"Here Comes The Cliff!": Carson Block Shorts Blackstone Mortgage REIT As 'Liquidity Crisis' Risks Mount

At the Sohn Conference in London on Wednesday, Carson Block, the founder of Muddy Waters Research, warned that Blackstone's Mortgage Trust (BXMT) is facing a "perfect macro storm." He suggested that a crisis in commercial real estate could potentially lead to a "liquidity crisis" in the trust.

Block told attendees at Sohn that Muddy Waters is short BXMT because "borrowers will be unable to refinance and repay" the trust. He cautioned that BXMT is at "risk of a liquidity crisis" and explained, "This is not a story where bad people have done bad things, they are just unlucky."

"Blackstone may modify the loans but it's such a big number of loans terminating next year that will not be able to be swept under the rug," he continued.

In a report published on the Muddy Waters' website, the research firm outlined its reasons for taking a short position on BXMT:

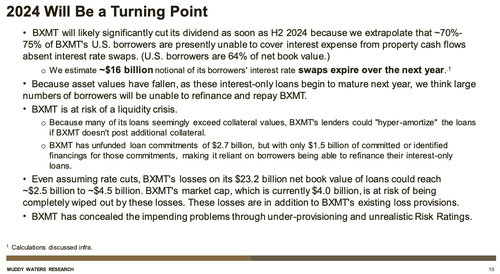

Muddy Waters is short Blackstone Mortgage Trust (BXMT US). Interest rate swaps and manipulated risk ratings / loss provisions have obscured serious deterioration in BXMT's loan book. Muddy Waters believes that starting in 2024, as an estimated $16 billion of swaps terminate, the following problems will be evident:

BXMT will likely significantly cut its dividend as soon as H2 2024. At present SOFR, we expect BXMT to cut its quarterly dividend by at least half.

We think large numbers of borrowers will be unable to refinance and repay BXMT.

BXMT is at risk of a liquidity crisis.

Even assuming rate cuts, BXMT's losses on its $23.2 billion net book value of loans could reach ~$2.5 billion to ~$4.5 billion. BXMT's market cap, which is currently $4.0 billion, is at risk of being completely wiped out by these losses. These losses would be in addition to BXMT's existing loss provisions.

The report starts with, "Here Comes the Cliff!"

BXMT is a REIT that borrows money and lends to commercial mortgage borrowers.

Muddy Waters explained many CRE borrowers are underwater on their properties because values have plunged, making it impossible for some to repay BXMT. It noted, "Anticipated rate cuts would be too little, too late for many CRE borrowers."

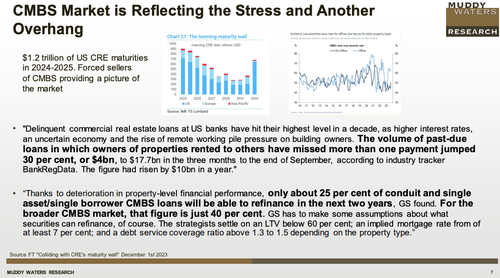

Muddy Waters zooms out on the CRE sector and shows the mounting stress.

Despite no signs of distress at the trust, Muddy Waters said troubled loans are being modified by extending maturities.

Turbulence appears to be arriving as early as next year.

Shares of BXMT fell 6% in the US cash session. Since pre-Covid levels, shares of the trust have been halved and near Covid lows.

In October, a Bloomberg survey of professionals found that most respondents were expecting a "severe crash" in the CRE space.

Meanwhile, the private $64 billion Blackstone Real Estate Income Trust has experienced troubles of its own, gating redemption requests for 13 consecutive months amid CRE woes.

https://ift.tt/ltMaZ4U

from ZeroHedge News https://ift.tt/ltMaZ4U

via IFTTT

0 comments

Post a Comment