Buffett's Berkshire, Awash In Cash, Can't Find Much To Buy

By Ven Ram, Bloomberg Markets Live reporter and analyst

Stocks are still holding onto their gains for the year, though investors would do well to ponder what legendary investor Warren Buffett may be doing.

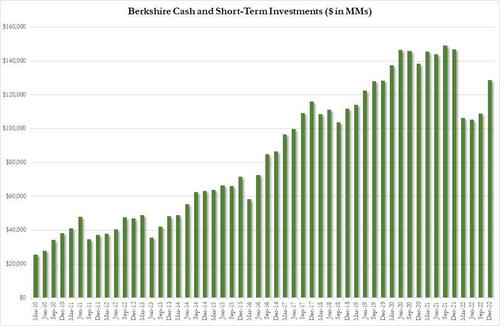

Or rather, what he isn’t. At the end of last year, Berkshire Hathaway had cash holdings alone of $128.59 billion. That’s, of course, a ton of cash and then some, but how about this for perspective? Only about 50 or so companies on the S&P 500 had a market capitalization greater than the conglomerate’s cash holdings. In other words, Berkshire could buy most member companies of the S&P individually — or even a combination of them — for cash outright.

While he has been looking to buy big, that hasn’t quite panned out. And we all know that Buffett and his deputy Gregory Abel are itching to deploy that cash, for no investor worth his salt is satisfied with returns on cash over the longer term. Granted, given the nature of Buffett’s thinking, he would always sleep well at night with adequate liquidity in hand — meaning his company would never be invested to the last dollar.

Even so, it’s worth asking the question that if one of the smartest investors out there can’t find reasonably priced investments, what makes stocks so alluring as to prescribe an 8% rally in the S&P this year and an epic 19% in the Nasdaq? This isn’t meant to suggest that there aren’t opportunities out there for those seeking alpha. Far from it. Investment horizons, mandates, benchmarks against which your returns are assessed all play into the buying decision, so it’s perfectly plausible to find suitable companies to buy into. It’s just that it may be worth asking the question that if the backdrop is so gung-ho as to jump in front of the Fed’s putative loosening down the year (at least in terms of what the markets reckon is bound to happen).

As Buffett is fond of saying:

“Economic predictions just don’t enter into our decisions. Charlie Munger – my partner – and I in 54 years now never made a decision based on an economic prediction. We make business predictions about what individual businesses will do over time, and we compare that to what we had to pay for them. But we have never said yes to something because we thought the economy was gonna do well in the next year or two years. And we have never said no to anything because we were right in the middle of a panic.”

That may be worth keeping in mind as the markets continue to rally.

https://ift.tt/Pn7k1Hl

from ZeroHedge News https://ift.tt/Pn7k1Hl

via IFTTT

0 comments

Post a Comment