"We Haven't Seen This In More Than 30 Years" - Shipping Rates From China To US Hit Record $20,000 With No Drop In Sight

Those looking for signs of transitory inflation are advised to not look at the latest container data, which contrary to many commodities tracked by Wall Street, resolutely refuses to turn lower.

Of course, regular readers are well aware of the hyperinflation in shipping rates as we have extensively covered this move in the past few months, as well as some more unique cases such as this one "More Container Ships Score "Astronomical" $100,000/Day Rates" but today Reuters readers are also learning that shipping rates from China to the United States have scaled fresh highs above $20,000 per 40-foot box as rising retailer orders ahead of the peak U.S. shopping season, adding strain to global supply chains.

Having already scaled all time highs, the acceleration in Delta-variant COVID-19 outbreaks in several counties has added to the upward price pressure by slowing global container turnaround rates. Typhoons off China’s busy southern coast in late July and this week have also contributed to the crisis gripping the world’s most important method for moving everything from gym equipment and furniture to car parts and electronics.

“These factors have turned global container shipping into a highly disrupted, under-supplied seller’s market, in which shipping companies can charge four to ten times the normal price to move cargoes,” said Philip Damas, Managing Director at maritime consultancy firm Drewry.

“We have not seen this in shipping for more than 30 years,” he said, adding he expected the "extreme rates” to last until Chinese New Year in 2022.

Here are some mindblowing numbers: the spot price per container on the China-U.S. East coast route - one of the world’s busiest container lanes - has climbed over 500% from a year ago to $20,804 this week, freight-tracking firm Freightos said. That compares to just under $11,000 on July 27 or about one week ago. The cost from China to the U.S. west coast is a little below $20,000, while the latest China-Europe rate is nearly $14,000, Freightos’ data shows. Ding Li, president of China’s port association, told Reuters the spike followed a rebound in COVID-19 cases in other countries, which has slowed turnover at some major foreign ports to around 7-8 days.

The surging container rates have fed through to higher charter rates for container vessels, which has forced shipping firms to prioritize service on the most lucrative routes.

“Ships can only be profitably operated in the trades where freight rates are higher, and that is why capacity is shifting mostly to the U.S.,” said Tan Hua Joo, executive consultant at research consultancy Alphaliner.

Some shippers have also reduced volumes in less profitable routes, such as the transatlantic and intra-Asia, said Damas. “This means that rates on the latter are now increasing fast.”

The rate surge is the latest reflection of disruptions since COVID-19 slammed the brakes on the global economy in early 2020 and triggered huge changes to the flows of goods and healthcare equipment around the world.

"Every time you think you’ve come to an equilibrium, something happens that allows shipping lines to increase the price," said Jason Chiang, Director at Ocean Shipping Consultants, noting the Suez canal blockage here in March had played a major role in allowing firms to hike rates.

"There are new orders for shipping capacity, equal to almost 20% of existing capacity, but they will only come online in 2023, so we will not see any serious increase in supply for two years," Chiang added.

Then again, perhaps expectations that all will be resolved by the Chinese new year are overly optimistic. In "Shipping braces as China goes into lockdown mode" we read that most Chinese ports are now requiring a Covid test for all crew, with vessels forced to remain at anchor until negative results are confirmed, and/or requiring ships to quarantine for 14-28 days if they previously berthed in India or changed crew within 14 days of arriving. That spells further delays. After all, when Covid was detected at Yantian Port in late May, that key export hub cut its operations by 70% for most of June.

Rabobank's Micheal Every touched on this topic and underling some key points regarding shipping and the consequences for global markets:

- Before this surge in shipping costs, most economists thought logistics were invisible, efficient, and of no interest. Like plumbing, you need it, but don’t let it dictate your plans for the day;

- Those logistics assumptions were only possible because since 1945 the US Navy has kept global sea lanes open and safe for all maritime traffic. Pirates and hijacking get attention today because they are *rare* – but they did not used to be. Indeed, global sea lanes used to be carved up by empires for their preferred shipping and production, not open to all;

- That paradigm starting to fray along with the rest of the post-WW2 global architecture;

- Current price surges are due to massive supply-demand imbalances that are not going to go away any time soon;

- But imagine shipping costs, and the broader implications, if we get maritime chaos in the Straits of Hormuz, around Suez, or in the South China Sea;

- Building new maritime capacity from ship to port to warehouse to rail to truck to store to home to address our supply-demand imbalances is tied to the post-Covid economic geography: is it still a post-1945 open economy?; if not, where will things be made? We still don’t know, but we BRI vs. B3W is an example of how things are trending; and

- In short, the ship of apolitical logistics has sailed. Just as ‘a conservative is a liberal who has been mugged’, so a ‘mercantilist is a free trader with squeezed supply chains’.

As a result, Every argues that "markets are right to price for the risk-off of very low bond yields - if they are willing to look past the demand-destroying price surge that will precede that slump; and if they remain unsure about the map of the reflationary, more fragmented world that emerges afterwards."

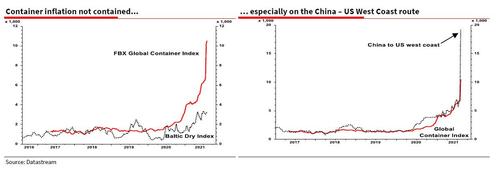

Of course, at some point rates will need to reverse and this is what SocGen's Albert Edwards touched on in his latest note, first noting the obviously namely that when it comes to shipping rates, "there is no inflationary parallel! The doubling of the commodity-led Baltic Dry Index since the outbreak of the pandemic last year is a mere blip compared to container shipping inflation – especially on the China-US West Coast route!"

However, Edwards then asks what happens when this surge reverses, supply chains normalize, and all those backlogged containers finally reach their port of call. In addressing this question, Edwards points to a recent column by the FT's John Dizard who discussed the potential for an old-fashioned inventory-led recession next year when the current bottlenecks affecting container shipping dissipate. All that “delayed stuff, when it finally lands where it is supposed to, looks as though it will create a big enough pile to trigger a bad inventory recession.… The supply chain practitioners I’ve been interviewing figure that the port backups, unavailable trucks, Covid-19 restrictions and unskilled warehouse staff will be more or less ironed out by Chinese New Year.”

The SocGen strategist concludes that "if the FT’s Dizard is right, we should watch for a reversal of container prices as an indication that normality is returning to the global supply chain. US domestic demand has run well ahead of restricted supply recently. But the current depleted inventory levels may be rising rapidly by Chinese New Year (February) – causing production to adjust sharply downwards."

https://ift.tt/3Cjmvat

from ZeroHedge News https://ift.tt/3Cjmvat

via IFTTT

0 comments

Post a Comment