July Payrolls Preview: 1 Million Or Bust

July's jobs report will shape expectations of when the Fed will announce, and then start, the process of tapering its asset purchases. Accordingly, as Newsquawk notes, some analysts argue that "good data is bad for the prospects of continued policy accommodation" may be the play book traders reach for, while others suggest that many of the key debates will not be resolved with the release of the July jobs report, and therefore the event may be subject to the usual post-data knee-jerk reactions, but ultimately do little to materially shift expectations just yet - it may not be until December when a clear picture emerges on the progress that the labor market is making to meet the Fed's "substantial" threshold.

That said, whether he wanted to or not, Fed Governor Christopher Waller set up the market to expect a big payrolls print on Friday morning, when he said earlier this week that if July jobs report shows a gain of 1 million workers and there is close to another million next month, the labor force will have recovered 85% of the losses suffered during the pandemic setting up the stage for "substantial further progress" - as defined by Jerome Powell last week - and for a Jackson Hole taper announcement. And so, the whisper number on trading desks quick became 1 million if not a little big higher, even as the Wall Street consensus is somewhat lower, at 880K and just barely higher compared to last month's nice, round 850K. Of course, being a "whisper number" means that while aspirational, few banks are willing to bet their reputation on its actually being met and of 70 forecasts, only 14 are calling for a 1MM+ print.

One among them is Goldman, which almost went all-in with the 2nd highest forecast, projecting nonfarm payrolls rising 1,150k in July, above consensus of +870k.

Coming just one day after ADP reported a catastrophic 330,000 private payrolls for July, the number sure was ballsy, so how did Goldman get to there? This is how Goldman's Jan Hatzius justifies his outlier bogey:

"Labor supply constraints eased further due to the wind-down of federal unemployment top-ups in some states and the addition of over 2 million youth job seekers in June and July. Coupled with very strong labor demand and continued progress on vaccinations and reopening, we believe job growth picked up further in the month. We also note little impact on dining activity in response to the Delta variant, even in highly-impacted states."

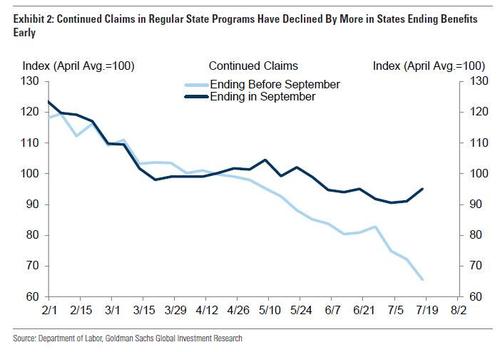

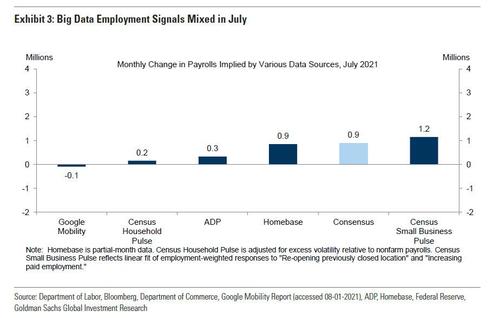

And while Big Data employment measures tracked by Goldman were mixed in July (more below), continuing jobless claims declined significantly in states that are ending UI top-ups early (as noted before).

Goldman also expects a roughly 150k boost from fewer end-of-year layoffs in the education sector, and notes that the nonfarm seasonal hurdle eases considerably in July.

Other metrics forecast by Goldman are also quite impressive and would likely spark an immediate pro-taper response: the bank estimates a 0.4% drop in the unemployment rate to 5.5% (vs. consensus 5.7%), reflecting a strong household employment gain offset by a sizable rise in the participation rate. Meanwhile, average hourly earnings are expected to rise 0.3% and +3.8% yoy, reflecting some continued wage pressures but mixed calendar effects (consensus is +0.3% and +3.9%.

Goldman aside, here is a snapshot of what consensus thinks will happen tomorrow, courtesy of Newsquawk.

- The consensus looks for 880k jobs to be added to the US economy in July, and if that is realized, it would still mean around 5.84 million fewer Americans employed vs pre-pandemic levels in February 2020.

- The unemployment rate is seen declining to 5.7% from 5.9%, but more useful color will be provided by the participation rate (61.6% in June vs 63.2% pre-pandemic), the U6 measure of underemployment (last 9.8% vs 7.0% pre-pandemic), as well as the employment-population ratio (last 58% vs 61.1% pre-pandemic).

- Average hourly earnings are expected to rise 0.3% M/M taking the annual rate to 3.9% Y/Y, and these measures will be used by analysts to inform the debate on how persistent price pressures in the US are developing.

The read from other labor market metrics calls for some caution:

- ADP's payrolls data disappointed to the downside, while weekly initial jobless and continuing claims data that usually coincide with the BLS survey window rose against expectations of a decline, perhaps relating to seasonal adjustment issues.

- The Conference Board's gauge of consumer confidence said consumer assessments of the labor market were flat on the month, though consumers were more mixed about the short-term outlook.

The Macro Focus: The key question for macro traders is when the Fed announces tapering of its asset purchases, the composition of tapering, how long the process will last, and the sequencing with eventual rate hikes. The FOMC's statement now acknowledges that the economy continues to make progress towards its goals, and language around the pandemic was constructively tweaked. Chair Powell himself seemed little troubled by delta variant fears, noting that further waves of the pandemic were having a smaller economic impact as we learn to live with the virus. The July FOMC was consistent with the expectation that the Fed will provide a taper signal at the upcoming Jackson Hole Economic Symposium (26-28th August), before an official announcement at either the September, November, or December FOMC meetings. This suggests that incoming data will likely dictate the pace of tapering, rather than the announcement itself; and given that Powell also said it was likely that the taper will conclude before the Committee begins lifting rates, these taper timeline expectations will subsequently shape lift-off expectations for the Federal Funds Rate target.

Historical Context: The Jackson Hole Economic Symposium is famed for being a platform where Fed officials signal upcoming policy shifts. But in 2013, there were no explicit taper hints; the outgoing Fed Chair Bernanke did not attend due to a "personal scheduling conflict," although many speculated that he wanted to avoid stepping on the toes of his successor, who had not been announced. (NOTE: Jerome Powell was handed a four-year term as Fed Chair in February 2018; no decision has yet been made on whether he will continue). The FOMC officially announced a taper in December 2013 and implementation began in January 2014, configured so that purchases of MBS and Treasuries were both scaled-back by USD 5bln/month; the program was concluded in October 2014. Given that the pandemic is an unusual event, different from previous economic downturns, there are risks in extrapolating the 2013 normalization parameters to what we are seeing today. Indeed, at least one Fed official has expressed a desire that the future taper of asset purchases not be placed on 'autopilot', in order to give the Fed more flexibility in these uncertain times. It is also worth noting that there is just one jobs report before Jackson Hole, and two ahead of the Fed's September meeting.

Wages: Average hourly earnings are expected to rise by 0.3% M/M, and the annual rate is likely to be lifted to 3.9% Y /Y from 3.6%, marking the third straight rise in the Y/Y metric from the 0.3% Y/Y seen in April. The Fed continues to frame the post-pandemic upside in consumer prices as 'transitory'. Although there is building evidence that this surge in prices is likely temporary, and may already have peaked, this debate cannot be resolved until at least later this year, and perhaps into next. One element that has potential to derail the 'transitory' narrative is the extent to which higher prices result in workers' demands for higher compensation, and how this impacts consumption patterns. Historically, higher wages usually occur with a lag to price rises, and are also typically accompanied by collective bargaining power or labor scarcity; although the former has diminished across the US in recent business cycles, there is building evidence for the latter. The emergence of persistent wage upside could stoke inflationary pressures, which could compel the Fed into a quicker pace of policy normalization down the line.

Slack: The consensus looks for 880k nonfarm payrolls to be added to the US economy in July, with the pace picking up from the 850k added in June. From the period between March 2020 through June 2021, there were still around 6.76 mln fewer Americans in work vs pre-pandemic levels, judging by headline nonfarm payrolls growth (if the consensus is realised, this would fall to 5.84mln). The unemployment rate is seen falling to 5.7% in July from 5.9%, although this metric will be framed in the context of the participation rate (61.6% in the June report vs 63.2% pre-pandemic in February 2020) as well as the U6 measure of 'underemployment' (last 9.8% vs 7.0% pre-pandemic); additionally, some Fed officials are watching the employment-population ratio to judge the pace of slack erosion (last 58% vs 61.1% prepandemic). Enhanced USD 300/week unemployment benefits have already started to roll-off in some states, and the programme is set to expire in September; accordingly, a clearer picture of slack levels might not emerge until further jobs reports are published through the end of the year. More broadly, Chair Powell last week suggested that it would take 'a couple of years' for the US economy to reach maximum employment, and the Fed forecasts 3.5% unemployment by the end of 2023, although at least one member of the Committee has suggested full employment could be achieved in Summer 2022 (NOTE: The Fed's economic projections are next updated at the September meeting).

Recent Labor Market Metrics: ADP National Employment Report for July disappointed to the downside, showing 330k additions to the US labour market against an expected +695k; ADP itself noted that the US labor market recovery continued to exhibit uneven progress, but that was progress nonetheless, adding that the July data represented a marked slowdown from the pace of jobs growth seen in Q2. Jobless claims data for the week that usually coincides with the BLS survey period saw initial claims jump to 419k against expectations of a decline to 350k, while continuing claims rose a little to 3.269mln from 3.262mln (against an expectation of a fall to 3.196mln). Analysts at Pantheon Macroeconomics explained that seasonal adjustment difficulties caused by shifts in the timing and extent of the automakers’ annual retooling shutdowns from year-to-year may have driven the disappointment, and the overall trend still appeared to be falling. Markit's flash composite PMI data for July said firms recorded a solid increase in employment, the level of outstanding business rose further in July as service providers struggled to keep up with incoming new business, and that Amid labor shortages and pressure on capacity, firms noted the lowest degree of optimism since February. The Conference Board's gauge of consumer confidence saw the differential between jobs 'hard-to-get' and jobs 'plentiful' widen to 44.4 from 43.5, although CB said consumers' assessment of the labor market was relatively flat, and consumers were mixed about the short-term labor market outlook.

Arguing for a better-than -expected jobs report:

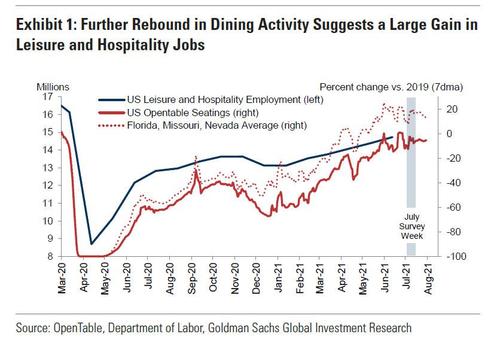

- Reopening. Despite the rebound in Covid infection rates, business restrictions have continued to ease, as illustrated by the further downtrend in Goldman's Effective Lockdown Index during both June and July. Additionally, the change in the CDC mask recommendation occurred 10 days after the payroll survey week had ended (July 27). Reflecting this and continued progress on vaccination, restaurant seatings on OpenTable rebounded further to 94% of their 2019 levels during the July survey week, compared to 90% in May and 83% in April (respective survey weeks, see Exhibit 1). Goldman also notes continued strength in dining activity in states where the Delta variant is spreading more rapidly (seatings across Florida, Missouri, and Nevada are still above pre-crisis levels, see dotted line). US leisure and hospitality employment has lagged the spring pickup in dining activity, consistent with a drag from labor supply constraints in those months—and introducing scope for catch-up in the July report.

- Seasonality. In April and May, reopening effects likely overlapped with normal seasonal hiring patterns, resulting in less-impressive job gains on a seasonally-adjusted basis. In normal times, many service industries ramp up operations in the spring ahead of peak-season demand. This year, however, firms in heavily-impacted industries may simply have been more focused on bringing back their pre-crisis permanent workforce than on expanding their businesses and adding temporary seasonal labor. Hiring subsequently picked up in June, and the July seasonal hurdle is sequentially easier than in each of the prior three months: the BLS adjustment factors generally assume a 1.1-1.2mn decline in employment, compared to +0.5mn over the previous three months.

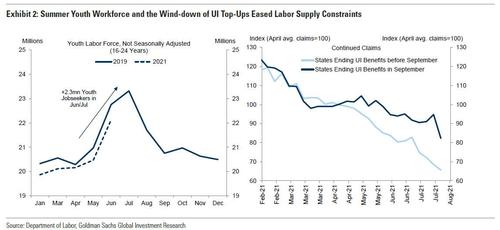

- Labor supply constraints. Goldman also expects less of a drag from labor supply constraints in tomorrow’s report, due to the mid-summer peak in the youth labor force and the wind-down of federal unemployment top-ups in some states. As shown in the left panel of Exhibit 2, 2¼ mn 16-24-year-olds typically join the labor force after the school year ends. This may have boosted July payroll growth if a higher proportion successfully found jobs due to strong demand for labor in lower-skilled occupations. According to the household survey, only 1.3mn of these potential jobseekers obtained employment in June. Youth employment typically rises by 500k in July, and any increase in excess of this number would represent a boost to seasonally-adjusted job growth. For example, if three-quarters of the remaining summer youth job-seekers find jobs, it would boost nonfarm payrolls by 750k non-seasonally adjusted and by roughly 250k seasonally adjusted.

- Turning to the unemployment top-ups, the right panel indicates that the expiration of federal benefits in some states has also boosted labor supply. Federal benefits were partially or fully curtailed in half of US states (representing 29% of the outstanding job losses since the start of the pandemic) in June and early July. And encouragingly, continuing claims declined more quickly in these states (by roughly 150k relative to the trend in all other states in the July payroll month).

- End-of-Year education layoffs. Goldman expects a boost from fewer end-of-year layoffs in the education sector (public and private) in tomorrow’s report. With education payrolls still depressed by 0.8mn relative to pre-crisis, many of the end-of-school-year layoffs that normally happen in July have already occurred this year. Goldman assume a similar employment change as in July 2020, which would boost seasonally adjusted payrolls by around 150k.

- Job availability. The Conference Board labor differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get— increased by 0.2pt to +44.4 in July and is now at its highest level since 2000. Additionally, job openings increased by 16k to a record high in May, according to the JOLTS report.

- Employer surveys. The employment component of Goldman's manufacturing survey tracker increased (+1.4pt to 59.1), as did the employment component of our services survey tracker (+0.5pt to 54.8), and both remain around early-2019 levels. Furthermore, the industry commentary of the ISM services report indicated the broadest employment gains in the recreation industry, with accommodation and food services second. The employment component of the GSAI edged down but to a still-elevated level (-1.2pt to 67.2).

- Job cuts. Announced layoffs reported by Challenger, Gray & Christmas decreased by 24% in July after increasing by 16% in June (mom, SA by GS). Layoffs were at the lowest level since 1993.

Arguing for a weaker-than-expected report:

- ADP. Private sector employment in the ADP report increased by 330k in July, below consensus expectations for a 680k gain. While the ADP report was disappointing, Goldman expects a much larger gain in the BLS measure, for two reasons. First, the bank had expected the statistical inputs to the ADP model to be a large drag this month. Education seasonality unique to the BLS measure should boost tomorrow’s report relative to the ADP numbers.

- Big Data. High-frequency data on the labor market were mixed between the June and July survey weeks (see Exhibit 3). Only one of the five measures GS tracks indicates an underlying job gain in excess of consensus (Census Small Business Pulse, +1.2mn). However, Homebase—one of the more reliable indicators—is consistent with a large gain in payrolls (+0.9mn), and that any boost in the BLS measure from education seasonality will be additive to the underlying trend.

- Jobless claims. Initial jobless claims edged down during the July payroll month, averaging 392k per week vs. 394k in June. Continuing claims also decreased, averaging 3,188k in July vs. 3,448k in June. Across all employee programs including emergency benefits, continuing claims remained roughly unchanged between the payroll survey weeks.

https://ift.tt/3jrrugT

from ZeroHedge News https://ift.tt/3jrrugT

via IFTTT

0 comments

Post a Comment