How To Spot The Start Of The Tapering Cycle

By Vincent Cignarella, Bloomberg Markets Live commentator

Job growth at pre-pandemic levels is the key to the start of tapering, according to Fed Chair Powell. The good news for fixed income traders worried about higher rates and bond bulls is we’re not there yet.

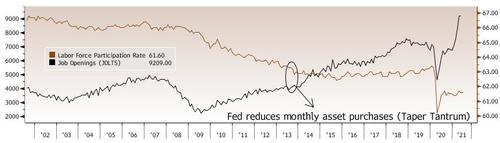

A good gauge for when we do get there, take a look at the spread between the labor participation rate and job openings (JOLTS). It’s nowhere near pre-pandemic levels. Looking back at where labor and job openings were when the Fed announced tapering in December 2013 serves as a decent indication of what this relationship needs to look like before tapering is a more convincing option for the central bank.

The question Fed Chair Powell is asked time and time again and the one he cannot seem to answer is “what does transitory mean and when will inflation point to the beginning of tapering?” The answer is likely not about inflation at all, but jobs. Remember, inflation is transitory for the Fed, or is it?

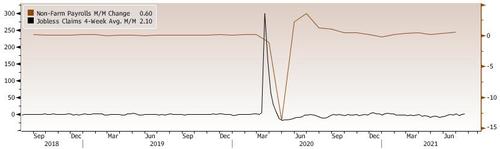

Take a look at another metric of jobs returning to pre-pandemic levels: payroll gains and jobless claims. It seems we’re already there and the Fed is indeed behind the curve. It’s likely to fall even further behind once inflation begins to percolate.

That means inflation and inflationary expectations are like a spring wound tight. It is only when you reach the tipping point that it unravels. For the Fed, it appears that time is when labor participation increases sufficiently to fill current job openings.

We may be closer than we think to that moment. School re-openings and the end of extended jobs benefits is right around the corner. That should produce an increase in the labor participation rate and result in fewer job openings. That’s when the first aforementioned metric may come into play.

For equity investors, it’s not a time to panic. The 2013 taper tantrum didn’t produce an extended selloff but it was a different story for bond traders. As the participation/job opening gap closes, the canary in the coal mine may stop singing. That’ll likely be a sign that tapering is at hand and signal the beginning of a substantial bond correction.

https://ift.tt/3CblEIQ

from ZeroHedge News https://ift.tt/3CblEIQ

via IFTTT

0 comments

Post a Comment