ECB Leaves Policy Unchanged (As Expected), Will Keep Buying Bonds Until At Least March 2022

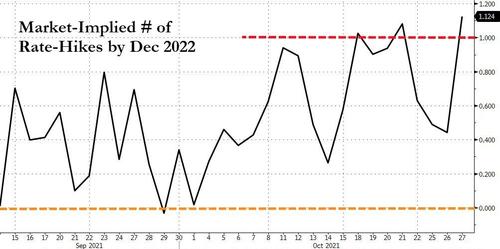

With global bond markets starting to 'tantrum' at the short-end, and price-in policy-errors at the long-end, traders are hoping for soothing words from ECB's Christine Lagarde this morning as the market has shifted notably more hawkish for European rates, pricing in a full rate-hike by the end of 2022 (due to mounting inflation expectations)...

Source: Bloomberg

While no change in policy is expected in the ECB's statement, or a decision on the APP/PEPP's taper timeline (expected in December), so all eyes will be on how (or if) The ECB attempts to shift the market's far more hawkish views on rates than the monetary policy-setters project.

The hawkish market pricing is “hard to reconcile with our view of ECB coming on the dovish side today,” said Piet Christiansen, chief strategist at Danske Bank.

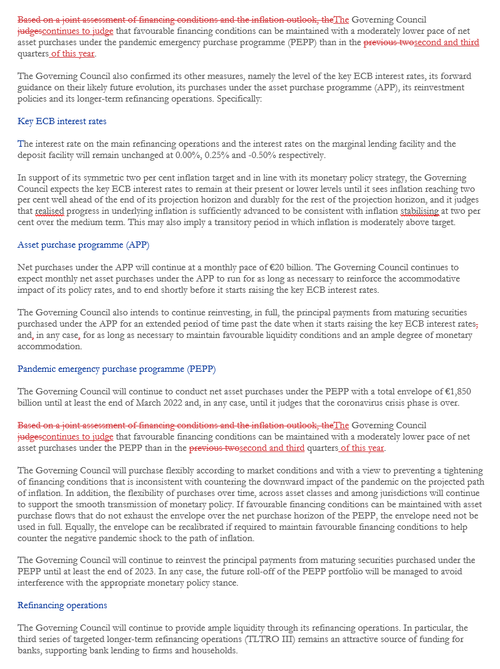

And as expected, The ECB makes no major changes in the policy statement.

Officials reiterated they will continue bond buying at a “moderately lower pace”, and that the pandemic program will run until at least the end of next March.

The Governing Council will continue to conduct net asset purchases under the PEPP with a total envelope of €1,850 billion until at least the end of March 2022 and, in any case, until it judges that the coronavirus crisis phase is over.

The full redline shows very little change in the statement:

Now all eyes back to Lagarde and her press conference at 0830ET for more dovish leanings on rates. So far, she has made it clear that the bank considers the higher prices to be temporary and said the bank won't “overreact” by easing its efforts to keep interest rates low for businesses, governments and consumers. She is expected to argue that the economy still needs extensive support.

* * *

The Governing Council continues to judge that favourable financing conditions can be maintained with a moderately lower pace of net asset purchases under the pandemic emergency purchase programme (PEPP) than in the second and third quarters of this year.

The Governing Council also confirmed its other measures, namely the level of the key ECB interest rates, its forward guidance on their likely future evolution, its purchases under the asset purchase programme (APP), its reinvestment policies and its longer-term refinancing operations. Specifically:

Key ECB interest rates

The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.50% respectively.

In support of its symmetric two per cent inflation target and in line with its monetary policy strategy, the Governing Council expects the key ECB interest rates to remain at their present or lower levels until it sees inflation reaching two per cent well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realised progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilising at two per cent over the medium term. This may also imply a transitory period in which inflation is moderately above target.

Asset purchase programme (APP)

Net purchases under the APP will continue at a monthly pace of €20 billion. The Governing Council continues to expect monthly net asset purchases under the APP to run for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it starts raising the key ECB interest rates.

The Governing Council also intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates and, in any case, for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

Pandemic emergency purchase programme (PEPP)

The Governing Council will continue to conduct net asset purchases under the PEPP with a total envelope of €1,850 billion until at least the end of March 2022 and, in any case, until it judges that the coronavirus crisis phase is over.

The Governing Council continues to judge that favourable financing conditions can be maintained with a moderately lower pace of net asset purchases under the PEPP than in the second and third quarters of this year.

The Governing Council will purchase flexibly according to market conditions and with a view to preventing a tightening of financing conditions that is inconsistent with countering the downward impact of the pandemic on the projected path of inflation. In addition, the flexibility of purchases over time, across asset classes and among jurisdictions will continue to support the smooth transmission of monetary policy. If favourable financing conditions can be maintained with asset purchase flows that do not exhaust the envelope over the net purchase horizon of the PEPP, the envelope need not be used in full. Equally, the envelope can be recalibrated if required to maintain favourable financing conditions to help counter the negative pandemic shock to the path of inflation.

The Governing Council will continue to reinvest the principal payments from maturing securities purchased under the PEPP until at least the end of 2023. In any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

Refinancing operations

The Governing Council will continue to provide ample liquidity through its refinancing operations. In particular, the third series of targeted longer-term refinancing operations (TLTRO III) remains an attractive source of funding for banks, supporting bank lending to firms and households.

***

The Governing Council stands ready to adjust all of its instruments, as appropriate, to ensure that inflation stabilises at its two per cent target over the medium term.

https://ift.tt/2ZBz4Q0

from ZeroHedge News https://ift.tt/2ZBz4Q0

via IFTTT

0 comments

Post a Comment