Emerging Markets Hit 20 Year Low Against S&P, Waiting For A "Cathartic Event"

The old "new normal" is firmly back in control of the market.

As BofA CIO Michael Hartnett writes in his latest Flow Show, despite a host of stagflationary concerns about the economy and markets in the second half (laid out in his second half preview discussed here), investment grade bonds (LQD) and semiconductors (SOX) are back at all time highs, both leaders of a ”secular stagnation” bull market indicating that the Fed's reflationary hopes are all but dead for the time being; Additionally, the Brazilian real (BRL) - which Hartnett calls the "world’s best “risk-on” indicator" - is dithering above 5.00 level despite the Brazilian Central Bank hiking 325bps in 5 months (and warning that inflation is anything bur transitory), while stealth “flight-to-quality” trades are observed so far in H2, as utilities, health care, and REITs are the best SPX performing sectors.

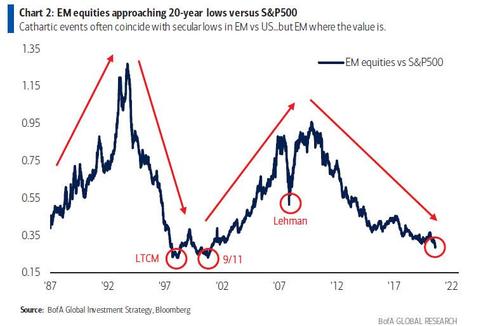

Hartnett then looks at the latest "Biggest Picture" trend which shows that EM stocks are approaching a 20-year low versus S&P500...

... and notes that big lows in EM normally triggered by cathartic events (LTCM, 9/11, Lehman) and while we wait for the next "cathartic" trigger, Hartnett notes that emerging markets are unambiguously where the secular value is, e.g. EM bonds cheapest relative to US high yield in 20 years (of course, China is a big factor here and following Beijing's recent crackdown on various "non-social" industries - as defined recently by Goldman - the wait for the catalyst could prove to be a lengthy one). Hartnett concedes as much, but notes that whereas regulatory risk has hit large cap China tech (HSTECH -43% peak to trough) where over a $1 trillion in market cap has been lost, the small cap China innovation index, i.e., ChiNext (CNT) is trading to new all time highs.

Hartnett then switches track to observe the performance of various "balanced" portfolios, but instead of the ubiquitous 60/40, the BofA CIO instead focuses on his favorite "25/25/25/25", i.e., a max diversified portfolio of 25% in global equities, bonds, commodities, and cash which he has pitched for the past several years and which in 2021 is enjoying record returns, annualizing a 16% return which is the best since 1987.

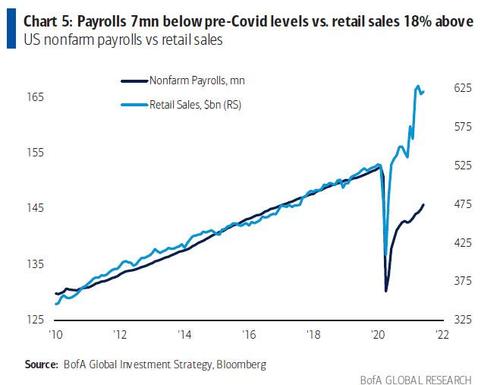

The bank strategist then focuses on the macro distortions that have emerged in the US economy and captured best by a chart showing payrolls (7 million below pre-covid levels) vs retail sales (which as 18% above covid).

And while the market was clear to jump on Friday's payroll as opening the gates to a Jackson Hole taper announcement, Hartnett is not so sure, noting that the Fed has made it clear they don’t see clarity on payrolls until Sept report released early-Oct.

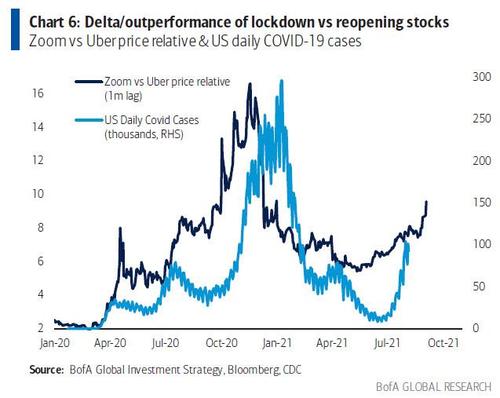

Additionally, the recent surge in Delta cases coupled with renewed outperformance of lockdown vs reopening stocks is also clouding the autumn outlook.

Looking ahead, Hartnett lays out a trio of potentially "unanticipated" autumn events which could undo the market's relentless meltup, including:

- White House fails to reappoint Powell as Fed Chair;

- escalation of US-China cold war (Covid-19 origin investigations, Biden-Xi to meet in Rome Oct 30th);

- stagflationary resolution to US labor market conundrum.

Putting it all together, Hartnett says that the best analog to the current market regime is the late ‘60s-early ‘70s with persistent negative real rates, large budget deficits, populist & polarized electorates, an excessively easy & complicit Fed, which led to inflation rising to multi-year highs. Back then the value bull of 1968 (= H1’2021) was followed by volatile bear of 1969 (H2’2021).

As such, his advice to investors: own defensive quality = good market hedge H1 (peak policy) & good macro hedge H2 (peak profits).

One final point: in keeping with what his publication originally covered, namely market flows, Hartnett makes the following notable observations:

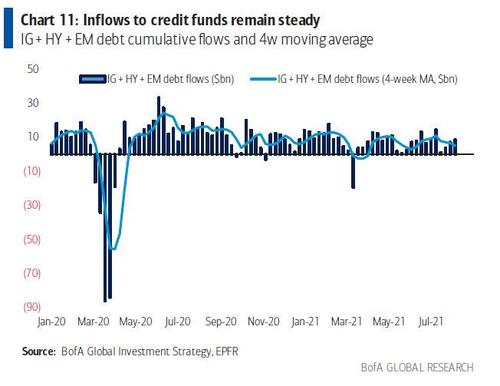

- The latest week saw $24.7Bn flows to cash, $12.1Bn to bonds, $4.8Bn to stocks, and $0.7Bn to gold (the largest in 8 weeks) which alas culminated with a brutal hammering gold sustained in the aftermath of the blockbuster jobs report

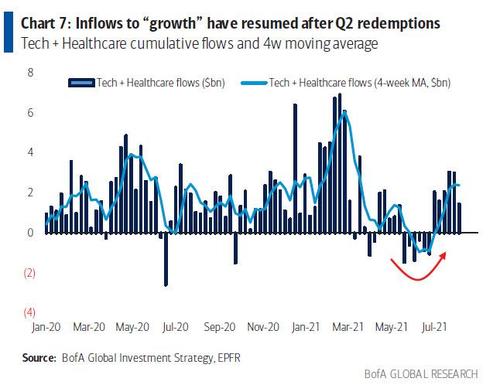

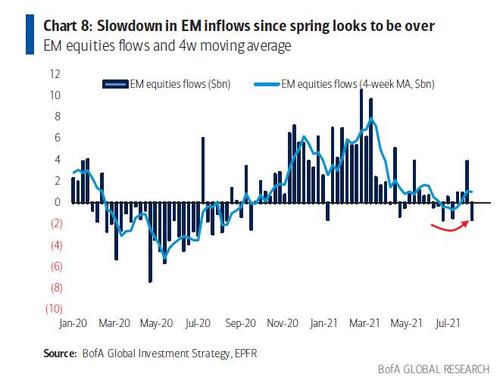

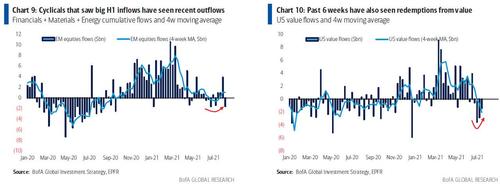

- Flows to Know: 6th week of inflows to tech ($1.2bn), 7th week of inflows to healthcare ($0.3bn), largest outflow from EM equities in 6 weeks ($1.6bn).

- Tech & healthcare: inflows to “growth” sectors have resumed after Q2 redemptions

- EM equities: similarly, slowdown in EM inflows since spring looks to be over (Chart 8).

- Financials, energy, materials, value: in contrast cyclical sectors that saw big H1 inflows have seen redemptions past 6 weeks; same trend for value funds

IG, HY, EM debt: inflows to credit funds (need-for-yield bid) remain steady

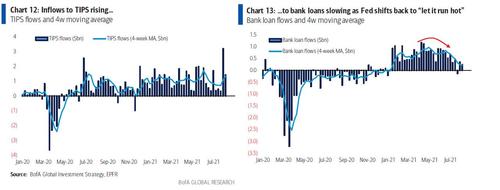

TIPS, bank loans: inflow to TIPS rising, to bank loan funds slowing as Fed shifts back to ‘let it run hot” in recent weeks.

https://ift.tt/3rYKo2t

from ZeroHedge News https://ift.tt/3rYKo2t

via IFTTT

0 comments

Post a Comment