Fed Hawks Hammered Stocks, Bonds, Bullion, & Bitcoin This Week As J-Hole Looms

Comments from Richmond Fed president Barkin today summed a week of hawkish prompts from the central bank that a pivot ain't coming soon and there's more pain to come (for the economy and the market):

"The Fed must curb inflation even if this causes a recession," adding that The Fed "needs to raise rates into restrictive territory."

All of which sent rate-cut expectations plunging on the week while rate-hike expectations remained high...

Source: Bloomberg

“The Fed would, in order to get inflation down to the 2% target, have to crush the economy,” said Ann-Katrin Petersen, a senior investment strategist at BlackRock Investment Institute.

In order to bolster growth, the Fed will at some point “accept to live with inflation. This dovish pivot is not likely in the very near term, in contrast to what markets seem to be expecting right now, but this dovish pivot may come in 2023,” she told Bloomberg.

The hawkish nudge finally hit the YOLO/MOMO crowd sending stocks reeling today after a big options expiration. Nasdaq and Small Caps were clubbed like a baby seal today (down over 2%) and all the US Majors ended the week lower (with The Dow the prettiest horse in the glue factory this time as growthy tech was hammered with rising rates)...

Dow, Nasdaq, and S&P all reversed at their 200DMAs this week...

The S&P reverted back down to its 50% Fib retracement level...

Source: Bloomberg

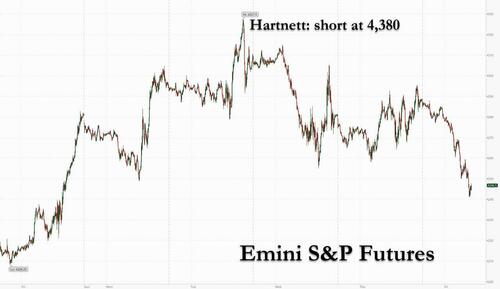

And DO NOT forget our post suggesting cover on the back of Mike Hartnett's top call...

Source: Bloomberg

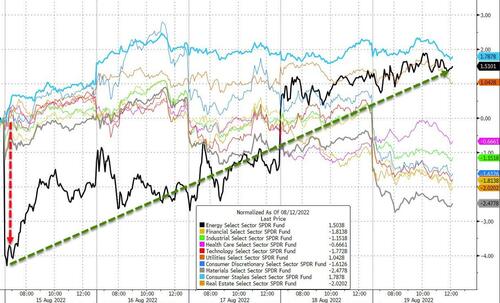

Energy stocks went from worst to almost first on the week after a big puke at the Monday open. Staples were the leaders while Materials the laggards....

Source: Bloomberg

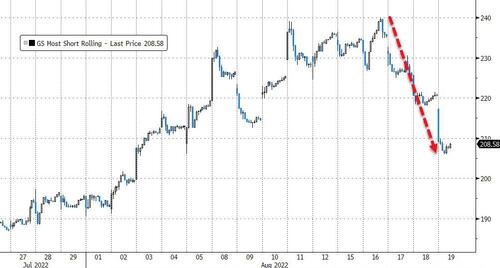

Before we leave stock-land, there's this utter shitshow...

Did the YOLO-ers just shoot their final wad?

"Most Shorted' Stocks tumbled hard this week as it appears the squeeze ammo has run out...

Source: Bloomberg

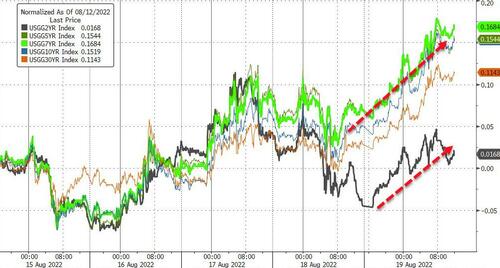

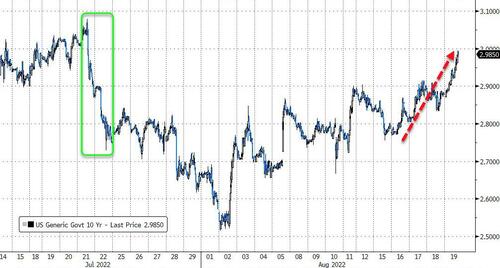

US Treasury Yields surged this week with the belly underperforming dramatically...

Source: Bloomberg

10Y spiked up to 3.00% - erasing all the price gains from the ECB/US-weak-data bond rally...

Source: Bloomberg

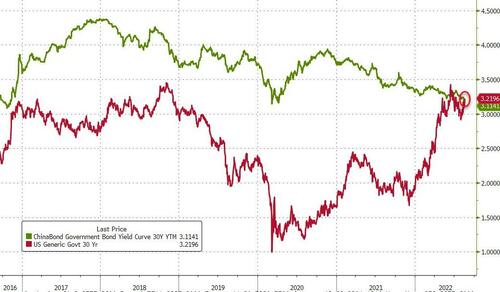

US 30Y yields rose back above China 30Y yields which dropped to 6 year lows: Traders might be betting that lower mortgage rates - led by expected cuts in loan prime rates - will push banks to buy more longer-dated bonds, wrote Qin Han, an analyst at Guotai Junan Securities in a note.

Source: Bloomberg

The hawkish speak sent the dollar soaring with Bloomberg's Dollar Index up a stunning 2% on the week - its biggest weekly spike since April 2020. Notice that the dollar broke back above the FOMC day selloff highs...

Source: Bloomberg

Cryptos were monkeyhammered lower as the week progressed with ETH and BTC down around 12%...

Source: Bloomberg

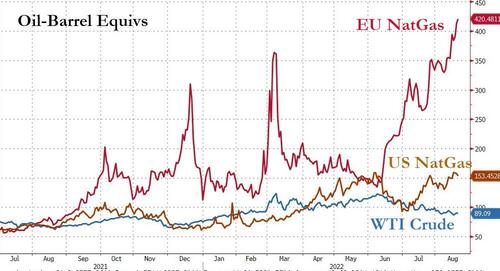

EU NatGas soared to a new record high (and US Natgas closed at its highest since 2008)

Source: Bloomberg

Gold tumbled back below $1800 this week as the hawkish hammering spread to commods...

And oil ended the week lower - despite some choppy trading - with WTI holding around $90...

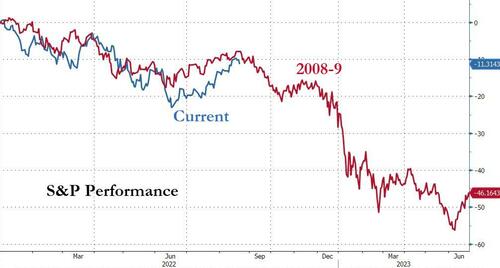

Finally, we note that we've seen these kind of bounces before...

Source: Bloomberg

...and it didn't end well.

https://ift.tt/eVLC0sN

from ZeroHedge News https://ift.tt/eVLC0sN

via IFTTT

0 comments

Post a Comment