Massive Dixie Wildfire To Strain California Fire Fund

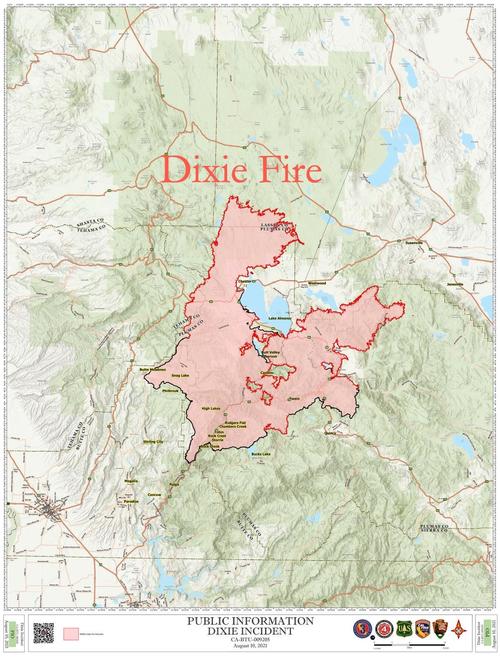

Dixie Fire has become California's largest single blaze ever and soon could pressure a two-year-old multi-billion fund used to keep utility companies solvent if a catastrophic wildfire was sparked.

The first real big test of the fund is the Dixie Fire that has burned nearly 500,000 acres and destroyed more than 500 building structures. According to Bloomberg, one estimate from Guggenheim Securities suggests damage already surpassed $1 billion, which is the threshold PG&E could tap the state-backed insurance fund to cover damages.

The Golden State is under extreme drought conditions. Bone-dry vegetation fuels the wildfire ravaging Northern California's Butte, Plumas, Tehama, and Lassen counties. The cause of the fire has so far been pinpointed to PG&E equipment.

The fund has grown to more than $10 billion. The disastrous start to the 2021 wildfire season and low containment level of Dixie suggests the fund could be depleted, and PG&E could face insolvency concerns once again.

Andy DeVries, a utility analyst for CreditSights, said, "all it takes right now is one or two really big fires. Then that fund is already depleted. So far, about 900,000 acres have been scorched by wildfires this year, more than triple the amount when compared to last year.

When asked about fire damage, PG&E said, "it's too early and not estimable." The utility has about $900 million in fire insurance and is focused on "mitigating wildfire risk across its system" amid a summer of heat waves and a megadrought.

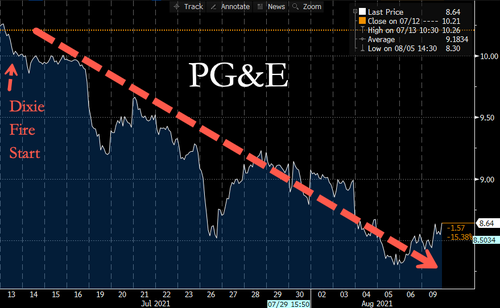

PG&E's shares have plunged 15% since the fire began around July 14.

The fund was established two years ago after PG&E's equipment sparked the Camp Fire, the state's deadliest blaze that burnt the town of Paradise to a crisp and drove the utility into bankruptcy. After the historic fire, top utilities in the state banded together to form the fund that would support them in the time of need during wildfire season.

https://ift.tt/3lP0ElB

from ZeroHedge News https://ift.tt/3lP0ElB

via IFTTT

0 comments

Post a Comment