Goldman Slashes China GDP On Delta Spread, Warns Of Inflation Spike Risk On "Supply-Chain Spillovers"

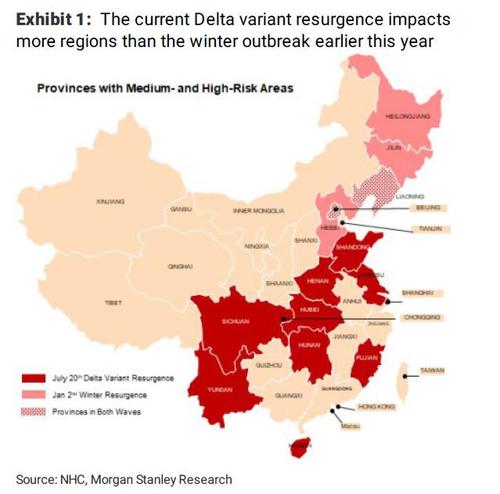

While the rest of the developed world is scrambling to reverse the most recent spike in covid cases, attention is increasingly turning to China where the current Delta variant-driven outbreak has affected more regions than the winter resurgence, with 144 mid- to high-risk districts scattered over 11 provinces (vs. 72 districts over six provinces during the winter) as the following chart from Morgan Stanley shows.

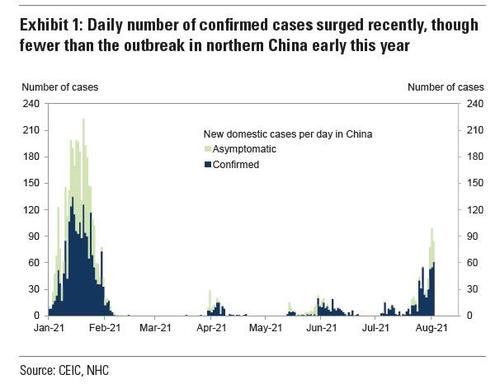

While the case count is still relatively modest...

... the more transmissible nature of the variant and China's Covid-zero approach indicate that economic impact is inevitable. Evident of this, in addition to stringent lockdowns and travel restrictions in higher-risk regions, most low-risk regions have also imposed precautionary social-distancing measures in entertainment venues.

Echoing this downbeat take, Bloomberg commentator Ye Xie writes that "the delta variant adds to downside risks for the economy" noting that "the regulatory tightening adds to downside risk for China’s economy just as the Covid-19 virus reemerged. China began imposing travel restrictions as the delta variant fueled the nation’s broadest outbreak in more than a year. The dimmed growth outlook sent bonds rallying, pushing 10-year yields down for a seventh straight week, the longest decline since 2018. Meanwhile, the crisis at China Evergrande deepened, with its bonds dropping to new record lows."

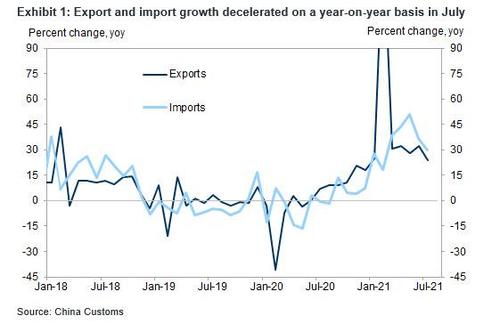

In this context, shortly after Nomura trimmed its Chinese economic forecast, late last week Morgan Stanley also cut its China economic forecast - just before the latest disappointing trade data was released out of Beijing on Saturday which saw sequential declines in both imports and exports...

... and the bank now expects 3Q GDP to soften to 5.0% 2Y CAGR (vs. 5.5% in 2Q and 5.0% in 1Q), which corresponds to 5.1% YoY and 1.6% QoQ SAAR. According to the bank's China economist Robin Xing, "the downward revision is mainly attributable to a weaker service consumption including travel, catering and entertainment." That said, Xing expects 4Q GDP to rebound to 5.5% 2Y CAGR (or 4.5% YoY), considering: 1) backloaded fiscal support and infrastructure investment; and 2) a mild rebound in service growth conditional on stable domestic virus situation. Consequently, Morgan Stanley lowered its full-year GDP growth forecast by 50bp to 8.2%, with below-trend consumption growth as the lingering elevated uncertainty over the virus situation would cap hiring in service sectors below full employment

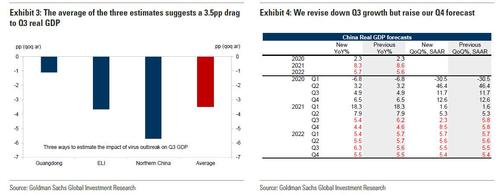

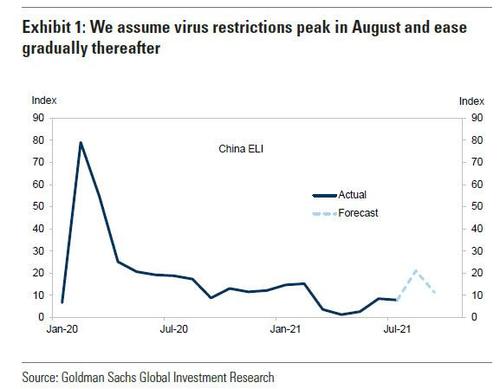

Fast forward to Sunday, when - never too far behind the curve - Goldman's China economists also took the machete to their GDP forecasts, writing that with the virus spreading to many of China's provinces and local governments reacting swiftly to control the spread of the highly contagious Delta variant, "we have begun to see softening in national aggregate data."

Similar to Morgan Stanley, Goldman slashed its Q3 real GDP forecast by 3.5% to 2.3% Q/Q (vs. 5.8% previously), even if - similar to MS - Goldman also predicted an offsetting hike to Q4 GDO growth which is expected to benefit from both activity normalization after the Q3 outbreak and policy support: "wWe revise up our Q4 real GDP forecast to 8.5% qoq ar (vs. 5.8% previously). This leaves our full-year 2021 projection modestly lower at 8.3% yoy (vs. 8.6% previously)."

Why just a modest one-quarter drip in GDP, and subsequent renormalization? The bank explains:

Our forecasts assume the government brings the virus outbreak under control in about a month and the virus outbreak and related control measures mainly hit service activities. Industrial activities appeared less affected as of early August. Even in Nanjing where restrictions are arguably among the tightest, industrial companies have managed to maintain operations. But we would closely monitor high-frequency indicators such as steel demand and listed companies’ guidance to see if there are signs of industrial activity disruptions at the national level.

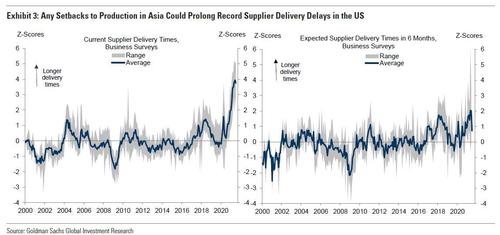

Whether Goldman is right that the Chinese speedbump will last just one quarter is debatable, but a bigger problem emerges when looking at the potential for global supply chains to be snarled further, with Goldman's chief economist Jan Hatzius writing in a separate report that while he expects the direct impact of the Delta variant on the US economy to consist mainly of a delay in the final steps of reopening, rather than a major reversal, "many Asia Pacific economies have imposed tighter restrictions that in some cases have included factory closures, raising the risk of negative spillovers at a time when supply chain disruptions are already at record levels."

Why does this matter? Because as Haztius explains, significant "downside risks are possible if new restrictions constrain semiconductor or auto production in the region, or if China adopts tighter restrictions that affect exports to the US of several currently constrained goods" which could lead to further supply chain blockages, to wit:

Any setbacks in Asia could spill over to the US at a time when supply chain disruptions are already the most severe and widespread in decades, as shown in Exhibit 3. These supply-side problems accounted for much of the disappointment to our initial Q2 GDP growth expectations and have lingered into Q3

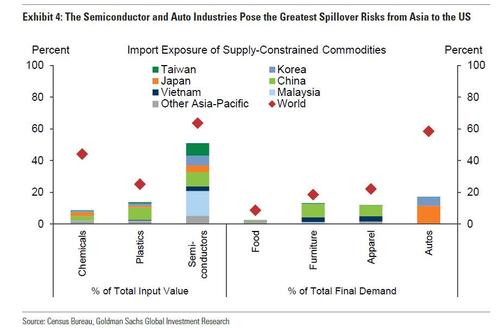

To narrow in on current vulnerabilities where Delta-related supply disruptions pose the greatest risk, the chart below shows the share of US imports from Asia Pacific economies for several intermediate inputs and consumer goods that have been in short supply recently.

Here, Goldman highlights three key risks.

- First, Asia Pacific countries account for about half of the semiconductors used in the US. Our sector analysts do not expect shutdowns of semiconductor plants themselves because cleanliness standards are exceptionally high even in normal times, but the plants rely on a long supply chain in the region that could be vulnerable to tighter restrictions. The final packaging and export steps also pose some risk.

- Second, the US imports just under 20% of its autos from the Asia Pacific region. Our sector analysts see some risk that auto parts producers in Southeast Asian countries with especially stringent lockdowns could further reduce production in Japan, where Toyota has already announced a brief production halt. Any reduction in auto exports to the US would worsen already tight new auto inventories in the US.

- Third, US imports from China account for 7-9% of domestic use of several vulnerable goods, including plastics, semiconductors, furniture, and apparel. If China—which is also experiencing supply chain challenges related to weather and flooding in July—needs to adopt tighter measures that hamper either production or exports, the US could also see moderate negative spillover effects in these areas.

But the biggest threat of all, in a time of "transitory inflation" when everyone is keeping one eye on stratospheric trans-Pacific container shipping rates which ensure far higher inflation until there is significant renormalization...

... is that "any setbacks in the Asia Pacific region could also pose upside inflation risk, especially for autos and other goods that require semiconductors. Port closures or stricter control measures at ports could also put further upward pressure on shipping costs, which are already very high." Hatzius lists three specific inflation risks from extended Delta-related restrictions in China and Asia-Pacific:

- First, further delays in the rebuild of auto inventories would push back the timeline for new and used car price normalization.

- Second, any further hit to semiconductor output could raise prices on a range of consumer electronics that require them.

- Third, port closures or stricter virus control measures at ports could further increase shipping costs from East Asia to the US, which are already extremely high due to container shortages and remaining restrictions on international transport services.

In other words, if China really wants to tighten the screws on the Biden admin and send already soaring US prices into orbit, all it has to do is develop a sudden case of the "Delties", shut down its ports for a few weeks and watch as the US screams in terror as "transitory" hyperinflation takes hold.

https://ift.tt/37zPjNH

from ZeroHedge News https://ift.tt/37zPjNH

via IFTTT

0 comments

Post a Comment