Howard Marks: "We Are In An Everything Bubble"

The otherwise subdued and very unhyperbolic Howard Marks caused quite a stir across trading desks (and perhaps the Marriner Eccles building) this afternoon, when speaking to Bloomberg's Erik Shatzker, the Oaktree co-founder said what has been obvious to most - even if it carries high career risk in saying it in public - that “we’re in an everything bubble" adding that "I don’t say today, but let’s not miss the opportunity to let the rates float back up."

"The stock market is high and the S&P is at 4,400. Last March 2,200. Doubled. Prices are high. Real estate has come back. Certain sectors are very strong like infrastructure, real estate, distribution centers and so forth. We are in a low return world. The lowest returns we've ever seen prospectively."

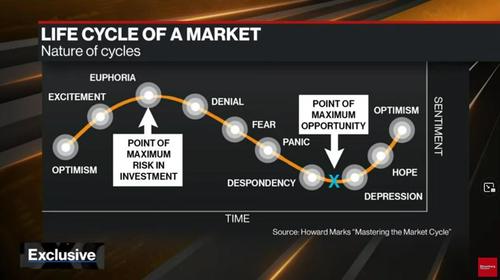

Looking at his favorite Life Cycle of a market chart, Marks says that whereas normally the stock market and the economic cycles coincide, where the high in the stock market is close to the high in the economy and vice versa, today we have high stock prices and we are early in the economic cycle. "That's unusual. You could say well this is bad because the recovery is nascent and stock prices are already high."

So what should happen? According to Marks, the Fed should "leave the markets alone", and "remove the punch bowl somewhat" so that interest rates can be what the economy and participants want them to be, not what the Fed wants them to be. Reminding viewers that the Fed missed an opportunity to raise rates in 2018 - when the market drop dragged the Fed right back in - Marks says "let's not miss the opportunity to let rates go back up" and the Fed should not hold back out of fear of another “taper tantrum.”

"It's like with your kids. As a parent we can't be afraid of our kids tantrums. The Fed can't be afraid of investors' tantrums. The Fed has to do the right thing for the economy. It's job is not to make money for investors. And when the economy is strong you have to stop emergency measures and let rates go back up."

But far from concern about the soaring prices (courtesy of the Fed's exploding balance sheet) that have made life for every middle-class American unbearable, his concern was for his fellow finance professions; to wit, pension funds and many other institutional investors rely on getting 7% returns every year, but that's impossible when the federal funds rate is zero.

Of course, running the most overlevered economy in history will be impossible when rates are 7% but by the time it comes crashing down, we are confident that Howard will be sitting on a beach far away, earning 7%.

Today’s credit markets offer “the lowest return we’ve ever seen, prospectively,” Marks said. It is still possible to make more than investing in U.S. Treasuries, but that is getting harder. “It’s never been this unrewarding."

Actually, a few million Robinhooders will beg to differ: with no risk-free returns left in the market, it means that anyone hoping to generate any material alpha is forced into chasing meme stonks which is great as long as they go up, but catastrophic once they plunge as Robinhood did today following yesterday's gamma squeeze. But yes, there is no disputing that the Fed has broken the market. Where our view differs with Howard's, is that we are absolutely certain that it is now completely impossible to undo 12 years of Fed central planning and micromanagement of markets. Back in 2009 it may still have been feasible to extricate asset prices from monetary policy, but now it is too late.

Where we agree is that he is of course, right: this is indeed an everything bubble, something we have been saying since inception.

And indicatively, whereas one year ago there was $1 trillion in distressed debt last year, since then that number has plunged to just $124.7 billion, aided by the Federal Reserve’s unprecedented steps to steady the markets economy.

The full interview is below.

https://ift.tt/3xtBivw

from ZeroHedge News https://ift.tt/3xtBivw

via IFTTT

0 comments

Post a Comment