Nasdaq's Casino-Like Returns Turns Investment Into Roulette Game

By Ven Ram, Bloomberg Markets live reporter and strategist

Sometimes, watching stocks go up, up and away to stratospheric heights, one may end up thinking they are in a casino.

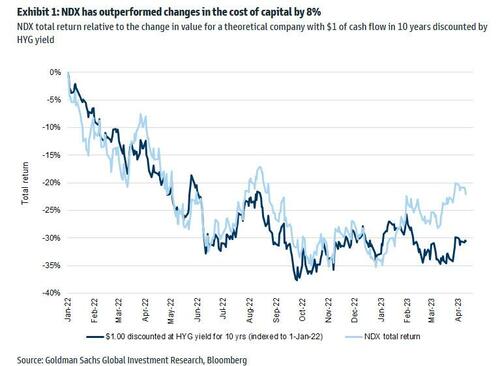

The gravity-defying performance of technology stocks this year is a case in point. After Thursday’s 2% rally, the Nasdaq 100 basket has serenaded investors with a stunning 20% return. And that’s not counting the dividend yield. Given the potent rally, that yield may not be stellar at less than 1%, but every percentage point does count in the long run.

At current levels, the earnings yield available to a stockholder is around 3.26%, and you know that you can aspire to higher yields in the Treasury market without accruing any credit risk. Talking of the latter, even the option-adjusted spreads on high-yield credit in Corporate America are a lot higher — a full 130 basis points. The question to ask, of course, is whether the growth picture of technology stocks is so alluring and risen suddenly so meteorically since the start of the year that investors should forsake all sense of caution and flee to high-duration stocks.

That last bit is likely to come into sharper focus now that it’s becoming increasingly clear that the Federal Reserve is entering the last lap of tightening for the current cycle. But the end of a tightening cycle doesn’t necessarily have to give way to a loosening cycle — especially given above-target inflation — but that point is pretty much lost on the markets. “Hike and hold”, which has been the Fed’s refrain, doesn’t translate into “Hike and cut immediately” even in Swahili the last time I checked, but you could argue until the cows come home and still not get anywhere.

So if the current mood in the market continues, we may well see technology stocks climbing higher and higher for longer than you keep your sanity or solvency — or both. However, one thing is for sure: those who live by the sword must be prepared to die by it. Buying high and selling higher may be a thrilling ride while it lasts, but the point is that it doesn’t last long enough until you are burnt.

For, if you treat the markets like a casino, you should also expect the returns you would get from being inside one.

https://ift.tt/UbOXEvk

from ZeroHedge News https://ift.tt/UbOXEvk

via IFTTT

0 comments

Post a Comment