Hedgies Hammered As Retail 'Dash-For-Trash' Accelerates; Oil & Gold Jump

"What hath Powell wrought?"

Decoupling from reality?

The Atlanta Fed GDPNOW forecast jumped up to 2.7% for Q4... does that seem like it fits with The Fed's dreams of rate-cuts galore priced in?

Source: Bloomberg

Dramatically easier financial conditions and lower mortgage rates supported a manic (surprise) surge in Housing Starts, which was the main macro data of the day... which lifted homebuilder stocks higher again. Are we about to see a massive 'catch-up' from the dismal housing data?

Source: Bloomberg

But The Fed has pivoted and the Dash-for-Trash continues as 12Mo Laggards soaring as financial conditions ease...

Source: Bloomberg

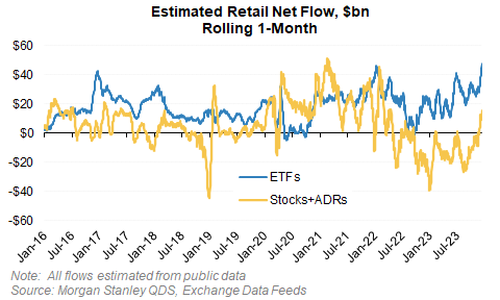

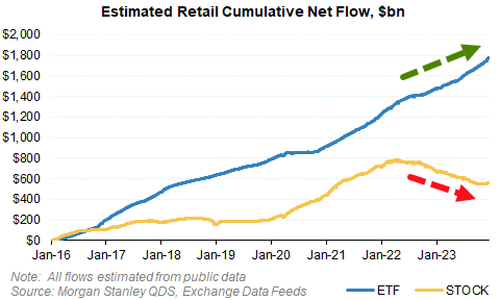

Early last week, we highlight that retail investors were the only buyers left, and while some questioned whether that would be enough to support stocks, MS Quant desk notes today, it is retail investors that have arguably been a big driver of the melt up given they have been buying at the fastest pace in over 18 months, coming in with over $60bn in total equity market demand over the last month on QDS estimates based on public data.

Retail is typically a buyer of ETFs, but the last month hit a record in dollar terms, likely helping the market rally.

Even more remarkably, SPY - the largest and most liquid S&P 500 ETF - has seen 4 straight days of massive inflows since Powell pivoted with Friday 15th seeing the all-time biggest inflow into the fund of almost $21BN (and over $40BN in the last four days)...

Source: Bloomberg

As Bloomberg's Eric Balchunas notes, the $21BN SPY inflow is an all-time world record for any ETF in one day flow.

In single-names the story is a little different though, and retail is likely less of a driver of price action compared to HFs – while retail has turned a single-stock buyer after 18 months of selling, retail volumes as a share of total are down slightly (although not historically low)...

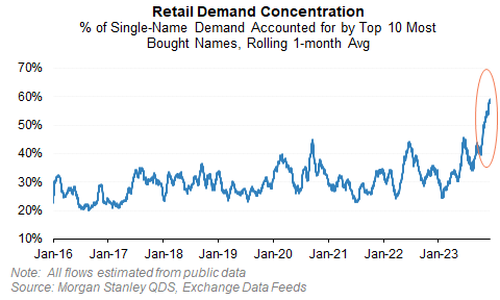

... and that demand has never been more concentrated in a handful of Tech and Consumer names, and in aggregate only totals $15bn over the last month...

Looking forward, retail demand may slow into year-end before picking up again in January given seasonals – and while MS QDS is skeptical the pace of demand continues then given the narrow breadth, the potential is there for plenty of more buying given only a small piece of the selling from April 2022 through October this year has been reversed.

All the majors kept going higher today with Small Caps dramatically outperforming. Nasdaq was actually the laggard on the day...

The Dow is up 9 days in a row (it was up 12 in a row in July 2023). closing at a new record close.

'Most Shorted' stocks screamed higher today in another massive squeeze. 'Most Shorted' stocks are up a stunning 16% since The Fed last week (and MAG7 stocks up around 2%)...

Source: Bloomberg

Which broadly speaking, means L/S hedge funds ugly December, just got even uglier...

Source: Bloomberg

For context, this is the worst month for L/S hedge funds since Jan 2021 (and second worst month in at least 12 years)...

Source: Bloomberg

Before we move on from the chaos in stocks, it is worth noting that there is a small canary in the coalmine starting to croak. VVIX (vol of vol) remains significantly elevated relative to VIX - someone is hedging for a sudden VIXplosion?

Source: Bloomberg

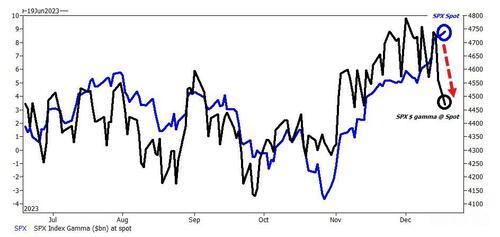

Maybe because market gamma is starting to decline from record highs, unclenching its range-bound hold on markets...

Source: Goldman Sachs

Turning to bonds, they were very quiet today compared to stocks, with yields barely changed at all (perhaps a smidge lower). Since The Fed, all rates are basically down 27-30bps...

Source: Bloomberg

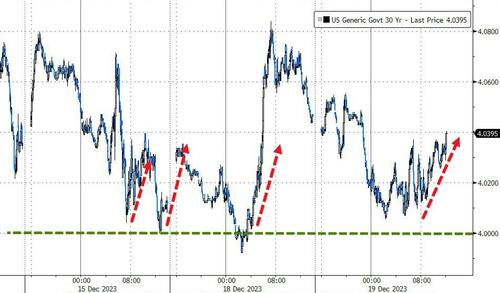

The 30Y Yield continues to try and test down to 4.00%... but not `quite make it...

Source: Bloomberg

Bitcoin extended yesterday's gains up to $43,500 overnight before sliding back to find support at $42,000...

Source: Bloomberg

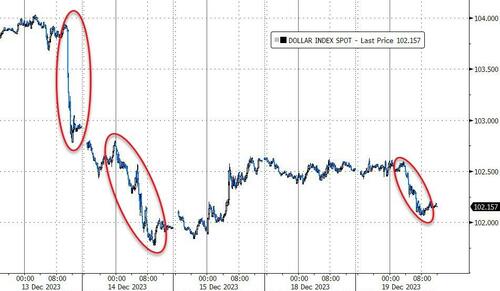

The BoJ's utter failure overnight sparked JPY weakness, but EUR and GBP strength offset that and pushed the Dollar lower...

Source: Bloomberg

Oil bounced again today amid growing tanker tensions in the MidEast

Gold ripped back above Friday's plunge levels...

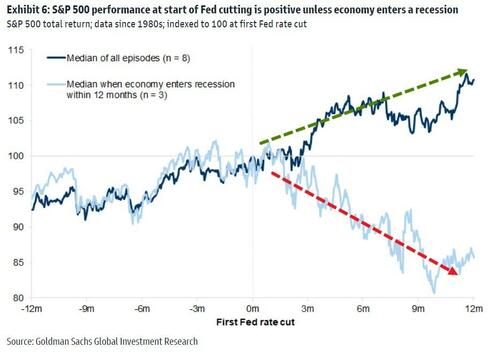

Finally, we note that equity markets generally perform better as interest rates fall...

https://ift.tt/O0CtnRL

from ZeroHedge News https://ift.tt/O0CtnRL

via IFTTT

0 comments

Post a Comment