Bonds Bid, Stocks Skid As Debt-Ceiling Doubts Soar

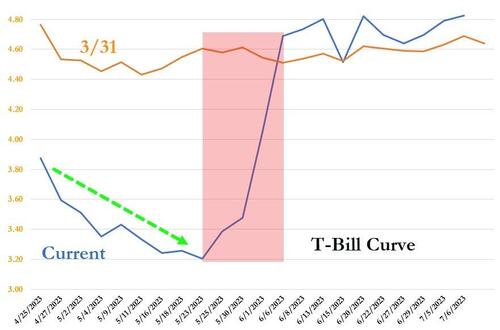

The T-Bill curve is extremely dislocated following Friday's "worst case scenario" tax receipts data...

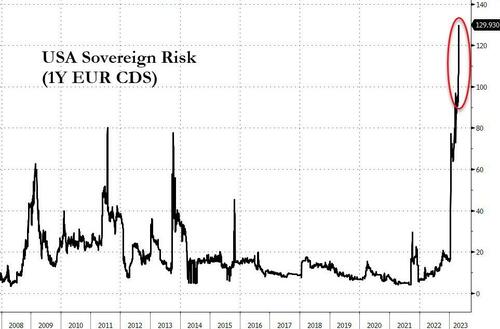

And the debt ceiling anguish is most clear in the short-dated cost of protection against a technical default by The US - which has soared today to its highest level ever (far above the Great Financial Crisis, debt downgrades, and prior debt ceiling crises)...

Source: Bloomberg

While equity markets remained largely ignorant of this threat again today (Nasdaq was down today but The Dow and S&P managed small gains)...

All eyes will be on FRC's earnings tonight after it rallied over 10% today (and is expected to swing +/- 23% after the earnings hit based on options pricing). Putting that 10% jump in context however...

The vol term structure shows the general level of anxiety ahead of rising with the data this week, FOMC next week, and then the imminent X-Date...

Source: Bloomberg

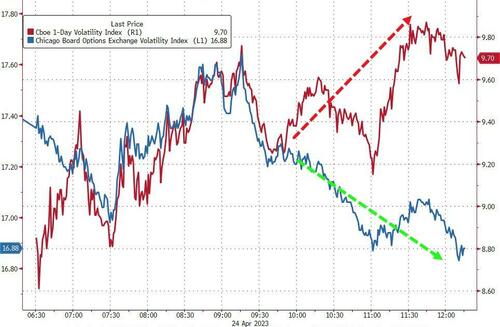

But we do note that with today's release of the 1-day VIX, that 0-DTE traders lifted vol while (normal) VIX drifted lower from its spike open...

Source: Bloomberg

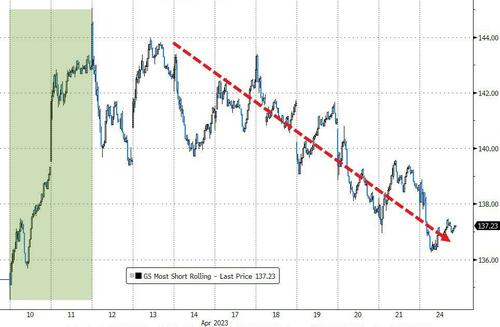

Notably, the big short squeeze from mid-April (post-Payrolls) is rapidly running out of steam with 'most shorted' stocks down again today...

Source: Bloomberg

Treasury yields tumbled today, erasing all of Friday's spike, with the belly outerperforming...

Source: Bloomberg

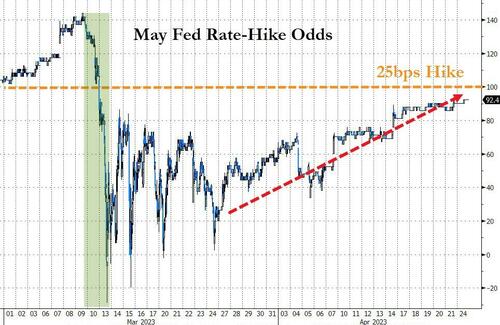

Rate-hike expectations for next week rose to post-SVB highs (92% odds of +25bps)...

Source: Bloomberg

The dollar ended the day lower, back at last week's lows. Notably, the dollar was bid during the Asia session then dumped in Europe and US...

Source: Bloomberg

Bitcoin touched $28,000 overnight, only to fall back to touch $27,000 this morning, and found support there...

Source: Bloomberg

Gold managed gains on the day but spot prices remain below $2000...

Source: Bloomberg

Oil prices bounced today, with WTI back above $79, after almost erasing all the post-OPEC+ production cut gains...

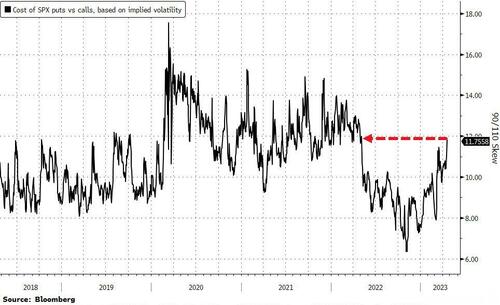

Finally, circling back to where we started, while vol has been drifting generally lower - ignoring the earnings avalanche, the debt ceiling, and FOMC uncertainty - Bloomberg notes that the price to hedge, as measured by the spread between implied volatility for puts and calls, is spiking and has climbed above the latest peak in March during the worst of the banking crisis.

Source: Bloomberg

The move suggests traders are bracing for bigger moves to the downside ahead.

https://ift.tt/URpBKac

from ZeroHedge News https://ift.tt/URpBKac

via IFTTT

0 comments

Post a Comment