WTI Holds Gains After 2nd Large Weekly Draw In A Row

Oil prices ended higher on the day, despite another Iran-nuke-deal headline (supply) and ugly economic data (demand) as OPEC+ sources confirmed the cartel's willingness to shift to production cuts in the case of an Iran deal in order to recouple physical and futures markets.

“Oil continues to march higher today as the market digests comments regarding potential cuts from OPEC+,” said Stacey Morris, head of energy research at VettaFi.

“Market observers will also be closely watching US inventory reports to see if the recent strength in gasoline demand has held up.”

Adding further support to prices, Kazakh oil exports may be disrupted for months due to damaged moorings.

API

-

Crude -5.632mm (-3.2mm exp)

-

Cushing +679k

-

Gasoline +268k

-

Distillates +1.05mm

After the prior week's large crude draw, analysts expected another sizable draw last week and according to API's report, they are right with a larger than expected 5.632mm barrel draw. Cushing stocks rose and product inventories built...

Source: Bloomberg

WTI was hovering around $93.50 ahead of the API data and limped modestly lower after the print...

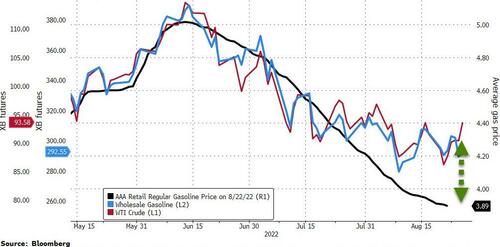

In the US, gasoline prices are on their longest run of declines since 2015, potentially easing some of the inflationary pressures on the country’s economy. However, that slide may soon come to an end as wholesale gasoline and crude prices have decoupled higher...

Source: Bloomberg

US diesel prices have fallen for more than 60 days, though that may reserve as demand for the fuel rises in the approach to winter.

https://ift.tt/3pB4cqZ

from ZeroHedge News https://ift.tt/3pB4cqZ

via IFTTT

0 comments

Post a Comment