One Bank Asks How Much Lower Stocks Would Be Without Covid

With another round of economic lockdowns and restrictions on the immediate horizon as Joe Biden unexpectedly admitted on Friday, one bank has dared to ask where we would be without the pandemic, and correctly extrapolates that the worse it gets for the general population the better it is for markets... just in case anyone is wondering who the Biden administration is really working for.

That said bank is Goldman Sachs is surprising: the vampire squid is not known for calling a spade a spade, especially when telling the truth could get the bank deplatformed, or worse, kicked out of the woke corporations club. Despite these risks, Goldman's head of HF equity derivatives sales, Tony Pasquariello, focuses precisely on this "no covid" counterfactual in his latest markets and macro note, pointing out that "as a client once put it, financial markets have no moral conscience. as we sit here today, one can argue the paradox of recent COVID variants is they’ve become a net positive for certain risk assets - on the thesis that local setbacks have kept the activity meter from going into the red, allowing for a back-footed Fed and a slower but, certainly far from slow -- pace of US and global growth."

Pasquariello then says that his sales & trading colleague Mark Wilson summarized it best, as follows: “the irony of this most recent bout of virus concern is that it actually likely exacerbates (not undermines) the durability of the medium-term growth outlook: inflation concerns have been pushed further out, central banks temptation to reduce support has been quashed, financial conditions have eased to new lows, and determination to follow through on widely heralded investment plans will have only increased.”

To take that logic a step further, Pasquariello shares a thought provoking two-liner that he saw on Twitter...

"imagine the counterfactual of the pandemic never happening; would the S&P 500 be 30% above its peak in February 2020 without it?"

... and notes that despite his normally bullish instinct, readers should put him in the “no” camp:

while the global economy had plenty of cyclical momentum coming out of 2019, in the absence of the utterly enormous policy response that COVID set off, it’s a little hard for me to think S&P would be printing 4400. here’s another approach: all else equal, without COVID, would US 10yr real yields be negative 1.17% ... and, without that rate underpinning, would US equity markets be trading on multiples never sustained outside of the 1990s tech bubble?

And just in case it's unclear, he simplifies the quite provocative point he is trying to make:

despite all of the deep awfulness of the pandemic, it touched off a series of events and reactions that are still playing out -- and, largely to the benefit of the risk complex, with no better example than the NDX 100.

Almost as if the covid pandemic is precisely what bull markets ordered (and according to a growing number of people that's precisely what happened, but that's a topic for another day)

Taken together, the balance between a strong runway for growth (increasingly more first derivative than second) and remarkably easy financial conditions (the same statement applies here) is still healthy for risk assets over the near-term. So, if the biggest dynamics remain in favor of the bulls, the Goldman trader argues that “the main thing” is to keep your eye on the ball amidst the inevitable noise and volatility; That means: (1) be long, on a responsible and flexible risk setting, given how far we’ve come; (2) maintain a split between secular growers and cyclical plays, with a shade towards the former; (3) yes, favor the US over all other markets.

Recapping his market sentiment, Pasquariello shares the following sentiment (first brought up by his Goldman colleague Dominic Wilson): “the environment is still one where you want to be buying dips and reducing on good news. there’s probably too much negativity around the growth outlook, and thus cyclicals. the overall balance of underlying growth and real yields is very healthy. so, stick with the game plan.”

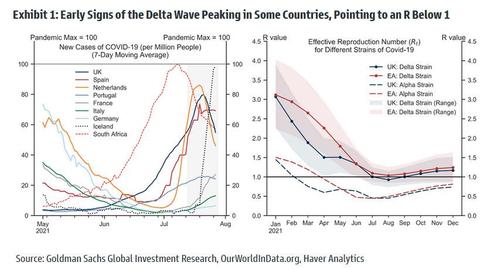

To dig a step deeper into the biggest question of the day, if the UK analog for how a highly vaccinated country handles the Delta variant is the best available stress test, there should be a reasonable limit to concerns even as US case growth accelerates (and, objectively, may not peak for another month).

This means that we have a reference point that looks reassuring on the biggest risks as we are within 1-2 weeks of the Delta wave peaking around the globe. Pasquariello also notes that it is interesting that the bank's pandemic basket (GSXUPAND) and back-to-office basket (GSFINOFC) outperformed the S&P this week - those are the high quality gauges to measure investor anxiety as we get into and move through August...

We concludes with some parting observations from Pasquariello: "if you take a big step back, the underlying strength of asset markets is stunning. This, of course, includes risk assets -- particularly equities and credit markets. It also extends to luxury goods, be it boats or watches or art or fine wines. It also includes the interest rate market, where persistently lower nominal yields in the face of many countervailing factors calls to mind the “conundrum” word choice of prior years. If there’s one pattern of fact that helps to rationalize all of this, it’s the simple point that there’s a ton of cash still looking for a home -- again, recall our work on $5tr of excess savings globally or the rise of family offices and their considerable war chests."

So going back to the original question - how much has covid boosted stock returns - The Goldman traders says that while he doesn't know how this story ends, "but apropos of nothing, if you told me in March of 2020 that I’d be typing this, there’s no way I’d believe it."

https://ift.tt/3lkc28B

from ZeroHedge News https://ift.tt/3lkc28B

via IFTTT

0 comments

Post a Comment