Delta Is The Latest Risk Facing Chinese Stocks, Goldman Warns

One of the biggest COVID-related stories of the week (outside the US, where the media has decided to fixate on the fact that one-third of new cases are coming from three states that represent roughly one-third of the US population) is the arrival of the delta variant in China, which has called into question the efficacy of its domestically produced vaccines.

But outside of China, the delta variant is driving, hospitalizations and deaths higher across Southeast Asia, which has far less vaccination penetration than the US and China. According to the IMG, close to 40% of the population in advanced economies has been fully vaccinated. The percentage for emerging-market economies is less than half of that. In many countries in the region, the rate is even lower. Only about 8% of the Indonesian and Philippine populations have been fully vaccinated, and around 6% in Thailand.

Ultimately, the impact of the resurgence of delta in Asia will be borne mostly by China. And as a team of Goldman analysts in Hong Kong pointed out in a note to clients, this is only one of a handful of growing headaches for the CCP. China's domestic markets have been roiled by the government's crackdown on everything from the country's biggest tech firms, to purveyors of private tutoring services, to video games and beyond.

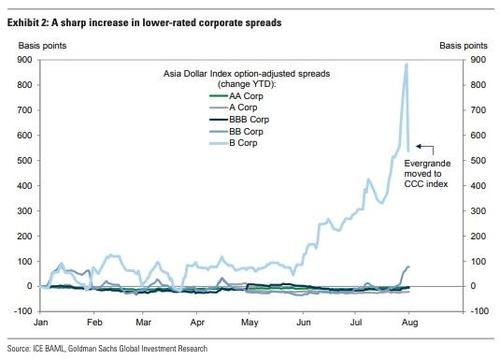

Separately, China's property sector remains under pressure due to the problems at Evergrande, one of the country's largest property developers, which is struggling with its worst liquidity crisis yet.

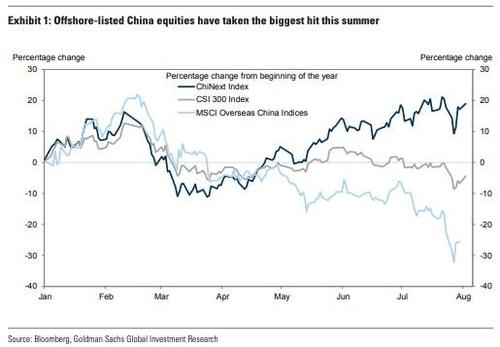

Offshore-listed stocks have taken a massive hit this summer, the analysts pointed out.

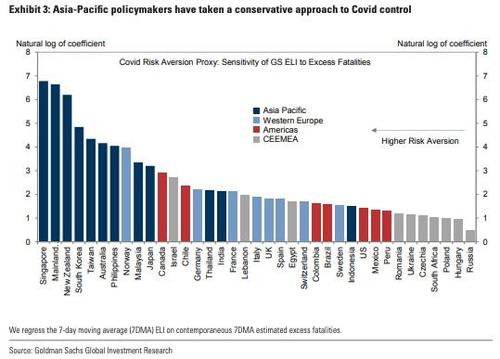

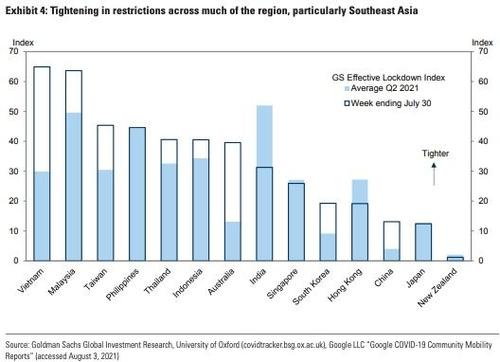

"Several downside risks exist for China's second-half growth outlook," the analysts said. "Some long anticipated, some new". The spread of the delta varaint, combined with Asia's low-tolerance approach to battling COVID, has led to "significantly tighter restrictions in most countries, most notably in Australia.

Using its proprietary "Effective Lockdown Index", Goldman illustrated how some southeast Asian nations currently have tighter COVID restrictions than they had last year.

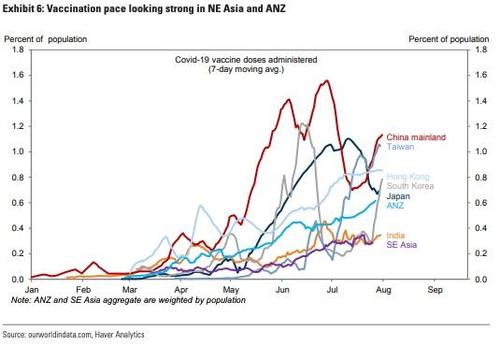

As far as vaccinations go, the picture is changing as more emerging market economies in the region get their hands on more supplies of the jabs, and not just from China.

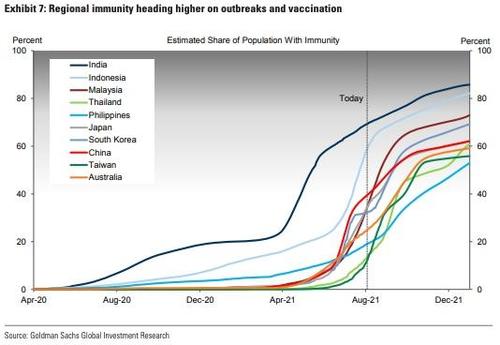

Regional immunity is also heading higher too, with hard-hit India notably leading the pack.

Ultimately, the biggest blowback in the markets will likely be borne by Chinese firms, particularly Chinese companies who are listed abroad, which are vulnerable to all of these headwinds, from COVID-related disruptions, to the government's own hostility.

https://ift.tt/3jiQqXG

from ZeroHedge News https://ift.tt/3jiQqXG

via IFTTT

0 comments

Post a Comment