What Will The I-Bond Interest Rate Be In November 2022?

Authored by Mike Shedlock via MishTalk.com,

Let's go over how you can project I-bond rates based on semi-annual CPI estimates.

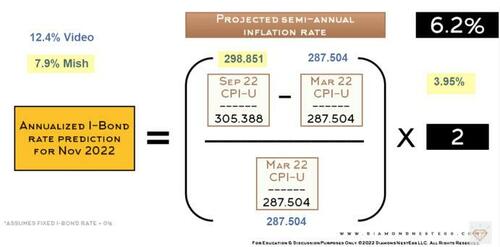

Image from Diamond NestEgg (DNE) video with Mish alternate calculations

I Bond Interest Rate November 2022 Prediction

Assuming a base fixed rate of 0%, the formula for the next I-bond rate is ((September CPI-U Minus March CPI-U) Divided by March CPI-U) * 2.

The CPI numbers are unadjusted.

DNE estimates a whopping 12.4% annualized yield. I arrive at 7.9%.

The difference is in CPI projections. DNE assumed 1.0% inflation for July, August, and September.

We already know July was 0.0% (technically slightly negative).

The Cleveland Fed projects 0.09% month-over-month inflation for August. My assumption based on utilities and rent, with gasoline mostly flat is 0.40%.

For lack of a better number, I used 0.40% for September as well.

Mish vs DNE CPI Projections

July (subject to revision) is a known value. Tacking on 0.40 percent to July and then again for August yields a CPI-U of 298.851.

Plugging that into the lead chart formula gets an annualized yield of 7.9%. That's far under DNE's calculation but a very nice yield that everyone should take advantage of.

I-Bond Details

-

The limit for purchasing I-bonds is per person, so a married couple can each put up to $10,000 in the investment annually, or up to $15,000 each if they both also elect to get tax refunds in paper I-bonds.

-

Also, you can purchase I bonds for each child and if you have a trust, the trust can buy them.

-

An investor must hold the bonds for 12 months, and if they sell the bonds before five years, they lose three months of interest.

-

You must hold the bonds for 5 years to collect all of the interest and the rates will change semi-annually.

Treasury Direct has more details on Buying Series I Savings Bonds

In a calendar year, you can acquire:

-

up to $10,000 in electronic I bonds in TreasuryDirect

-

up to $5,000 in paper I bonds using your federal income tax refund

Is it worth the hassle given the above limits?

They make great gifts. But hassle is in the eyes of the beholder.

* * *

Like these reports? I hope so, and if you do, please Subscribe to MishTalk Email Alerts.

https://ift.tt/fIVwXc3

from ZeroHedge News https://ift.tt/fIVwXc3

via IFTTT

0 comments

Post a Comment