US Bank Deposits Resume Outflows, Led By Large Institutions; Small Bank Loan Growth Slumped

It's late on a Friday afternoon, but there's still more things to worry about as The Fed's H.8 (commercial bank deposit data) just dropped.

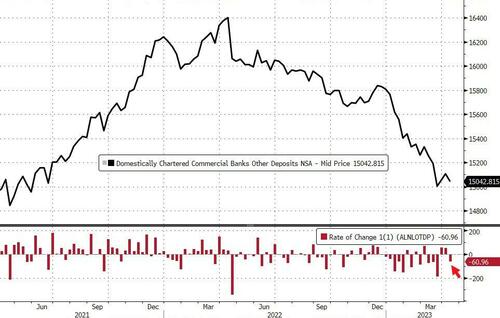

After yesterday's report showed the Fed balance sheet shrinking but bank bailout facility usage higher, US commercial bank deposits (ex-large time deposits) unexpectedly resumed their freefall (during the week-ending 4/12), tumbling $68.66 billion to the lowest since April 2021...

Source: Bloomberg

That is the 11th weekly deposit outlfow in the last 12 weeks.

On a non-seasonally-adjusted basis, deposit outflows also resumed (after two weeks on inflows) with $60.96 billion leaving the banking system...

Source: Bloomberg

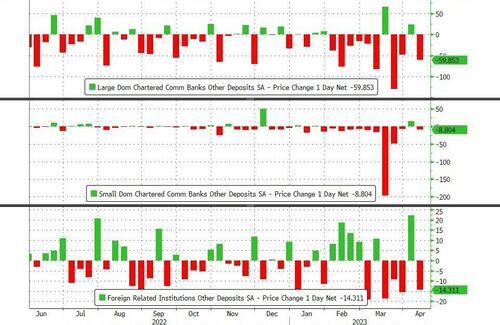

While we note yesterday's surprise surge in outflows from Money Market funds, suggesting inflows back to deposits, it is key to remember two things - 1) the deposit data is a week lagged to the MM flow data and 2) it's tax time and the MM fund outflows are likely driven by coporate tax payment demands...

Source: Bloomberg

Large, Small, and Foreign commercial banks all saw deposit outflows (seasonally-adjusted) last week...

Source: Bloomberg

Large banks saw the largest outflows

-

Large Banks -$59.85bn

-

Small Banks -$8.80bn

-

Foreign Banks -$14.31bn

Source: Bloomberg

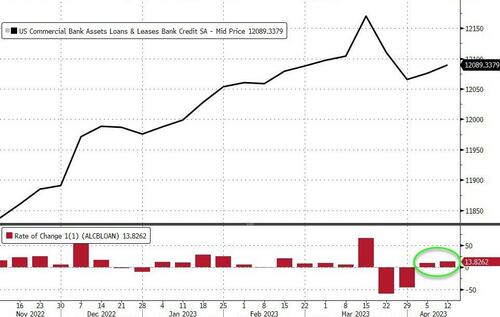

And on the other side of the ledger, commercial bank lending rose $13.8 billion in the period after increasing $10.2 billion in the prior week on a seasonally adjusted basis. On an unadjusted basis, loans and leases fell $9.3 billion.

Source: Bloomberg

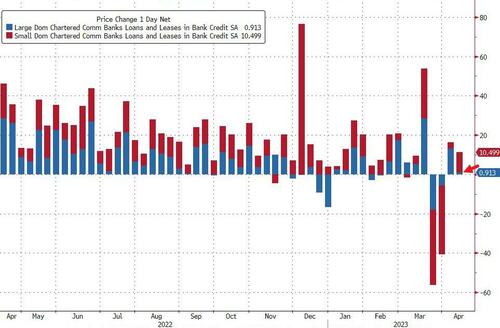

However, Small Banks only lent $913mm, while large banks lent $10.5 billion...

Source: Bloomberg

Bear in mind however that, while loan growth for the quarter just reported has been in-line with expectations, forward guidance suggests a moderation. Banks generally pointed to weakening loan growth expectations for the balance of the year.

Finally, for those who think the crisis is over and everything is over, there's just one more thing. Wondering why, amid all this great news, regional banks just can't catch any kind of reasonable bid?

It's simple - as we detailed previously (as far back as Nov) - as long as we are above the reserve constraint level for small banks, there is stability courtesy of the Fed's massive reserve injection.

It appears Small banks are moving back towards the critical level, and the closer we get to that level, the greater the risk of bank failures and Fed panic.

https://ift.tt/Ar7FzoB

from ZeroHedge News https://ift.tt/Ar7FzoB

via IFTTT

0 comments

Post a Comment