The Bond Market Is Calling For A Recession In Mid-2023... But That Has Not Eased Inflation Expectations

By Marcel Kasumovich,head of research at One River Asset Management and Paul Ebner, digital portfolio manager

1/ Market sentiment is a curious thing. For any idea to win the day, it needs to become a consensus opinion. Yet, once any idea is the consensus, investors fear being part of the herd. Asset manager surveys are useful guideposts for being alert to such cycles. None does it better than the long, rich, independent history of the Fund Manager Survey (FMS) from BofA. And at a time of unprecedented macro crosscurrents, it is worth taking stock of positioning.

2/ Are you part of the herd? Investors are demonstrating strong conviction in the latest survey. Uncertainty be damned. Yes, fund managers have built an above-average cash cushion in response to future unknowns. But that is where the indecisive investor mindset ends. Investor expectations for growth and corporate profits are the worst since 2008. Recession risk is the greatest concern. A conventional allocation to such a backdrop would be short stocks, long bonds, and long the US dollar. Instead, the consensus is powerfully positioned long commodities and an extreme short in bonds.

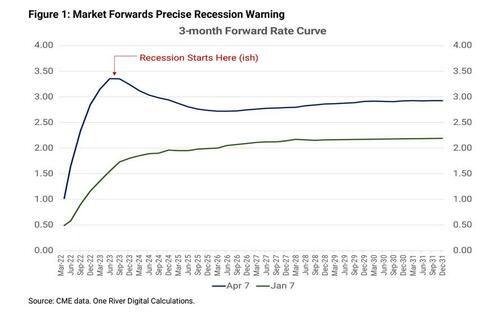

3/ Structural inflation. That is the central theme in the positioning of asset managers. The surveys do not foresee recession curing current inflation ills. It is also not a message unique to market sentiment surveys. Bond markets are emphasizing the same point. The curvature of short-term interest rate futures provides one of the most precise indicators of the business cycle. Expectations have shifted to a more rapid monetary tightening, with rate cuts in the second half of next year (Figure 1). The interpretation is simple – the wisdom of the bond-market crowd is calling for US recession to start in the middle of next year. But this has not eased market inflation expectations – to the contrary, they have quietly risen to cycle highs.

4/ Where does digital fit into the consensus equation? Interestingly, surveys say that it doesn’t. Investors are trading with a recency bias. And most recently, digital assets have been linked to equity markets, not inflation. The correlation between the S&P 500 and our Core Digital Index jumped to an all-time high on a one-month rolling basis, up nearly four times since the end of last year. Investors are steering portfolios to guard against inflation and don’t see a role for digital. It is also evident in perceptions of crowded trades by fund managers. Bitcoin was considered the most crowded three times in the BofA FMS since 2013, twice since the start of last year. Today, it doesn’t crack the top five of importance.

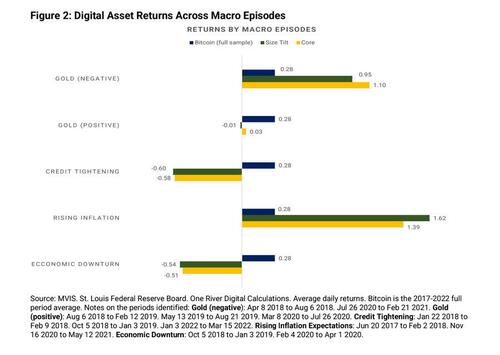

5/ But investors are forgetting the longer, cyclical properties of digital assets. Correlations are easy to calculate. They also change a lot and often depend on time-specific circumstances. One way to humanize the historic properties of digital assets is through the lens of relatable macro episodes. To that end, we classify 12 macro episodes into four themes since the start of our

indices in 2017: gold cycles, credit tightening, economic downturns, and rising inflation expectations. Figure 2 illustrates the average daily returns for our digital indices filtered through those macro periods. There are two striking results.

6/ First, digital does not follow gold cycles – at all. There is always Twitter excitement when gold is outperforming digital assets and vice versa. It’s noisy entertainment. We parsed gold cycles into positive and negative cycles to be sure that the result was robust. It is. In fact, digital asset performance was the strongest during downturns in the price of gold. There is a lot more to digital than the yellow metal.

7/ Second, the cyclicality of digital assets is more geared to inflation. Periods of rising inflation expectations have disproportionately higher returns for broader digital assets. Our Size-Tilt Index averaged a daily return of 162 basis points in those periods compared to bitcoin’s average daily return of 28 basis points since our Indices began. These gains also dwarf the average daily decline in periods of credit tightening and economic downturns, where the Size Tilt Index was down 60 basis points and 54 basis points for bitcoin on average per day.

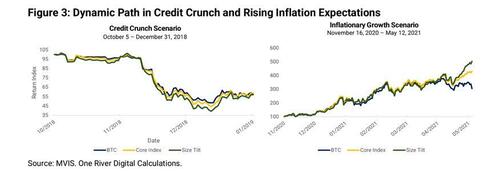

8/ The dynamic path of our indices in cyclical episodes is also enlightening (Figure 3). In the negative scenario, the average performance across the benchmarks is not very different. The distinction across drawdowns, however, is notable, and much larger with Size Tilt, that leans to smaller assets. It is a critical reminder that high-volatility assets and leverage do not mix. To benefit from the upward drift in Size Tilt seen in the inflationary growth scenario, you cannot get stopped out in the negative drawdown. Volatility is best managed with unleveraged exposure.

9/ Historic analyses provide a foundation for discussion – no more, no less. Investors are charged with the far more creative and difficult task of understanding how things will be different. Investor sentiment provides a glimpse – inflation will be persistent, and investors are skeptical of the role digital will play. But investors are focused on a meaningful shift from recent history – a long period of persistent inflation and weaker real activity. Can digital assets perform in that world? The short answer is yes. The same recency bias impacting sentiment is constraining expectations on the role the digital ecosystem plays in a new macro environment.

10/ Consider the role of digital in generational austerity. The good fortune of the older generation is imposing austerity on the younger one. Asset prices, housing costs, student debt, and higher taxation are obstacles to the next generation of entrepreneurs. Austerity is a matter of survival. The “Young and Austere” can innovate in the digital ecosystem in a far more efficient manner. From design to architecture and financial services, the cost of operating in the digital world is far less than the ‘real’ world and there are fewer barriers to entry. Fashion week in Decentraland becomes the headline act, not the footnote that it was last week. Digital assets and their role in portfolios can’t be reduced to a 3-year or 30-day correlation. It is an ecosystem that will flexibly adjust to its environment, including the new macro world order. So, too, will our indices.

https://ift.tt/pfX5TO2

from ZeroHedge News https://ift.tt/pfX5TO2

via IFTTT

0 comments

Post a Comment