Bonds, Stocks, & Bitcoin Surge Amid Week Of Stagflationary & Systemic Threats

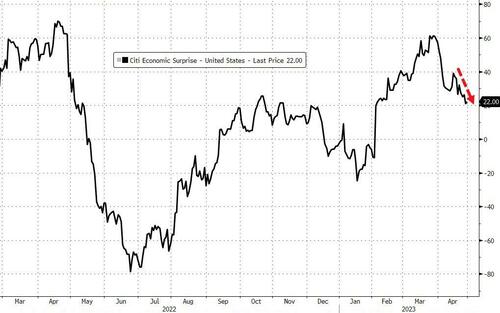

A week of disappointment in macro with stagflation very much back on the table...

Source: Bloomberg

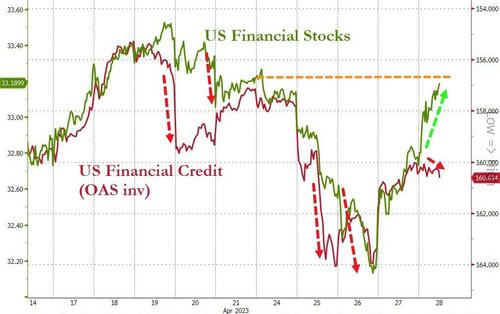

Increasing banking system threats with FRC literally collapsing...

...but the 'rest' surviving based on stocks, but credit markets ain't buying what stocks are selling...

Source: Bloomberg

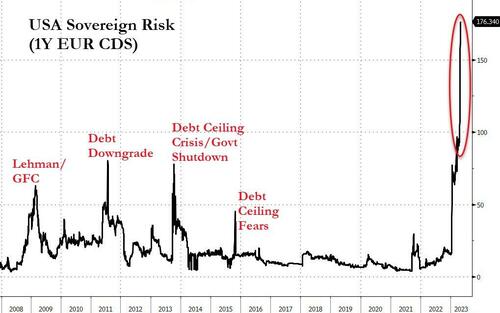

And looming US debt defaults...

Source: Bloomberg

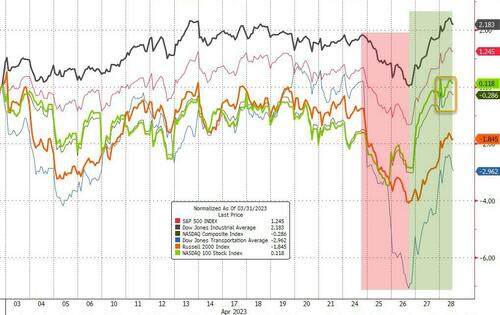

...was ignored by stocks this week as mega-cap tech gains dragged Nasdaq notably higher (along with the S&P and Dow) while Small Caps lagged...

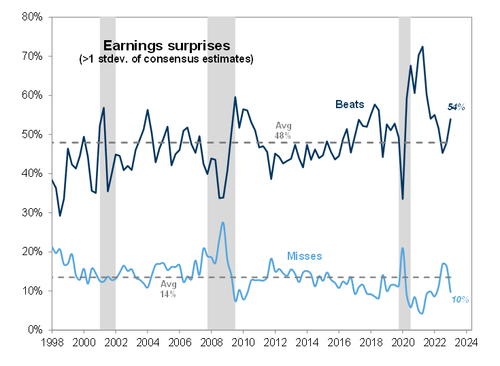

Of course, the illusion of earnings 'beats' has helped... as Goldman notes, the bar was very low coming into this earnings period.

Consensus expectations were for EPS to fall by 7% year/year, the largest decline since 3Q 2020 and a significant deterioration from the -1% year/year growth posted in 4Q 2022. This is not playing out and as a result the market is hanging tough.

Good News: So far earnings have been much better than feared with 54% of companies beating consensus estimates by at least 1SD (vs historical avg of 48%). Only 10% of companies have missed consensus estimates by at least 1SD (vs historical avg of 14%).

Bad News: The companies that are beating consensus ests by >1SD are only outperforming the S&P 500 by 40bps on the trading session directly following earnings. Typically beats outperform the S&P 500 by over 100bps. The few companies that are missing these low bars are being severely punished, underperforming the S&P 500 by -290bps vs historical avg of -211bps.

But the equity market had help from its 0DTE pals the last two days as the call-grab was unleashed. Yesterday and most of today saw 0DTE call-buyers run riot, lifting the S&P easily back into the green for the week. We do note that late on today, there was some serious negative-delta flow (profit-taking) into the weekend...

Which sparked a remarkable short-squeeze...

Source: Bloomberg

VIX was lower on the week, down considerably from the early week tag of 20. However, 1-Day VIX (tracking 0DTE) ended notably higher with every day looking the same: an opening gap down and persistent vol bid all day...

Source: Bloomberg

On the month, Nasdaq's last few days got it back to unchanged while The Dow was the month's biggest gainer and Trannies and Small Caps the biggest losers...

Source: Bloomberg

Year-to-date, the Nasdaq continues to roar while the S&P 500 treads water at levels we've seen before...

Source: Bloomberg

While stocks were higher on the week, bond yields ended the week lower with the entire curve down around 11-13bps by the end, as mid-week underperformance of the long-end compressed...

Source: Bloomberg

On the month the picture was even less distributed with yields practically unchanged (belly modestly outperforming as wings underperform)...

Source: Bloomberg

The dollar ended April marginally lower (its 6th month drop of the last seven months)

Source: Bloomberg

Solana, Bitcoin, & Ethereum all had a solid month while Ripple was down notably...

Source: Bloomberg

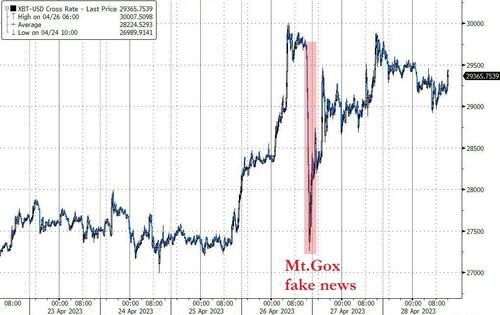

Amid a very volatile week, Bitcoin was notably higher, pushing back above $29,000...

Source: Bloomberg

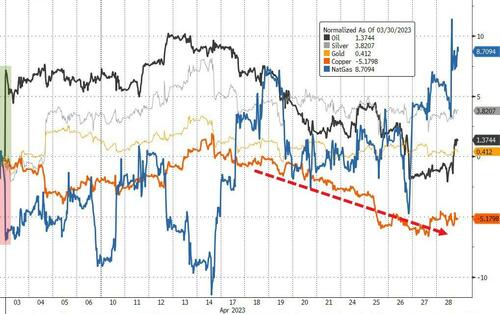

Oil managed very modest gains on the month having erased all of the post-OPEC+ production-cut spike that started the month off. NatGas did the opposite, soaring after a kneejerk lower on OPEC. Perhaps most ominously, we note that copper was hammered on the month as growth fears and China reopening hopes fade (that's the third straight mont of drops for Dr.Copper)...

Source: Bloomberg

Gold ended April higher (though by less than 1%) for its 5th positive month of the last six, having tested near record highs and holding around $2,000...

Source: Bloomberg

WTI managed to close back above pre-OPEC+ level thanks to today's bounce, but oil overall remains rangebound broadly speaking between 74 and 81...

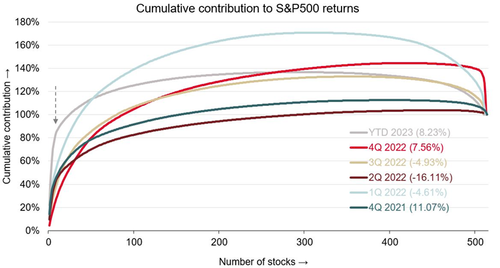

Finally, we note that the top 10 stocks are responsible for 86% of the overall index return YTD...

"To infinity and beyond" for 'safe haven' mega-cap tech appears to be the mantra of the market once again, but be careful what you wish for as this narrow breadth often dangerous (see NDX vs NDXE in Nov’08, Oct’18, Dec’21)...

And talking of the future, congrats to Nico on the internship. Enjoy and soak up everything you hear.

https://ift.tt/JgkLhdZ

from ZeroHedge News https://ift.tt/JgkLhdZ

via IFTTT

0 comments

Post a Comment