The Paradigm Shift In China

By Chetan Ahya, Morgan Stanley chief Asia economist

A profound policy shift is under way in China. To achieve the goals of ensuring social stability and making economic growth more sustainable, policy-makers have initiated a far-reaching and wide-ranging regulatory tightening cycle. This new course will shape the evolution of China’s economy and capital markets in the coming years. The implications? Rebalancing the shares of corporate profits and wages in GDP as well as recalibrating China’s equity risk premium.

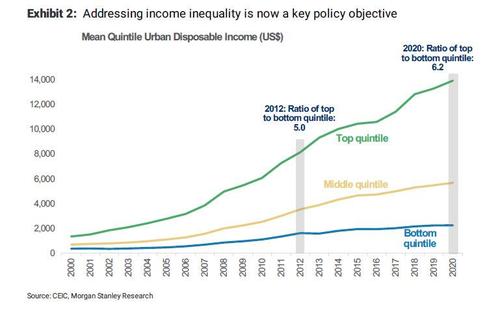

Broadly speaking, we believe that policy-makers’ goal of ‘common prosperity’ focuses on the challenges of rising income inequality. Significantly, this parallels the unfolding policy shift in the US, albeit with different approaches and starting points (see Sunday Start: The Paradigm Shift). While this change in policy should not come as a surprise since income inequality is a global issue, the speed, scale and intensity of the measures we are seeing in China today are unexpected.

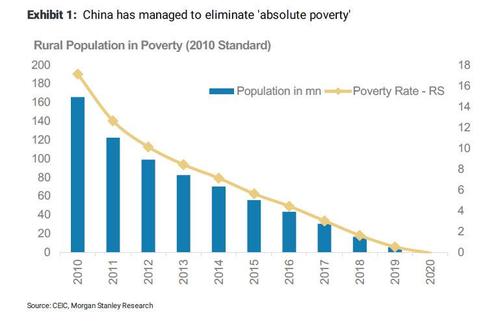

To take a step back, from a macroeconomic perspective, ‘common prosperity’ is consistent with rebalancing China’s economy towards consumption. In the early phase of China’s modern economic development, the most pressing need was to create employment opportunities to meet a sharp and sustained rise in China’s working age population. To address this, policy-makers took the approach of incentivizing investment, especially in the manufacturing sector. Costs for a wide variety of inputs across land, labor, capital and energy were kept low, while growth took precedence over the environmental impact of industrialization. The result was a rise in the ratio of fixed investment to GDP from 24% in 1990 to 42% in 2020, which catalyzed a period of fast-paced GDP growth, in the process lifting hundreds of millions out of poverty.

Economic development has now reached a critical juncture. Per capita income is on the cusp of crossing the high income threshold, but the distribution of household incomes has become markedly uneven. The most pressing need today is to address income inequality and raise the share of wages in GDP to support the long-standing goal of rebalancing the economy towards consumption. With a wage share of 52% and high levels of precautionary saving given limited access to healthcare, education and housing (especially for migrant workers), the proportion of private consumption in GDP is naturally limited. Raising the share of household incomes in GDP and reducing inequality while tackling the ‘three big mountains’ – escalating healthcare, education and housing costs – should support a higher share of private consumption.

Rebalancing towards consumption comes at a price. A higher wage share helps households but affects the owners of capital. A declining share of corporate profits in GDP means that even with relatively high rates of GDP growth, corporate profitability in aggregate will face headwinds.

What’s more, regulatory actions to rebalance the shares of labor and corporate profits inevitably raise the equity risk premium. Regulatory changes are often unpredictable, leading market participants to second-guess when the next wave will hit, which sectors might be affected and to what extent. In some instances, especially in recent years, regulatory actions have not kept pace with the growth of industries. Industries were initially allowed to grow and gain scale, attracting significant capital commitments for future growth and investment. But after exponential expansion, these industries have experienced a wave of intense regulatory action, limiting their scope severely and even disrupting their business models. Moreover, the uneven communications around regulatory changes and seemingly uncoordinated actions across different regulatory agencies leave global investors in need of clarity.

The upshot is that, in the near term, the effects of the regulatory tightening cycle should dampen overall corporate sentiment, curtail private investment and weigh on the growth outlook. It may also deter global investors from deepening their participation in China’s capital markets. Our equity strategists, Jonathan Garner and Laura Wang, believe that equity risk premium will remain at a relatively high level, at least in the near term, and that, over time, the MSCI China universe will gradually have a more balanced sector allocation with a reduced weight for Internet and a higher weight for sectors like Industrials and IT. From a capital markets perspective, our China financials analyst, Richard Xu, believes that the recent regulations may lead to further shifts in some IPOs from the US to Hong Kong.

Policy trade-offs and choices will likely determine the intensity of these headwinds. While all industries need regulations to varying extents, these constraints need to be balanced against the overarching objective of maintaining economic progress. The private sector plays a crucial role in innovation and sustaining productivity gains, growth drivers that have become more important against the backdrop of weakening demographics. We believe that policy-makers understand the challenges posed by dampening corporate sentiment and investment and will steer a middle course between tempering the worst effects of market forces while ensuring a reasonable and sustainable rate of economic growth.

https://ift.tt/3s45Kvu

from ZeroHedge News https://ift.tt/3s45Kvu

via IFTTT

0 comments

Post a Comment