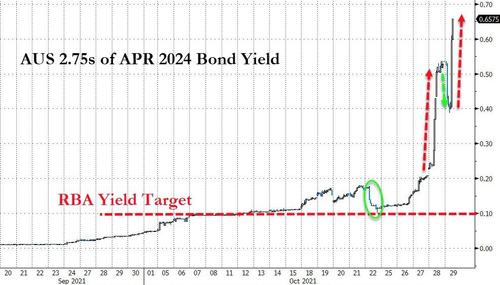

RBA Calls Bond Market's 'Taper Tantrum' Bluff, Yields Explode Higher Again

After last night's bloodbath down-under, traders were convinced that The Reserve Bank of Australia (RBA) would step in to save the day - like they did last Friday - to defend their yield target ion short-dated bonds.

However, echoing yesterday's move, RBA defied market expectations and let'er rip, sending the 2024 bond yield soaring from 40bps to almost 70bps...

As highlighted in the green oval above, RBA stepped in last Friday to purchase the bond in an unscheduled operation as markets challenged the bank’s dovish outlook and pushed the yield above 0.17%.

This week, no such luck for bond bulls as yields spiked to their highest since Feb 2020...

As we pointed out last night, this move (or lack of move) by the RBA means simply that its Yield Curve Control - at least on the short end - is now, for all intents and purposes, over.

Kit Lowe (@Kit_Lowe) summed up RBA Monetary Policy perfectly...

Bloomberg reports that some economists have suggested the RBA could drop or amend its yield target for the April 2024 bond as early as Tuesday’s meeting. The central bank already owns 64% of the notes.

Tonight's extended move with add further fuel to expectations that Governor Lowe will entertain the idea of an earlier rate hike, but it will reprice the entire short-end of the Australian yield curve, which will soon pancake in preparation for the coming inversion...

...which in turn will lead to shockwaves that will be felt in Europe and the US as soon as tomorrow.

https://ift.tt/3nFMlPn

from ZeroHedge News https://ift.tt/3nFMlPn

via IFTTT

0 comments

Post a Comment