Rugpull: After Stratospheric Gamma Squeeze, Ryan Cohen Files To Sell Stake In Bed, Bath & Beyond

Having watched the tremendous meltup in Bed Bath and Beyond in disbelief, we were struck to learn that none other than GameStop Chariman and BBBY investor, Ryan Cohen (through his RC Ventures investment firm) was at least partially responsible for the meltup.

Here's what happened: on Tuesday, following days of gradual but persistent short squeezes similar to what happened in January 2021, BBBY exploded higher as retail traders piled into the stock, encouraged by news that Ryan Cohen placed another bet on the struggling retailer whose EBITDA has been a melting icecube for the past decade: for all fundamental intents and purposes, the company is dead...

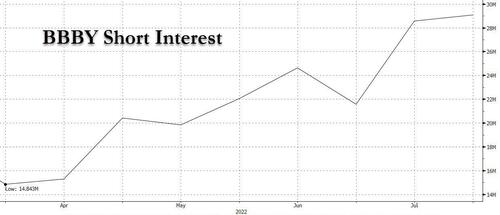

... but one wouldn't know it by the recent price action which saw the stock explode by orders of magnitude after a regulatory filing Monday evening showed that Cohen’s venture capital firm RC Ventures bought far out-of-the-money call options on more than 1.6 million Bed Bath & Beyond shares with strike prices between $60 and $80, in a classical attempt to spark a gamma squeeze, made popular by what Elon Musk's offshore investing unit did with Tesla repeatedly in 2020 and 2021. The call options that Cohen bought expire in January 2023, and are so far out of the money, the mere purchase created a feedback loop where dealers had to aggressively buy the stock to delta hedge and since the short interest in BBBY was off the charts, a short squeeze loop also kicked in on the stock that had a short interest at a whopping 44.3% of float.

In short, a carbon copy of the action we observed in Jan 2021 with GME, AMC, and so many other meme stonks.

To be sure, the call purchase by RC Ventures grabbed the attention of retail traders on the WallStreetBets forum, where the ticker BBBY became the most popular mention in the chat room Tuesday and Wednesday.

Trading volumes in Bed Bath & Beyond exploded Tuesday with more than 160 million shares changing hands as of noon ET, turning over the 65 million stock float many times.

In any case, having repeatedly seen this kind of attempt to gamma squeeze a stock higher, we said yesterday that "One day the SEC and @GaryGensler will figure out how management and top shareholders use call buying to force gamma squeezes of their own stock. But not yet.... not yet."

One day the SEC and @GaryGensler will figure out how management and top shareholders use call buying to force gamma squeezes of their own stock. But not yet.... not yet.

— zerohedge (@zerohedge) August 17, 2022

There was one reason why we were confident why "not yet" and why the SEC would not step in: after all, even if he was manipulating the stock higher, Cohen had not actually pulled the plug and sold, making millions in profits on the extremely overvalued BBBY stock, and without a profit there is no case.

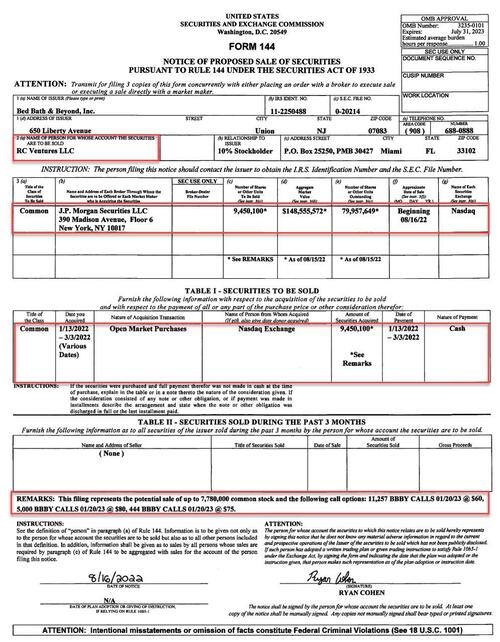

That, however, may be about to change when on Wednesday afternoon much to our - and the market's shock - Ryan Cohen through his RC Ventures, filed a Form 144 (just minutes before the close of course) telegraphing his intentions to sell 9,450,100 shares starting on August 16. This is equal to about 9.8% of BBBY's shares outstanding and is the full amount of stock owned by Mr. Cohen via a February 24, 2022, SEC filing.

According to the filing, it represents the potential sale of:

- up to 7,780,000 common stock,

and the following call options:

- 11,257 BBBY CALLS 01/20/23 @ $60,

- 5,000 BBBY CALLS 01/20/23 @ $80,

- 444 BBBY CALL 01/20/23 @ $175

The notice of the coming sale comes as a surprise not only because Cohen had said he was working with the board to turn around the company, but also because Cohen's stake has been a driver for the recent short squeeze and meme-stock rally in the name.

In other words, if and when Cohen starts selling in earnest, the SEC will be able to make a clear case for market manipulation, which considering all the rampant gamma squeezes in recent weeks, is probably long overdue.

As for the stock, well once retail investors realized they had been rug--pulled, BBBY stock tumbled in the last minutes of trading, and continue to slide after the close, dropping below $20 as all those who were hoping to piggyback on the gamma squeeze are suddenly hoping not to be the lat bagholder left.

The full filing is below (pdf link).

https://ift.tt/Mz7OCts

from ZeroHedge News https://ift.tt/Mz7OCts

via IFTTT

0 comments

Post a Comment