Shares Of Chinese Cross-Border Trading Apps Crash AFter PBOC Claims They Are Engaged In "Illegal Activities"

US-traded Chinese ADRs are in the red once again during early trading on Thursday after a PBOC official hinted at the next private industry to be targeted by the CCP.

As Beijing has cracked down on crypto, several Chinese fintech firms have tried to capitalize on the demand for off-shore assets in the Chinese market. Despite purportedly operating in a "grey area", these firms are backed by major Chinese tech firms like Tencent.

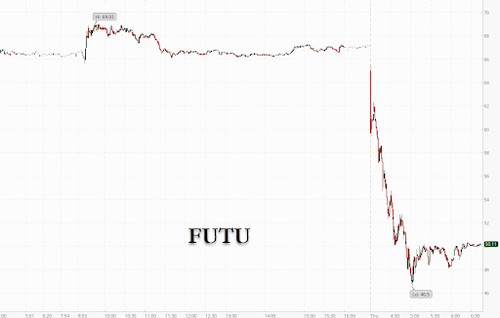

But on Thursday, senior PBOC official Sun Tianqi wrote in a Chinese finance website called Finance 40 Forum that these cross-border Internet brokers were engaged in "illegal financial activities" because they lacked "driver's licenses" (ie explicit permission from the PBOC). One such firm was Tencent-backed Futu Holdings, which saw one-third of its market cap vanish after the comments were published.

Another major competitor in this area, the Xiaomi-backed Up Fintech, slumped more than 20%.

According to Bloomberg, these two brokerage firms have been operating in a "grey area", since they could offer a venue for Chinese citizens to potentially shift their assets outside the country. Since these platforms allow millions of Chinese traders to evade the country's capital controls to trade shares offshore in markets such as Hong Kong and New York.

Probably to avoid setting off alarm bells, Sun said the issue has nothing to do with the convertibility of China's capital account, even though this has become one of the biggest (if least understood by the general public) problems facing the CCP.

In order to try and draw the public's attention away from the real reason for the crackdown, officials fell back on one of their usual excuses: since these platforms, which are mostly used by Chinese citizens, are regulated in Hong Kong and the Cayman islands, they could expose the private data of Chinese consumers to foreign authorities like the SEC. This crackdown on data privacy was the same excuse used to remove Didi's apps from China's app stores.

In an analysis earlier this month, the People’s Daily said online brokerages operating across borders run the risk of violating data privacy rules and are in the spotlight as China’s personal information protection law takes effect on Nov. 1, pointing to Futu and Up Fintech as case studies. The article said user data of both brokers are at risk of being compromised as they are required to provide certain information to the U.S. Securities and Exchange Commission.

Sun said one company, registered in Cayman Islands, received 80% of the funds from mainland China while another Hong Kong-based company received 55%. He didn’t name them.

"Since Futu Securities became a licensed institution under the supervision of the Securities and Futures Commission of Hong Kong, the institution has been running well without any bad regulatory records,” Futu founder Leaf Li said in a statement on Thursday. Futu Holdings has raised more than HK$15 billion ($1.9 billion) in the past year and the proceeds are mostly going to support Futu Securities’ business operations, the capital is ample and there is no problem of bankruptcy, he added.

A crackdown on these trading firms is hardly a surprise, as a warning was issued in the People's Daily earlier this month.

In an analysis earlier this month, the People’s Daily said online brokerages operating across borders run the risk of violating data privacy rules and are in the spotlight as China’s personal information protection law takes effect on Nov. 1, pointing to Futu and Up Fintech as case studies. The article said user data of both brokers are at risk of being compromised as they are required to provide certain information to the U.S. Securities and Exchange Commission.

Sun said one company, registered in Cayman Islands, received 80% of the funds from mainland China while another Hong Kong-based company received 55%. He didn’t name them.

Futu issued a statement insisting that it has a sterling record of regulatory compliance.

“Since Futu Securities became a licensed institution under the supervision of the Securities and Futures Commission of Hong Kong, the institution has been running well without any bad regulatory records,” Futu founder Leaf Li said in a statement on Thursday. Futu Holdings has raised more than HK$15 billion ($1.9 billion) in the past year and the proceeds are mostly going to support Futu Securities’ business operations, the capital is ample and there is no problem of bankruptcy, he added.

But after cracking down on bitcoin miners and trading platforms, perhaps this is the next logical step.

https://ift.tt/3jGJioT

from ZeroHedge News https://ift.tt/3jGJioT

via IFTTT

0 comments

Post a Comment