Bank Loan Volumes Shrink As Deposits Rise, But Trouble Is Brewing...

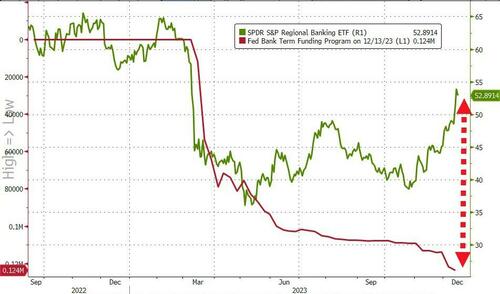

Yesterday we discovered that Regional bank shares have been soaring up towards pre-SVB levels despite yet another increase to a new record high in the usage of The Fed's bank bailout facility (now at $124BN)...

Source: Bloomberg

We also saw the first aggregate outflow from money-market funds in seven weeks.

And so, with all that in mind, we shift attention to bank balance sheets as The Fed attempts to manufacture data on loans and deposits to ensure we don't panic.

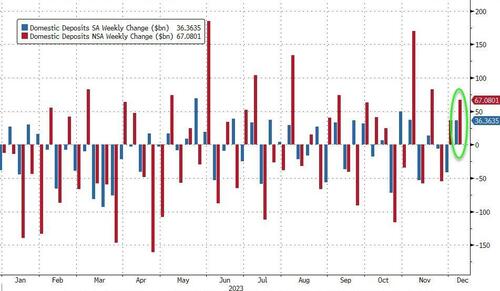

On a seasonally-adjusted basis, total bank deposits rose by $28.4BN, after falling $54BN the prior week...

Source: Bloomberg

On a non-seasonally-adjusted basis, total bank deposits jumped $65BN (the second weekly increase in a row) to the highest level since the SVB banking crisis (and deposit exodus)...

Source: Bloomberg

Even with deposit inflows and money-market outflows, the divergence did not improve much (yet)...

Source: Bloomberg

Excluding foreign bank deposits, domestic banks saw inflows on both an SA and NSA basis (+$36.4BN and $67.1BN respectively)...

Source: Bloomberg

Breaking it out, Large banks saw $30BN SA and $51BN NSA deposit inflows while Small banks saw $6.1BN SA and $15.3BN NSA deposit inflows.

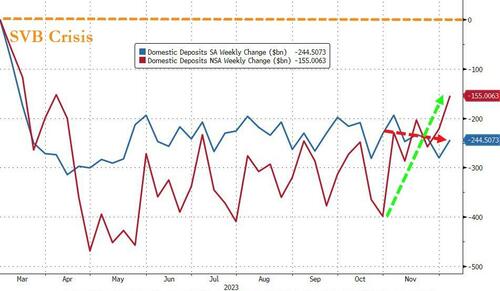

Over the past six weeks, domestic banks have added $245BN in deposits (on an NSA basis) and lost $13BN in deposits (on an SA basis)...

Source: Bloomberg

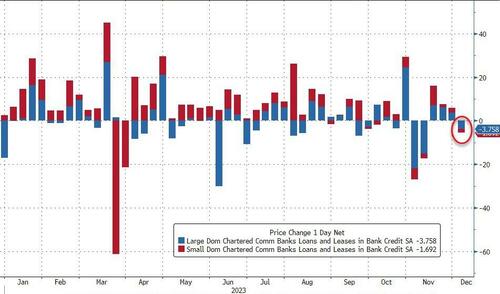

Rather oddly, on the other side of the ledger, amid these surging deposits this week, loan volumes shrank for both large and small banks (-$3.7BN and -$1.7BN respectively)...

Source: Bloomberg

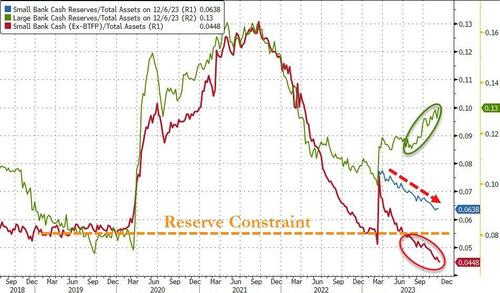

Finally, the key warning sign continues to trend ominously lower (Small Banks' reserve constraint - blue line), supported above the critical level by The Fed's emergency funds (for now)...

Source: Bloomberg

As the red line shows, without The Fed's help, the crisis is back (and large bank cash needs a home - green line - like picking up a small bank from the FDIC).

QAll of which makes us wonder - you know, just thinking out loud - are we setting up for another banking crisis in March as:

1) BTFP runs out (it was only a 12 month temporary program), and

2) RRP drains to zero, at which point reserves get yanked which means huge deposits flight.

Is that why The Fed needed to bring rates down massively and fast, to reduce the bond losses on banks' books?

https://ift.tt/8QCdfox

from ZeroHedge News https://ift.tt/8QCdfox

via IFTTT

0 comments

Post a Comment