Bitcoin, Big-Tech, & Bullion Dumped Ahead Of CPI

Today's calm - before the storm of event-risk-catalysts this week - was anything but.

Bitcoin was clubbed like a baby seal, Black Gold dumped and pumped, 'Magnificent 7' stocks stumbled, gold was hammered, and NatGas puked. Bonds were quiet (yields small higher) and the dollar rallied modestly.

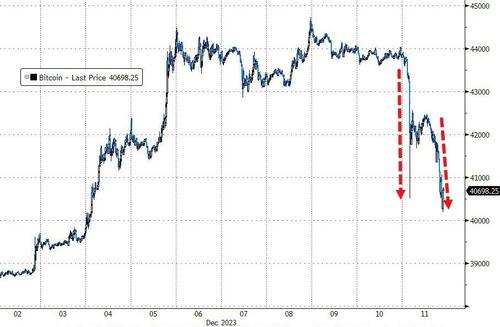

Bitcoin made the most headlines today as it saw large long liquidations overnight and then was punched in the mouth by Lizzy - blaming it for everything wrong in the world.

Source: Bloomberg

All of crypto suffered (with long-liquidations over $450mm)...

Source: Bloomberg

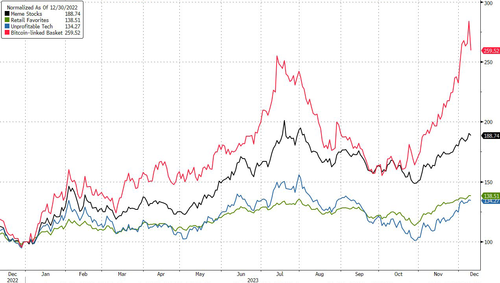

Bitcoin-linked stocks were (expectedly) hammered but the rest of the 'retail' faves were left relatively unharmed (for now)...

Source: Bloomberg

The US Majors were all higher on the day ahead of tomorrow's inflation print with Nasdaq outperforming (Small Caps lagged). The big gains all happened after Europe closed and into 1430ET (margin-call time)

But, while Nasdaq rallied, the biggest of the big-tech (Magnificent 7) stocks tumbled by the most since Oct 26th...

Source: Bloomberg

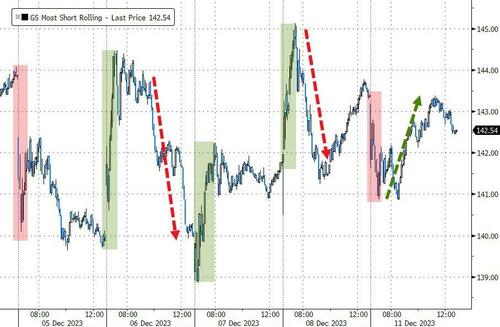

The wild-chop in "most shorted" stocks continued today...

Source: Bloomberg

Hedgies continued to drift sideways as favorite shorts and longs refuse to breakout...

Source: Bloomberg

Bonds roller-coastered today - ending with yields modestly higher. Bonds were sold overnight and through the 3Y auction but then rallied after the 10Y auction. The long-end underperformed (30Y +2.5bps, 2Y unch)...

Source: Bloomberg

The 2Y yields spiked over 20bps from Thursday night to today's highs before pulling back a little...

Source: Bloomberg

The dollar managed to hold gains after running stops above last week's highs and then fading back....

Source: Bloomberg

Oil managed to eke out a small gain today...

...while warm-weather whacked NatGas to 5-month lows before bouncing back today (still down over 5%)...

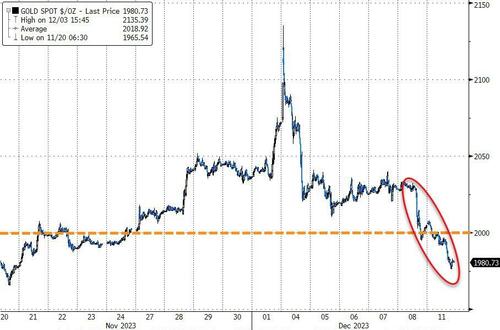

Spot Gold broke below $2,000, back to three-week lows...

Source: Bloomberg

Finally, since the last FOMC meeting, financial conditions have eased massively (by over 100bps based on Goldman's FCI)...

Source: Bloomberg

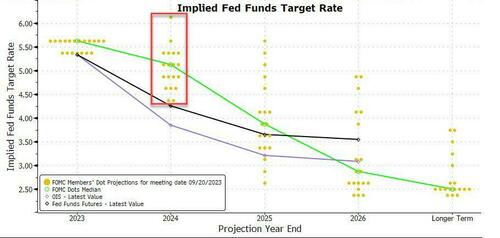

And, as we detailed earlier, there's a lot of room for disappointment in this week's FOMC as the market is pricing in the fact that every Fed member has to be wrong about next year...

Source: Bloomberg

Mr Market says “I do not believe you!” to the Fed. Now, what will Powell say back?

https://ift.tt/f2pzleq

from ZeroHedge News https://ift.tt/f2pzleq

via IFTTT

0 comments

Post a Comment