For The First Time Ever China Is Seeking Foreign Buyers For Its Municipal Bonds

While Beijing has been "encouraging" private companies to aggressively cut debt in the past year - and nowhere more so than at China's largest real-estate developer, Evergrande, whose bonds have cratered in recent weeks amid fears the forced deleveraging will push the company and its $300 billion in debt into a death spiral - China's local governments have more than doubled bond sales to roll over maturing debt this year, helping to ease their repayment risk.

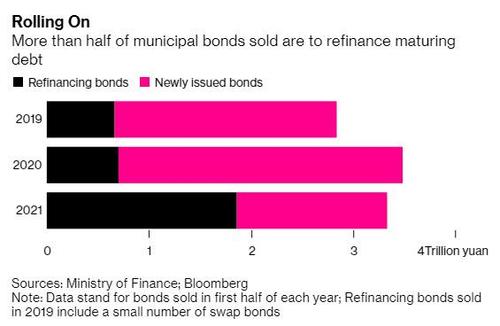

As Bloomberg reported back in July, cities and provinces sold about 1.9 trillion yuan ($293 billion) of so-called refinancing bonds in the first six months of the year. That’s a sharp increase from about 700 billion yuan sold in the same period of 2020, and 660 billion yuan in 2019.

These "refinancing" bonds are sold to replace maturing securities, reducing pressure on local authorities to pay back the debt.

China's refinancing scramble is just beginning: “The amount of debt due will keep growing, so the scale of refinancing isn’t likely to fall,” said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc in Hong Kong. “That’s the case unless policy makers seriously look to reduce the absolute value of the debt, which is unlikely.”

Meanwhile, local governments have slowed the pace of special bond sales used to finance spending on infrastructure like highways and houses, in part due to a lack of quality projects and Beijing’s stronger focus on debt control. Infrastructure investment contracted in May from a year earlier, and probably continued to decline in June and July due to a higher base from a year ago, according to economists at China International Capital Corp. They see investment growth rebounding after that to reach about 3.5% for the full year.

But with China's economic growth slowing drastically, it is inevitable that China would have to boost its fiscal stimulus, meaning many more bonds will be issued, it's just a matter of time. Indeed, at the start of July, government-linked economists cited by the state-run China Securities Journal said fiscal spending may increase in the second half of the year.

"Along with the economic recovery becoming more and more solid, fiscal revenue will gradually return to the normal level, and fiscal spending will maintain its due growth rate," the newspaper quoted He Daixin as saying. He is director of the Public Finance Research Department at the National Academy of Economic Strategy, a unit of the Chinese Academy of Social Sciences.

There was just one problem with this approach: as a result of the recent turmoil in the domestic bond market, demand for more government debt - at least among domestic buyers - appears to be fading, so China is doing the obvious thing: it is looking for foreign buyers.

* * *

Fast forward to today when as Bloomberg updates, China's so-called Dim Sum bond market - in which a renminbi-denominated bond is sold to foreign buyers - is about to get a new kind of issuer: local Chinese governments. In a first for the $77 billion offshore yuan bond market, Shenzhen city government is seeking underwriters for an offering of up to 5 billion yuan ($771 million), according to a statement Tuesday. Guangdong province is also planning such a sale in Macau, without giving the size.

While relatively small, and serving as a trial balloon to test foreign investor demand, such tenders will help pave the way for more regular, and far larger issuance, giving international investors more yuan-denominated assets to add to their portfolios, said Frances Cheung, rates strategist at Oversea-Chinese Banking Corp in Singapore. Assuming they want such exposure, of course.

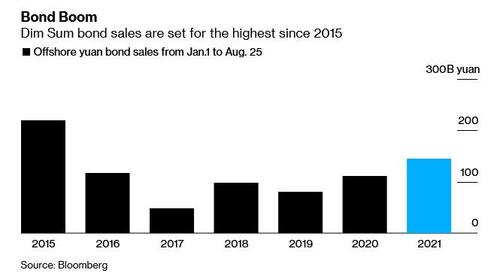

Meanwhile, overall offshore yuan debt sales are on track for the highest since 2015. Appetite was helped by tighter monetary policy in China earlier this year coupled with relatively easy money in the U.S., causing the cost to swap the Chinese currency into dollars to drop.

Coming at a time when there is widespread revulsion to Chinese equities (which not long ago were viewed by most hedge funds as alpha panacea), the nation’s finance ministry has sought to expand its bond issuance channels from the interbank market to retail investors and now offshore, because apparently even local retail demand is sliding. Luckily for Beijing, there are plenty greater fools offshore, and overseas investors’ holdings of onshore local debt has increased significantly by nearly 80% this year as of July.

There is another reason why China is targeting dumb foreign investors to fund its fiscal stimulus (similar to what the Treasury does, only there the Fed funds the bulk of it): the proposed offshore sales come amid concerns of a surge in local government bond sales onshore, as Chinese authorities pledge more support for the economy. Worries about surging supply continue to haunt the nation’s sovereign bond market. The proposed offshore sales won’t be large enough to alleviate those pressures, added Cheung.

Though foreign buyers already have access to onshore local government bonds, an offshore offering could attract more global funds, said Ming Ming, analyst at Citic Securities.

Bottom line: the US - with its massive current account deficit - used to rely on China to fund its growth (back before the Fed stepped in and is monetizing 100% of all US bond issuance), and now it's China's turn to return the favor.

https://ift.tt/3jhKNdr

from ZeroHedge News https://ift.tt/3jhKNdr

via IFTTT

0 comments

Post a Comment