"It Feels As If Nobody Knows Anything": A "Mystery" Market Meltup

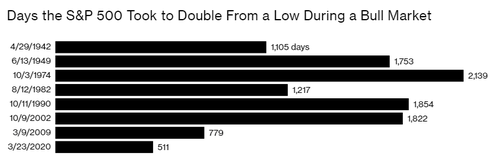

If you stopped paying attention for a couple of seconds, you have not have noticed that the S&P 500 just doubled off its pandemic lows at the fastest pace it has doubled since 1932.

Making sense of why the market has shot up like this is another story. With much of the economy still shut down, unemployment rampant and prices rising, "it feels as if nobody knows anything" about why the market keeps rising, Bloomberg wrote in a new piece this week.

Steve Chiavarone, a portfolio manager and head of multi-asset solutions at Federated Hermes Inc., told Bloomberg:

“If someone would have told me in March of last year, when Covid was first rearing its ugly head, that 18 months later we would have case counts that are as high—if not higher—than they were on that day, but that the market would have doubled over that 18-month period, I would have laughed at them.”

He continued:

“Even if you could forecast the virus, you didn’t necessarily get the market right. Even if you could forecast an election outcome, you didn’t necessarily get the market right.”

And it isn't just analysts getting the market wrong directionally - it has also been the inability to predict earnings throughout the pandemic. Earnings estimates have beaten analyst expectations "by an average of more than 19% in the past five quarters", the report notes.

Now, it looks as though analysts (and investors) are chasing the idea that higher valuations could wind up filling out. And this mindset has led to some astronomical S&P 500 targets for the year, with some banks setting their sights as high as 4,825.

30 year Wall Street experts like Julian Emanuel, the chief equities and derivatives strategist at brokerage BTIG, say they're "at a loss" to explain the run up. Emanuel points out that in an environment where the PPI is rising at a 13 year high and the economy is expected to expand at 6.2%, bonds should be selling off "aggressively".

Emanuel said:

“In what world could you possibly have imagined that 10-year yields would be closer to 1.2%? The absolutely impossible is literally commonplace now.”

He also noted the influx of retail traders playing a role. Shares traded by customers of retail brokers are up from 700 million pre-pandemic to 2.9 billion earlier this year.

Emanuel said:

“The investing public has become a force unto itself. If you ignore the investing public, you’re ignoring them at your peril.”

But of course the discussion always winds up turning back to the Central Bank.

And while investors and analysts claim that within their respective bubbles they can't find an explanation for the unprecedented runup in stocks, they really need to just look no further than the Fed's $8.3 trillion balance sheet.

Despite this, CEOs like Peter Mallouk have confidence that the market will eventually correct itself still: “We’re not there yet. But that’s what’s coming, and that’s the big picture that really drives everything.”

https://ift.tt/3gF0WI9

from ZeroHedge News https://ift.tt/3gF0WI9

via IFTTT

0 comments

Post a Comment