Futures Rebound Despite Distress Signal From Collapsing Yield Curve

US equity futures rebounded from yesterday's late-day selloff when a collapsing yield curve sent recessionary/policy-error shockwaves across market, as investors pointed to solid earnings to indicate that a slowdown is nowhere near. Nasdaq 100 futures led gains among other key U.S. gauges after setting an intraday record on Wednesday. Dow Jones and S&P 500 futures gained too. The 10-year Treasury rate was flat, while the two-year yield added five basis points. Oil was lower and the dollar was steady, while Bitcoin rebounded after the liquidity-draining Shiba Ina meltup finally cracked overnight.

In U.S. premarket trading, Caterpillar rose 2% after beating earnings with the industrial bellwether announcing it was successfully passing on price increases. Ford jumped 8.5% in premarket as the carmaker’s third-quarter earnings report brought positive surprises on cash and dividends, according to analysts. Ebay fell 5.7% amid mixed views on the ecommerce company’s revenue forecast. Ebay also expanded its stock buyback program. In the latest Chinese crackdown, Up Fintech fell 21% and Futu plunged -27% after a PBOC official called cross-border online brokers illegal.

Investors will now focus on the two giga FAAMGs Apple and Amazon.com which will report earnings later on Thursday.

“The U.S. earnings season has generally surprised to the upside so far, with cyclical and energy companies among major contributors to positive earnings revisions,” César Pérez Ruiz, chief investment officer at Pictet Wealth Management, wrote in a note.

Global stocks trade near all-time peaks, supported by a robust corporate earnings season so far, with profit margins widening on average despite cost pressures. But as Bloomberg notes, the risk is sentiment could weaken if investors lose confidence in the ability of policy makers to contain inflation while nurturing the economic rebound. The resilience of the Nasdaq 100 overnight and tumble in U.S. small-cap shares hinted at doubts about the so-called reopening trade.

Meanwhile, European stocks were steady. The Stoxx Europe 600 Index fluctuated between modest gains and losses, with the energy sector underperforming as Royal Dutch Shell Plc slid more than 4% after missing analysts’ profit estimates,and crude oil extended declines. Better-than-estimated results for companies from Anheuser-Busch InBev NV to Nokia Oyj cushioned the impact of concerns over elevated inflation. Here are the biggest European equity movers:

- CNP Assurances shares jump as much as 36% after majority owner La Banque Postale said it plans to buy the rest of the company.

- Zur Rose shares jump as much as 9.7%, the most since May 7, after the online pharmacy firm announced a diabetes collaboration with Roche. Shares in Roche are up 0.4%.

- AB InBev shares jump as much as 6% after the world’s biggest brewer reported 3Q results that showed “beats everywhere,” according to Citi (neutral).

- WPP shares jump as much as 4.9% after results, the most since Jan. 6, with Citi highlighting the advertising firm’s “massive” 3Q beat, and Shore Capital upgrading the stock to buy from hold.

- STMicro shares jump as much as 5.6% in Milan trading. Citi says the semiconductor maker’s results are “reassuring” with 3Q revenue in line with expectations, notwithstanding a shutdown at its Malaysian factory.

- Arcadis shares sink as much as 18%, the most since Oct. 2018, after the engineering services firm’s 3Q earnings missed estimates, KBC (buy) says in a note.

Earlier in the session, Asian equities dipped for a second day as risk-off sentiment prevailed amid global concerns that the prolonged pandemic and elevated inflation will hurt economic recoveries. The MSCI Asia Pacific Index was down 0.4%, with Japanese tech firms Fanuc Corp. and Fujitsu Ltd. among the biggest drags after disappointing earnings reports. Benchmarks fell at least 1% in India, Indonesia and the Philippines, while Chinese and Japanese stocks were also among the day’s biggest losers. Vietnam’s key gauge rose more than 1%, extending Wednesday’s rally. The Bank of Japan stood pat on policy Thursday while signaling more delays in the economy’s post-pandemic recovery. Sovereign-yield curves have flattened this week, adding to signs of growth concerns as price pressures stoked by an energy crunch and supply-chain problems push central banks to adjust policy. “The unfolding trade is a bet that central bankers will hike rates to quell inflation, and that’s going to come at the expense of future growth,” said Kyle Rodda, an analyst at IG Markets Ltd. Benchmarks in China dropped for a third day as traders continued to weigh a resurgence in U.S.-China tensions. Taiwanese President Tsai Ing-wen confirmed the presence of US. troops on the island as Beijing warned that American support for Taiwan poses “huge risks”.

Japanese equities fell after results from some major companies disappointed and the Bank of Japanstood pat on policy while signaling more delays in the economy’s post-pandemic recovery. Electronics and machinery makers were the biggest drags on the Topix, which fell 0.7%. Fanuc and M3 Inc. were the largest contributors to a 1% drop in the Nikkei 225 after their results. The yen extended gains against the dollar to a second day. The central bank’s lowered economic targets mean “the BOJ’s easy monetary policy stance is likely to be maintained for a quite a long time as a result -- it’s a plus for share prices,” said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management. Still, “it’s hard for the market to show a clear one-sided direction ahead of the general election.” Prime Minister Fumio Kishida faces his first national election on Sunday. His Liberal Democratic Party coalition is expected to lose seats but retain its majority in parliament.

In rates, the Treasury curve continued its flattening streak during Asia session and European morning with long-end yields richer by ~2bp on the day, front-end and belly cheaper, pivoting around a little-changed 10-year sector. European bonds were lower ahead of ECB meeting at 7:45am ET. U.S. auction cycle concludes with $62b 7-year note sale at 1pm; Wednesday’s well-bid 5-year auction has since lost value. U.S. 10-year yields steady around 1.545%, outperforming bunds by 2bp; front-end underperforns, lifting 2-year yields more than 5bp and flattening 2s10s spread as low as 97.9bp, lowest since early August. U.S. 5s30s spread reached 74bp, flattest since March 2020. Most European bonds gained

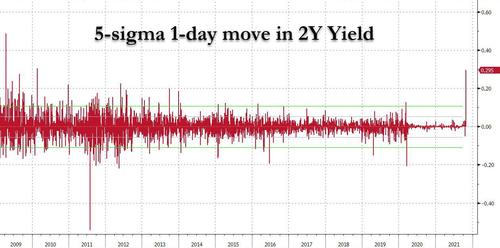

Overnight, Australian's 2Y bond yields exploded by a near-record amount, surging by a 5-sigma 30bps after the RBA refused to buy bonds maturing in 2024, effectively and unexpectedly ending the central bank's 0.1% Yield Curve Control.

Flatter sovereign-yield curves are highlighting growth worries as price pressures stoked by an energy crunch and supply-chain snarls push central banks toward paring accommodation. Investors will look to the European Central Bank later on Thursday for reassurance that surging prices are just transitory and not about to spiral out of control.

There seems to be “less confidence that the Fed will be able to thread the needle and neither end up behind the curve with its taper timeline/gradual hikes nor ahead of the curve if it reacts too quickly,” Jonathan Cohn, head of rates trading strategy at Credit Suisse, wrote in a note.

In FX, the Bloomberg Dollar Spot Index was little changed as the greenback traded mixed versus its Group-of-10 peers, though most moves remained confined to relatively tight ranges; the Treasury curve bear-flattened as the 2-year yield rose by about 4bps. The euro kept gravitating around the 1.16 handle with the options market suggesting the ECB policy decision will offer no impetus to trade the currency afresh, at least in size. European peripheral bond yields rose, led by the short end; bond traders are ramping up bets that the ECB will raise borrowing costs by the end of next year. The pound edged up and the gilt curve continued to flatten after a larger-than-expected cut to bond sales, hurting long-end supply. Focus is on next week’s Bank of England meeting, with Wednesday’s U.K. government budget seen by some economists as increasing the possibility that monetary stimulus will be withdrawn. Around 18 basis points of tightening is currently priced in for next week. The yen rose as trading related to month-end and position adjustments dominated before a slew of central-bank decisions next week including that of the Fed. Bonds rose after a rally in overseas debt markets overnight. BOJ kept its interest rates and asset buying plans unchanged while cutting its projections for economic growth to reflect setbacks from coronavirus and supply restrains. China’s onshore yuan extends its decline after the central bank set a weaker-than-expected reference rate for the currency for the seventh consecutive session.

In commodities, Brent crude fell about 1% just below $84, while WTI traded at about $82 a barrel. Spot gold flat on the day, trades around the $1,800/oz-level. U.S. dollar is little changed; Norwegian krone and Japanese yen lead G-10 majors, while Swedish krona and Danish krone lag. Base metals rise on the LME, led by copper, nickel and zinc. Meanwhile, natural-gas and power prices in Europe fell after Russia signaled it may increase gas shipments. Bitcoin climbs back above $60,000.

Looking at the day ahead, we get US weekly initial jobless claims, advance Q3 GDP, September pending home sales, October Kansas City Fed manufacturing activity, Japan September retail sales, Germany October unemployment change, preliminary October CPI, Italy October consumer confidence, Euro Area final October consumer confidence are due. In corporate earnings, Apple, Amazon, Mastercard, Comcast, Merck, Royal Dutch Shell, Linde, Volkswagen, Starbucks, Sanofi, Caterpillar, Lloyds Banking Group and Samsung are among companies reporting.

Market Snapshot

- S&P 500 futures up 0.1% to 4,551.00

- STOXX Europe 600 little changed at 473.78

- Euro little changed at $1.1599

- MXAP down 0.5% to 198.66

- MXAPJ down 0.3% to 653.65

- Nikkei down 1.0% to 28,820.09

- Topix down 0.7% to 1,999.66

- Hang Seng Index down 0.3% to 25,555.73

- Shanghai Composite down 1.2% to 3,518.42

- Sensex down 1.5% to 60,254.91

- Australia S&P/ASX 200 down 0.2% to 7,430.38

- Kospi down 0.5% to 3,009.55

- Brent Futures down 0.4% to $84.24/bbl

- Gold spot up 0.3% to $1,801.76

- U.S. Dollar Index little changed at 93.86

Top Overnight News from Bloomberg

- The European Central Bank is set to reassure consumers facing surging prices and investors considering the consequences that it’s just transitory and not about to spiral out of control: Decision Guide

- The benchmark rate for euro funding fell to an all-time low, driven by a near-record high level of spare cash in the economy

- Austrian Finance Minister Gernot Bluemel urged the European Central Bank to raise interest rates to curb inflation, which he said has been causing him sleepless nights, according to remarks published on Thursday

- European natural gas and power dropped after more signals from President Vladimir Putin that Russia will send extra gas to the continent next month

- Commodities from coal to aluminum posted huge swings Thursday afternoon in Asia, as traders said prices were reacting to speculation that China’s leadership is growing concerned over recent sharp declines in prices

- U.K. Chancellor of the Exchequer Rishi Sunak appears to have embraced surging inflation, as he delivered a budget that laid out plans to add 75 billion pounds ($103 billion) of stimulus across the next six years

- The U.K.’s debt chief says a larger-than-expected cut to bond sales this fiscal year reflects a commitment to funding rules -- even if that means surprising dealers and investors.

- The U.K. government hit back at France over its proposed retaliatory measures in a dispute over fishing access, as post-Brexit tensions between the two countries increased further

- Beijing City will join a trial program aimed at eliminating all so-called hidden government debt, underscoring China’s deepening campaign to improve public finances and cut risks

A more detailed breakdown of overnight events from Newsquawk

APAC equities traded mostly lower following the downbeat lead from Wall Street, which saw the S&P 500, DJIA and R2K finish the session in the red, whilst the Nasdaq closed flat as Microsoft (+4.2%) and Alphabet (+4.8%) provided tailwinds alongside the broader strong bid for duration. Overnight, US equity futures drifted marginally higher as trade resumed and held onto mild gains, whilst European equity futures traded flat. The ASX 200 (-0.3%) and the Nikkei 225 (-1.0%) were both pressured by hefty losses in their energy sectors, closely followed by materials and mining. The KOSPI (-0.5%) was somewhat supported by heavyweight Samsung Electronics trimming earlier losses, with the tech giant also expecting overall consumer electronic demand to weaken in 2022, whilst suggesting that component supply issues could improve from H2 2022. The Shanghai Comp (-1.3%) was softer despite another chunky net CNY 100bln liquidity injection by the PBoC, whilst the Hang Seng (-0.3%) initially moved between modest gains and losses before conforming to the overall mood, whilst property firm Kaisa group shares sunk 15% after S&P downgraded its rating due diminishing liquidity and elevated refinancing risk. Finally, Aussie bonds once again took the limelight after the RBA refrained from April 2024 yield target bond purchases, with the yield on the April 2024 bond extending its rise to 0.50% vs the RBA's 0.10% target range.

Top Asian News

- Commodities Whipsawed on Speculation of China’s Next Energy Step

- Unibail Sinks as Morgan Stanley Flags Soft Footfall Data

- Another Chinese Developer Is Sinking as Junk Bonds Sell Off

- Kaisa Is Latest Property Developer Worry in China

European equities (Stoxx 600 +0.1%) trade with little in the way of firm direction in what has been an exceptionally busy morning of earnings reports for the region ahead of the latest ECB policy announcement. The handover from the APAC region was a predominantly downbeat one after a late souring of sentiment on Wall St. filtered through to the region despite ongoing liquidity efforts by the PBoC and earnings-inspired upside for Samsung Electronics (+1.5%). Stateside, futures are a touch firmer with some modest outperformance in the NQ (+0.3% vs. ES +0.1%) ahead of another busy pre-market slate of earnings; highlights include Merck, Caterpillar, Comcast, American Tower and Mastercard. US investors remain cognizant of events on Capitol Hill, however, the ongoing stalemate within the Democrat party has resulted in a bit of headline fatigue for market participants. Back to Europe, sectors are somewhat mixed with Food and Beverage names the notable outperformer as AB Inbev (+6.6%) sits at the top of the Stoxx 600 after Q3 earnings prompted a FY21 outlook upgrade. Tech is also on a firmer footing amid earnings-related support from Cap Gemini (+3.9%) and STMicroelectronics (+3.9%) with the former also upgrading its FY21 financial targets. To the downside, Oil & Gas names sit at the foot of the table amid yesterday’s pullback in crude prices and losses in FTSE 100 laggard Shell (-2.9%) which reported a notable miss on earnings and is facing pressure from hedge fund Third point to break up the Co. Total (-1.4%) are also seen softer post-earnings, albeit to a lesser extent after reporting a beat on expectations for net income. Auto names are also facing pressure amid losses in Volkswagen (-3.0%) after the Co. cut its FY21 delivery forecast alongside earnings. Finally, Lloyds (+1.2%) shares are seen higher post-results which saw the Co. exceed estimates for Q3 pre-tax profits. That said, the Banking sector in Europe as a whole is softer ahead of today’s ECB meeting which is set to see the Bank push back on current market pricing for rate lift-off.

Top European News

- UniCredit Says Paschi Talks ‘Long and Detailed’ Before Collapse

- Sunak’s Budget Giveaways Spur Bets for BOE Rate Hike Next Week

- La Banque Postale to Buy Out CNP in Largest 2021 Insurance Deal

- Beiersdorf Falls; RBC Says Outlook Disappoints After 3Q Miss

In FX, the Dollar remains sidelined in many ways awaiting advance US Q3 GDP and the latest IJC update, or arguably next week’s FOMC and monthly jobs data for independent direction. However, month end rebalancing flows remain a drag and the index is also encountering resistance around the 94.000 mark on psychological and technical grounds following multiple failures to extend beyond the round number or even hold above. Indeed, after touching the 21 DMA yesterday (94.011), the DXY has slipped back again and into a range just under today’s chart mark that comes in at 93.988 to meander between 93.968-759. Moreover, decent option expiry interest in several major pairings are having a bearing on price action, as the Euro continues to oscillate either side of 1.1600 ahead of the ECB eyeing 1.6 bn that roll off at 1.1600-10, while the Yen is hovering near 113.50 post-BoJ amidst an array of expiries stretching from 113.00 (1.5 bn) through 113.70-75 (1.7 bn) to 113.80-85 (1.3 bn), and the Loonie straddles 1.5 bn between 1.2370-75 in wake of Wednesday’s hawkish BoC. Note, Usd/Jpy largely shrugged off the as expected BoJ policy meeting and comments from Governor Kuroda expressing no qualms about recent Yen depreciation, but Usd/Cad has rebounded further from circa 1.2300 lows when the BoC surprised with an immediate withdrawal of QE and shift to reinvestment buying mode compounded by an earlier tightening signal, as WTI crude retraces more upside. Meanwhile, Eur/Usd could well break out of its confines pending the tone of the ECB statement and President Lagarde’s press conference - see Headline Feed at 7.43BST for a preview of the event.

- NZD/AUD - Tasmin tides have turned via the cross to the Kiwi’s benefit and Aussie’s detriment irrespective of more follow-through selling in AGBs after forecast topping core inflation prints and no intervention from the RBA overnight. In fact, Deputy Governor Debelle stressed that monetary policy is set to generate price pressure and a bit more is welcome to leave Aud/Usd under post-data levels and pivoting 0.7500, while Nzd/Usd has nudged back above 0.7150 and Aud/Nzd is closer to 1.0450 than 1.0500 in advance of Aussie ppi, credit and final retail sales.

- GBP/CHF - It feels a bit like after the Lord Chancellor's show for Sterling that is straddling 1.3750 against the Greenback, but on a firmer footing vs the Euro regardless of rising UK-French fishing tensions due to increasingly diverging BoE/ECB outlooks and stances. Elsewhere, the Franc is keeping its head above 0.9200 against the Buck and on a more even keel with the Euro following another reminder from SNB’s Maechler that the Chf is still deemed to be highly valued.

- SCANDI/EM - Notwithstanding, the ongoing bull correction in Brent, Eur/Nok retreated from almost 9.8000 after a decline in Norway’s LFS jobless rate and significantly better than anticipated retail sales data, in contrast to a steady Eur/Sek circa 9.9600 weighing somewhat mixed Swedish sentiment indicators, consumption and GDP outturns vs consensus and previous readings. Elsewhere, the Brl may derive more momentum from the BCB’s decision to go big and hilke the SELIC rate 150 bp compared to the full point most penciling in, while flagging the same for the next policy convene, but the Try is on the rack again as CBRT year-end CPI forecasts jump and the Governor states that it is not targeting a stronger Lira, while adding that the Bank is not under outside influence.

In commodities, WTI and Brent remain pressured in a continuation of APAC action, fresh drivers have been limited though we saw mixed earnings reports from energy giants Shell and Total; currently, the benchmarks are lower by just shy of USD 1/bbl but have picked up from overnight lows. Fresh newsflow has been very minimal and the ongoing downside is perhaps still taking impetus from the week’s inventory reports. Returning to the oil giants, within their earnings Shell noted that oil product sales volumes for Q3 increased given seasonal factors and an ongoing recovery in demand. Separately, TotalEnergies notes of an increase in aviation fuel demand which is beginning to support high prices. Moving to metals, spot gold and silver are modestly firmer but haven’t managed to deviate too far from the unchanged mark in European hours with, for instance, spot gold pivoting the USD 1800/oz figure. Elsewhere, base metals are firmer but again drivers have been limited and thus such metals are, for the most part, within familiar ranges.

US Event Calendar

- 8:30am: 3Q GDP Annualized QoQ, est. 2.6%, prior 6.7%

- 3Q PCE Core QoQ, est. 4.5%, prior 6.1%

- 3Q GDP Price Index, est. 5.3%, prior 6.1%

- 3Q Personal Consumption, est. 0.9%, prior 12.0%

- 8:30am: Oct. Initial Jobless Claims, est. 288,000, prior 290,000; Continuing Claims, est. 2.42m, prior 2.48m

- 10am: Sept. Pending Home Sales YoY, est. -3.0%, prior -6.3%; Pending Home Sales (MoM), est. 0.5%, prior 8.1%

- 11am: Oct. Kansas City Fed Manf. Activity, est. 20, prior 22

DB's JIm Reid concludes the overnight wrap

Bond yields were at the centre of markets’ attention yesterday as we saw a major yield curve flattening across most developed markets on the back of the hawkish Bank of Canada monetary policy meeting, the UK cutting its gilt supply forecast, economic growth concerns, and big market flows. All this overshadowed earnings season and an ECB meeting today.

Starting with the main theme yesterday, the Bank of Canada became the latest to decisively act on the risk of higher inflation as it ended its quantitative easing programme earlier than expected and shifted forward the expected timing of interest rate hikes from the second half of 2022 to the middle quarters of 2022. STIR markets are now pricing the first Canadian rate increase by March, after some intraday volatility that saw liftoff priced as early as January at one point. The shift came as supply side disruptions and worker shortages translated into a downgrade in the BOC’s estimate of potential output. Conversely, with a smaller remaining output gap, growth forecasts were revised down and inflation forecasts were revised up, with the balance of risk towards higher inflation still. The 2y yield on sovereign bonds jumped by +20.7bps, which was the largest one-day increase since 2009, while the 2s10s flattened by -22.1bps, the largest one-day flattening since 2002. The CAD soared against most major currencies as the markets priced five full hikes by the end of 2022, up from less than two 2022 hikes a month ago.

The moves reverberated around the world. In the US, the 2s10s yield curve (-13.0 bps) also flattened dramatically (the most since March 2020, in the thick of the Covid crisis), as the 2y yield increased +6.3bps and the 10y yield (-6.7bps) fell. Adding to the big moves, the 5yr Treasury auction cleared 2.5bps through its offering rate, the strongest result in over a decade. After the dust settled, the market-implied chance of the Fed lifting rates in July increased, and there remains two hikes priced in over the full year.

US inflation breakevens (-1.5 bps) retreated slightly for the first time this week, whereas the dollar (-0.16%) fell and gold (+0.22%) gained. Commensurate with fears about growth, real 10y yields declined -4.9 bps to -1.13% marking a -27.6 bp decline month-to-date, and are now within 7 bps of August’s all-time low.

On the back of these moves, US equities eventually dipped from earlier highs, as the Nasdaq was flat and the S&P 500 fell -0.51%, with only communications (+0.96%) and discretionary (+0.24%) ending the day in the green. Energy (-2.86%) and financials (-1.69%) were the biggest laggards. The small cap Russell 2000 (-1.90%) fell even further. In yesterday’s earnings, McDonalds, Coca-Cola, and GM all beat estimates, Boeing missed on revenues and earnings, and Hilton, the hotelier, was just about in line, noting that pent up vacation demand helped results despite the spread of the Delta variant. The Hilton CEO also seemed to embrace rising inflation, going so far as thanking the Fed and Congress for the stimulus, noting they can reset room rates every night.

Back to bonds and we also saw big moves in Europe with the UK a standout internationally as yields fell across the curve rather than twisting flatter. We saw a -6.7bps fall on 2yrs, -12.4bps on 10yrs, and -18.1bps on 30yrs, while 10yr breakevens eased by -7.6bps, after the DMO revised its gilt sales until fiscal year end from 252.6 billion pounds back in April to 194.8 billion, below market estimates of 219.6 billion. Additionally, during the budget and spending review, Chancellor Sunak said the country is to see the fastest growth since 1973, forecasting growth rates of +6.5% (2021), up from +4.0% projected earlier, and +6.0% (2022). The 2022 number is well above street estimates. Our UK strategists covered the implications of the budget in more detail here.

In Europe, yields on bunds (-6.1bps), OATs (-5.8bps) and BTPs (-5.2bps) all edged sharply lower too, as breakevens fell by -2.9bps and -2.8bps in Germany and France (flat in Italy) after their dizzying recent run higher. Like the rest of the DM space, 2s10s curves flattened across Europe, with German, French, and Italian curves flattening -7.9bps, -5.7bps and -6.1bps respectively.

European stocks saw a weaker session as Germany cut its growth forecast for 2021 from 3.5% in April to 2.6% yesterday on the back of supply disruptions. The news weighed on the DAX (-0.33%) despite a surprising rise in German GfK Consumer Confidence (+0.9) versus an expected decline of -0.5. A downward trend was seen more broadly in Europe as well, with the STOXX 600 declining by -0.36% amid a decline in energy (-0.84%) and healthcare (-0.77%). The FTSE 100 (-0.33%) traded lower as financials (-0.66%) and materials (-1.34%) lagged.

Taking a closer look at energy markets, we saw both WTI (-2.35%) and Brent (-2.11%) falling amid DOE crude inventories for October 22 coming in at 4268k versus 1526k expected and Iran signaling that nuclear negotiations would resume in November. Natural gas prices had another big up day in the US (+5.44%) but declined in Europe (-1.71%) as Russian President Putin told Gazprom to increase supplies to Europe once the country fills its own stocks, which could happen on November 8.

The Banco do Brasil increased their policy rate 150bps last night, as expected. The real was around -0.5% weaker against the US dollar afterwards.

In Asia, most indices bar the KOSPI (+0.23%) (amid strong results from Samsung), are down as the Nikkei 225 (-0.91%), the Hang Seng (-0.24%) and the Shanghai Composite (-0.93%) follow on from Wall Street’s lead. Similar to Europe and the US, equities are being weighed down by growth fears especially as the BoJ cut its forecast for this fiscal year’s growth due to supply chain disruptions and the COVID surge back in the summer. The central bank kept rates and asset purchases unchanged. However, in line with movements in other bond markets yesterday, the 2y yield (+2.1bps) ticked higher and the 2s10s curve (-2.1bps) flattened. In data releases, Japan’s September retail sales (+2.7%) rose above expectations (+1.5%).

Elsewhere in the region, the 2yr Australian sovereign bond joined the rest of the DM space and increased +26.7bps overnight, after the RBA avoided buying the April 2024 bonds and decided not to defend the yield target. The 2s10s flattened by -25.2bps. The S&P 500 mini futures (+0.17%) are pointing slightly higher this morning. The 10y Treasury yield is at 1.55% (+1.2bps).

Looking to today, the ECB meeting is the main highlight. Our Europe team thinks they will re-emphasize their forward guidance, for lack of any better options, to push back on recent aggressive front-end pricing after 1y1y Euro OIS rates have climbed +19.0bps month-to-date. More in their full preview, here.

In terms of data releases, US weekly initial jobless claims, advance Q3 GDP, September pending home sales, October Kansas City Fed manufacturing activity, Japan September retail sales, Germany October unemployment change, preliminary October CPI, Italy October consumer confidence, Euro Area final October consumer confidence are due. In corporate earnings, Apple, Amazon, Mastercard, Comcast, Merck, Royal Dutch Shell, Linde, Volkswagen, Starbucks, Sanofi, Caterpillar, Lloyds Banking Group and Samsung are among companies reporting.

https://ift.tt/3bg4lKF

from ZeroHedge News https://ift.tt/3bg4lKF

via IFTTT

0 comments

Post a Comment