanghai Cooperation organisation appear to understand the dangers to them from a currency collapse of the dollar, other Western currencies and of associated financial assets. There are three pieces of evidence that this may be so. Firstly, China responded to the Fed reducing its funds rate to zero and the introduction of monthly QE of $120bn in March 2020 by stockpiling commodities, raw materials, and grains. Clearly, China understood the implications for the dollar’s purchasing power. By backing its economy with commodity stocks she was taking steps to protect her own currency from the dollar’s debasement.

Secondly, sanctions against Russia rendered the dollar, euro, yen, and pounds valueless in its national reserves. At the same time, sanctions have pushed up commodity prices measured in those currencies. Russia has responded by insisting on payments for energy from “unfriendly nations” in roubles, while the central bank has resumed buying gold from domestic producers. Again, the currency is reflecting its commodity features. And lastly, the Eurasia Economic Union, which combines Russia, Armenia, Belarus, Kazakhstan and Kyrgyzstan, has proposed a new currency in conjunction with China.

Details are sketchy, but we have been told that the new currency will combine the national currencies of the nations involved and twenty exchange-traded commodities. It sounds like it will be a statist version of earlier gold standards, with perhaps 40-50% commodity backing, presumably to be fixed against national currencies daily. Like the SDR, it will be supplemental to national currencies, but used for cross-border trade settlement. The involvement of both China and Russia suggests that it might be adopted more widely by the Shanghai Cooperation Organisation, representing 40% of the world’s population and freeing them from the dollar’s hegemony.

The original motivation was to remove a weaponised dollar from pan-Asian trade, but recent developments have imparted a new urgency. Rapidly rising prices, in other words an accelerating loss of the dollar’s purchasing power, amounts to a transfer of wealth from dollar balances in Asian hands to the US Government. That is undesirable for the EAEU members. Furthermore, the flaws in the yen and the euro have become obvious as well. All Western currencies will almost certainly be undermined by their central banks’ resistance to rising bond yields as the John Law experience Mark 2 plays out.

It might prove impractical for westerners to access this new currency to escape the collapse of their own national currencies. Anyway, a new currency must become established before it can be trusted as a medium of exchange. But the concept appears to be in line with Sir Isaac Newton’s rule of a 40% gold backing for a currency to be always maintained. The difference is that instead of the issuer lacking the flexibility to inflate the currency at will, the composition of the proposed Eurasian currency can be altered by the issuer.

Putting this objection to one side, prices of commodities measured in goldgrams appear to have been remarkably stable over long periods of time. Certainly, wholesale prices in nineteenth century Britain under its gold standard confirm this is so.

Figure 2 shows a remarkable stability of prices for a century under an uninterrupted gold coin exchange standard. The variations, most noticeable before the 1844 Bank Charter Act, are due to a cycle of expansion and contraction of bank credit. And the gentle increase from the late-1880s reflected the increased supply of gold from the Witwatersrand discoveries in South Africa. Whisper it quietly, but this remarkable price stability, coupled with technological developments, with minimum government saw a relatively small nation come to dominate world trade.

If the Eurasia Economic Union manages to establish a stable currency similarly backed by commodities as the British pound was by gold, a pre-industrialised Central Asia holds out the promise of a similar economic advancement. But that will also require a hands-off approach to markets, which is not in character for any government, let alone the authoritarians in Central Asia.

The value destruction ahead

So far, this article has drawn attention to the ending of an era of fiat currency financialisation, the monetary policy errors, and the contrasting developments in Asia, where a preference for commodity backing for roubles, yuan and a new Eurasian currency is emerging. The success of the Asian currencies is set to destabilise those of the West. But irrespective of the future for Asian currencies, the West’s currencies bear the seeds of value destruction within themselves, simply because their evolution has nowhere further to go other than downhill.

There is a complacent assumption that central banks are in control of interest rates and always will be. What is missing is an understanding of markets, which ultimately reflect human action. It is an error which eventually leads to states’ combined actions failing completely.

We saw this in the 1970s, after the last vestiges of gold backing for the dollar were abandoned with the suspension of the Bretton Woods Agreement. Not only did the dollar lose its tie to gold, but all other currencies from that moment lost it as well. Consequently, inflation in the form of consumer prices began to rise shortly thereafter, fuelled by a combination of monetary expansion and loss of faith in currencies’ purchasing power — the latter particularly from OPEC members who demanded substantially higher dollar prices for crude oil. Despite the prospects for North Sea oil, the consequences for the UK’s government finances were catastrophic, leading to a bailout from the IMF in September 1976 (IMF bailouts were exclusively for third-world nations — for the UK this was beyond embarrassing). And the Labour government was forced to issue gilts bearing coupons of 15%, 15 ¼%, and 15 ½%.

Globally, we have a similar situation today, except instead of entering the post-Bretton Wood years with the US dollar’s Fed Funds Rate at 6.62%, we have entered the new commoditisation era with the FFR at zero. We exited the 1970s with a FFR of over 19%. In August 1971 when the Bretton Woods Agreement was suspended the yield on the 10-year US Treasury constant maturity note was 6.86%. By September 1981 it stood at 15.6%. In August 2020 it was at an unnatural 0.5%, going to —who knows?

In 1980, Paul Volker slayed the inflation dragon by hiking interest rates to economically destructive levels. It is hard to envisage a similar action being taken by the Fed today. But what we can see is the potential for consumer prices to rise, driven by currency debasement, to at least similar if not greater levels seen during the 1970s decade. Accordingly, bond yields have much, much further to rise. The bankruptcies of over-indebted businesses, their bankers, the central banks loaded with failing financial assets, and governments themselves all beckon.

Financial assets are at the top of their bubble, of that there should be little doubt. As interest rates rise, all financial assets will begin to collapse in value. That cannot be denied. And where financial assets interact with the real world, such as mortgage finance, the disruption will undermine values of physical assets as well. Financial assets represent a higher level of collateral backing for bank credit than on previous credit cycles. Forced collateral liquidation will also drive financial asset prices lower.

The potential for a crash on the scale of Wall Street between 1929—1932 should be obvious. Equally obvious is the likely reaction of central banks, which will surely redouble their efforts to prevent it happening. Quantitative easing is set to increase to finance all spendthrift government spending shortfalls, which can only escalate in these conditions. Central banks will be doing it not just because they want to preserve a “wealth effect” for the private sector, but to save themselves from the consequences of earlier currency debasement.

The central banks of Japan, the euro system, the UK and the US have all loaded up on government bonds, whose prices are just beginning to collapse, if the higher bond yields seen in the 1970s return. Central bank liabilities are beginning to exceed their assets, a situation which in the private sector requires directors to admit to bankruptcy and cease trading. In most cases, recapitalising a central bank is a simple operation, whereby the central bank makes a loan to its government, and though double entry bookkeeping, instead of the government being credited as a depositor it is credited as a shareholder. Simple, but embarrassing in the middle of a developing financial crisis. When pure fiat currencies are involved. Undoubtedly, this is what the Bank of Japan will be forced to do, but for now it is refusing to accept the reality of higher interest rates and the effect on its extensive portfolio of JGBs, corporate bonds and equity ETFs. Consequently, its currency, the yen, is collapsing.

The position of the ECB is more complex because its shareholders are the national central banks in the euro system which in turn will need bailing out. The imbalances in the TARGET2 settlement system are an additional complication, and outstanding repos last estimated at €8.725 trillion are there to be unwound.

Between Japan and the Eurozone, we can expect to see their currencies collapse first. Initially, the dollar will appear strong on the foreign exchanges reflecting their decline. But foreigners possess financial assets and deposits totalling over US$33 trillion on current valuations. If the Fed is unable to prevent bond yields from soaring much above current levels, most of this, including the $15 trillion invested in equities, will be wiped out. The destruction of value measured in collapsing currencies will be economically catastrophic.

It is to avoid this fate that first China, and now Russia are commoditising their currencies and even planning for a new cross-border settlement medium tied partially to commodity values. They hope to escape from interest rates rising in fiat currencies as they lose purchasing power. If the global conflict is financial, the West has lost it already. The geopolitical consequences are another story for a later day.

https://ift.tt/05TH9xt

from ZeroHedge News https://ift.tt/05TH9xt

via IFTTT

0 comments

Post a Comment