Goldman Capitulates, Pulls Forward Date Of First Rate Hike By One Full Year To July 2022

Following last week's bond market turmoil, which led to shock and awe curve-flattening moves forcing various macro funds like Rokos and Alphadyne to capitulate and suffer massive losses, and sent Euribor Dec 22 futures crashing as even the ECB lost control of the front-end, virtually everyone has been forced to admit that the Fed's "transitory" narrative was dead wrong and the central bank will hike rates far sooner than expected. How much sooner? Well, according to Goldman, which until Friday expected the first rate hike would not take place until July 2023 hast just pulled forward its forecast for liftoff (i.e., the first Fed rate hike) to July 2022, one full year faster than its previous forecast. After that, Goldman expects a second hike in November 2022 and two hikes per year after that.

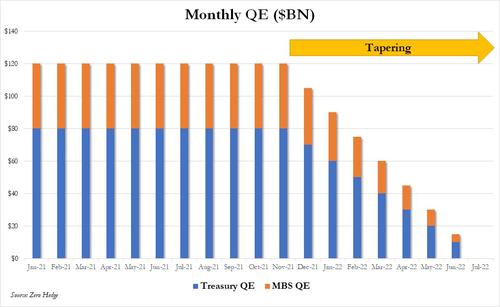

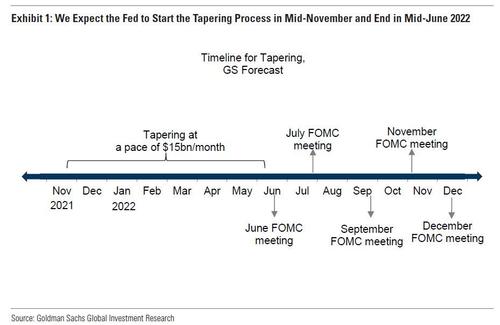

Goldman also believes that the FOMC will announce the start of tapering next week, presumably at the $15bn per month pace noted in the September minutes.

If implementation begins in mid-November, the last taper would come in June 2022. While large surprises on the virus, inflation, wage growth, or inflation expectations could prompt a revision, "the hurdle for a change in either direction is high."

That said, since the Fed is powerless to do anything to impact supply-chains - the primary source of bottlenecked supply and therefore surging prices - all the central bank will achieve is push the US into a recession faster while sparking a market crash, which in turn will mean an accelerated easing (rate-cuts, NIRP, more QE) cycle some time around early/mid-2023 at which point the Fed will likely start buying stocks, especially if some new veriosion of Covid mysteriously emerges out of China the blue.

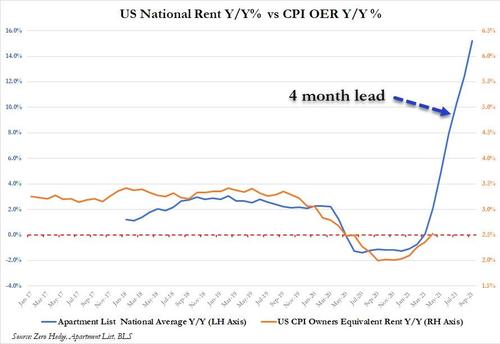

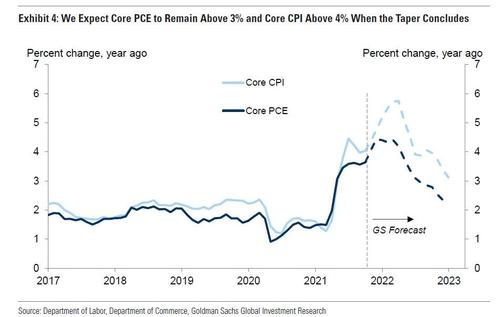

But that's out view, not Goldman's. As for the vampire squid, the reason for the dramatic change in the bank's liftoff call is that Goldman now expect core PCE inflation to remain above 3% - and core CPI inflation above 4% - when the taper concludes as shelter inflation will be running hot.

The next chart shows Goldman's forecasts for key indicators at the time of the July 2022 meeting. In addition to the strong inflation numbers, the bank also expects GDP growth to have re-accelerated to a 4% pace, with the eventual slowdown coming mostly in the second half of next year, and the unemployment rate to stand at 3.7%. Taken together, we think this will make a seamless move from tapering to rate hikes the path of least resistance.

Taken together, Goldman thinks "this will make a seamless move from tapering to rate hikes the path of least resistance."

Goldman's unexpected rate hike capitulation aside, the bank maintains its view that growth will slow to a trend-like pace and inflation will drop to the low 2s by late 2022 or early 2023, without an aggressive monetary policy response (here, too, Goldman is once again wrong because at this rate the best case outcome for the US is simply stagflation, while a currency crushing hyperinflation remains the worst). The key reasons cited by Goldman are that the level of fiscal support will continue to decline sharply and supply chain problems should be resolved, turning the inflationary surge in the goods sector into a temporary deflationary drag.

As a result, Goldman sees the possible paths ahead as bimodal: if something delays liftoff long enough for growth and inflation to fall sharply by end-2022, the Fed could stay on hold for a while. This was the scenario Goldman previously envisioned.... and it was dead wrong just as we said it would be.

Finally, beyond 2022, the bank forecasts one hike every six months: Goldman sees this twice-a-year pace as plausible "either as a dovish response to an environment where inflation remains modestly above 2%, or as an average outcome in an environment where inflation fluctuates above and below 2%." In support of the first possibility, the bank suspects that both Chair Powell and Governor Brainard wrote down two hikes per year at the end of the forecast horizon in their September dots, conditional on an inflation forecast of just over 2%. This means that they have in mind a somewhat slower pace of tightening and less emphasis on normalization for normalization’s sake than under the Fed’s more preemptive approach last cycle.

One outstanding question Goldman often gets is whether inflation needs to be above 2% for the FOMC to deliver subsequent rate hikes after liftoff. Here, the hawks would likely say no on the grounds that inflation has already averaged well above 2% this cycle, while doves would say yes because otherwise the FOMC would have returned to the old preemptive approach. Goldman's forecast of two hikes per year is based on an assumption that the dovish interpretation will win out, but this remains unclear.

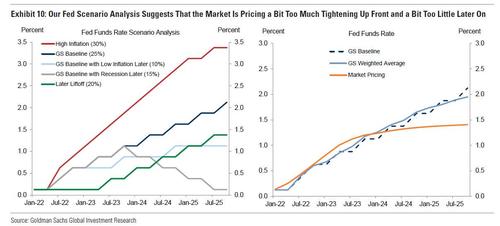

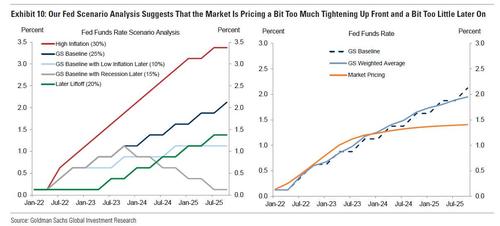

The left side of the chart below, presents a stylized scenario analysis of possible paths for the Fed: Goldman considers a high inflation scenario in which the Fed hikes three times next year and then quarterly after that to a rate 100bp above its estimate of neutral (red line), a later liftoff scenario in which the Fed does not start until 2023Q3 but then proceeds at our baseline pace (green line), and variations on its baseline (dark blue line) in which inflation is usually below 2% from 2023 on (light blue line) or the economy falls into recession at some point (grey line). The combined probability of the baseline scenarios, which are the same in 2022, is 50%.

Here there are two takeaways: first, the risks around the bank's baseline are symmetric, meaning that our baseline and weighted average views are similar (Exhibit 10, right), which is not always the case. Second, the weighted average view is somewhat below market pricing through 2023 and somewhat above market pricing in 2024 and 2025, suggesting that the market is pricing a bit too much tightening up front and a bit too little later on, even relative to Goldman's baseline expectation of a fairly slow pace and our view that there is some chance of inflation falling below 2%, resulting in very little further hiking.

One final observation: Goldman's decision to shockingly pull forward its first rate hike - and thus once again puke all over its reputation as a rational Fed watcher - has nothing to do with any of the abovementioned fundamental points, and everything to do with the violent market repricing in the short end and in terms of fed tightening. All of that can be summarized in the chart below courtesy of Bloomberg; it shows that as of Friday, the matket priced in odds as high as 87% -- 22 basis points of a 25 basis-point increase -- of a June 2022 rate increase. A week ago they priced in 16 basis points, a 62% likelihood. All Goldman is doing is following the crowd.

What Goldman does not get, is that as the market prices in more rate hikes, the market-implied slope of the Fed’s path continues to flatten as traders are also pricing in a policy error, i.e., tightening into a recession. As such, the curve's peak now suggests at most five to six hikes by the end of 2025 to a level more than 100 basis points short of Fed policy makers’ projection.

In other words, some time in 2023 at the very latest, we will likely see Fed Chairwoman Brainard announce the an accelerated rate cut cycle has arrived, one which may culminate with NIRP even as the Fed buys stocks to keep the wealth effect from collapsing.

https://ift.tt/2ZEvqV2

from ZeroHedge News https://ift.tt/2ZEvqV2

via IFTTT

0 comments

Post a Comment