Massive Meme Meltup Sparks Marketwide Squeeze, Until Hartnett Says "Sell"

It was setting up to be a quiet day, with futures drifting lower from their 4,300+ highs hit on Monday, when this morning Walmart's blowout results (at least relatively to sharply lower expectations) and guidance hike sent the stock of the retailer soaring...

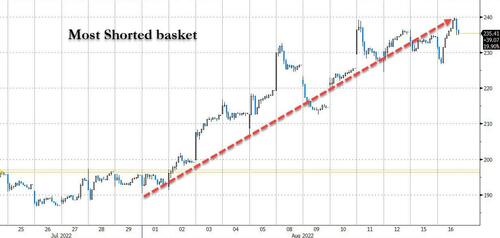

... lifting all heavily-shorted consumer discretionary stocks (but muh inventory overhang), and as the squeeze spilled over across the market, all most-shorted names melted up with Goldman's most shorted basket soaring to the highest level since April...

... but not even meme stonk "OG" Gamestop...

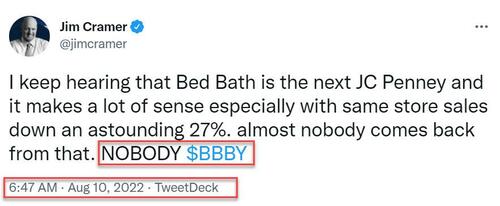

... had a day as stellar as Bed Bath and Beyond: the stock of the heavily-shorted retailer, which was trading at just $5 a few weeks ago, exploded as much as 75% higher today, one week after Jim Cramer said it was the next JC Penney...

... and briefly traded above $28, much to the chagrin of sellside analysts who recommended selling it (and leading to an even more powerful squeeze)...

... but just as most shorted memes rode the escalator up, so they took the elevator down, and tumbled even faster than they had risen amid a frenzied profit taking...

... potentially precipitated by the likes of Citadel which this time decided to trade alongside the squeeze.

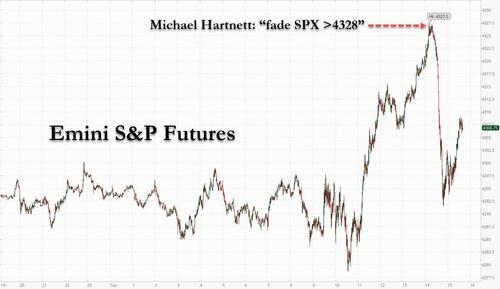

What caused the sudden dump? Well, there are conflicting narrative but one which appears rather likely is the market's sudden realization that euphoria was back to levels when the Fed Funds rate was 0% and the Fed was buying $120BN in securities every day, coupled with a warning from Wall Street's ultrabearish - and most accurate - strategist, Michael Hartnett, who having correctly called the meltup, warned early this morning that he "would fade SPX >4328 as rates up-profits down our base case."

Where did spoos rise to? 4327.5! Coincidence? We think not...

So has Hartnett done the impossible, and one month after calling the meltup, will he be right on the way down too? We will find out soon enough.

Elsewhere in today's market, yields initially spiked despite another huge miss in new home starts, which tumbled to a fresh 16 month low...

... and then drifted lower all day to settle just barely higher on the day.

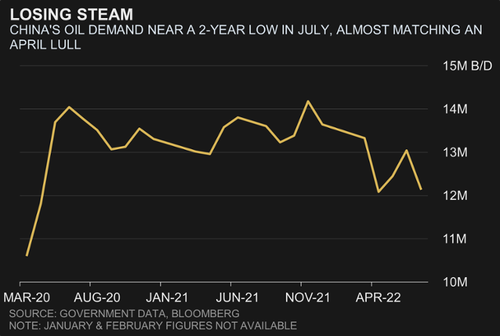

There were more fireworks in oil, which bounced early but then tumbled again to the lowest level since January...

... amid speculation that the Iranian nuclear deal - which has been "imminent" for the past 2 years will get finally done today (it didn't) - coupled with more fears about China's waning oil demand (somehow China is reportedly using less oil today than it did in 2020, which of course is a lie).

Ironically the lower the price of oil slides on expectations of a recession or some mythical supply blast (Iran is already selling all of its oil to China in violation of toothless US sanctions), the greater the ensuing inventory draws, and the higher the subsequent bounce as we hit a physical shortage wall - especially as the time comes to refill the SPR, and the summer of 2008 oil explosion repeats all over again.

Finally, while oil was plunging because a handful of bullish hedge funds were caught offside on their other positions and had to liquidate, US nat gas prices just hit a fresh 14 years high. Spoiler alert: either gas will plunge (it won't, with European gas prices at bananas levels) or oil will surge as gas-to-oil switching takes the world by storm during the coming long, cold winter...

https://ift.tt/ZTY5k8q

from ZeroHedge News https://ift.tt/ZTY5k8q

via IFTTT

0 comments

Post a Comment