What Does It Cost To Run Big Business?

Submitted byy Marcus Lu of Visual Capitalist

How much does it cost to run one of America’s largest corporations? For household names like Apple, Costco and Walmart, well over $100 billion each year.

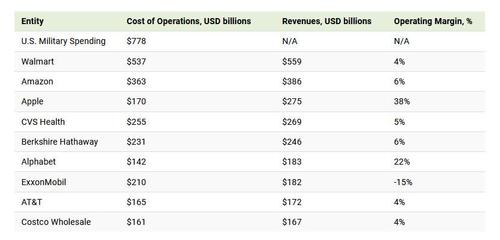

To get a better sense of their massive scale, this chart compiles financial data from some of the largest Fortune 500 companies, and includes U.S. military spending as an additional point of comparison.

To determine each company’s total cost of operations, we combined its selling, general & administrative expense (SG&A) and its cost of goods sold (COGS).

SG&A covers all of the costs associated with selling products and services, as well as managing day-to-day operations. This includes employee salaries, office rent, and marketing expenses. COGS refers to any costs directly associated with producing goods, such as raw materials and labor.

Operating Costs vs. Military Spending

At $778 billion, U.S. military spending in 2020 was the highest in the world. It dwarfs that of China, which took second place with $252 billion in spending. Beyond these two, there are no other countries that spent more than $100 billion on defense.

Massive government budgets like this may seem untouchable, but today’s chart proves otherwise. As the largest employer and retailer in America, Walmart spent $537 billion (70% of U.S military spending) to keep itself running.

Combine this with Amazon’s operating costs, and we reach $900 billion in expenses (16% more than U.S. military spending).

Operating Costs vs. Military Spending

At $778 billion, U.S. military spending in 2020 was the highest in the world. It dwarfs that of China, which took second place with $252 billion in spending. Beyond these two, there are no other countries that spent more than $100 billion on defense.

Massive government budgets like this may seem untouchable, but today’s chart proves otherwise. As the largest employer and retailer in America, Walmart spent $537 billion (70% of U.S military spending) to keep itself running.

Combine this with Amazon’s operating costs, and we reach $900 billion in expenses (16% more than U.S. military spending).

More Costs Doesn’t Mean More Profits

These businesses may be expensive to run, but how good are they at making money?

This can be measured by operating margin, which determines how much profit is generated from each dollar of revenue, after operating costs are deducted. We calculate it with a simple formula: operating earnings divided by revenues. Operating earnings are revenues less SG&A and COGS.

From the companies in this graphic, Apple had the greatest operating margin at 38%. Walmart was at the opposite end of the scale with a 4% margin.

This highlights the differences in business strategy. Walmart’s competitive advantage is cost leadership, meaning it strives to beat its competitors by offering the lowest prices possible. The retailer’s sheer scale (4,743 locations across the U.S.) is what enables this strategy to be effective.

Apple, on the other hand, combines strong branding and premium quality to command a high price for its products. This results in greater margins and valuations—at the time of writing, Apple is the world’s most valuable corporation with a market cap of $2.4 trillion.

These businesses may be expensive to run, but how good are they at making money?

This can be measured by operating margin, which determines how much profit is generated from each dollar of revenue, after operating costs are deducted. We calculate it with a simple formula: operating earnings divided by revenues. Operating earnings are revenues less SG&A and COGS.

From the companies in this graphic, Apple had the greatest operating margin at 38%. Walmart was at the opposite end of the scale with a 4% margin.

This highlights the differences in business strategy. Walmart’s competitive advantage is cost leadership, meaning it strives to beat its competitors by offering the lowest prices possible. The retailer’s sheer scale (4,743 locations across the U.S.) is what enables this strategy to be effective.

Apple, on the other hand, combines strong branding and premium quality to command a high price for its products. This results in greater margins and valuations—at the time of writing, Apple is the world’s most valuable corporation with a market cap of $2.4 trillion.

https://ift.tt/3ymaNZG

from ZeroHedge News https://ift.tt/3ymaNZG

via IFTTT

0 comments

Post a Comment