Apple Plunges After First Revenue Miss In 4 Years, Warns Of $6 Billion In "Supply Constraints"

Moments after a very ugly quarter from Amazon, which missed on the top and bottom line and guided far lower than consensus, investors held on to hope that at least the world's largest company, Apple, would somehow pull a rabbit out of its magic hat of tricks and report solid earnings pulling the Nasdaq out of its after hours slump. Alas, it did not and after reporting a miss on the top line (and matching the EPS), AAPL is also tumbling after hours and dragging Nasdaq futures down with it.

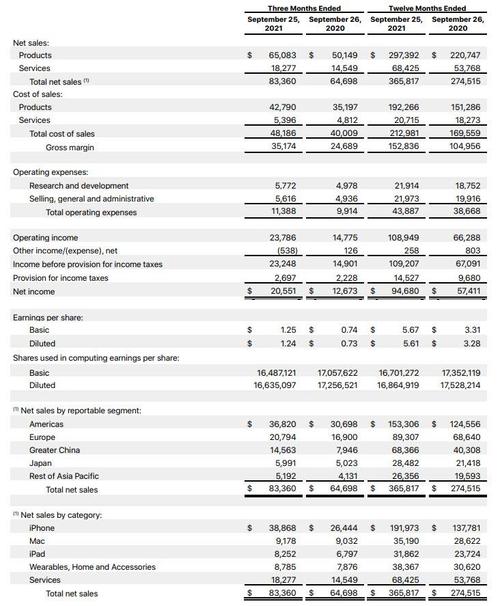

Here are the ugly details from the just concluded Q4:

- Rev. $83.36B, missing est. $84.69B, this was the first revenue miss since 2017!

- EPS $1.24, matching est. $1.24

Some more headlines:

- Q4 iPhone Revenue $38.87B, missing Est. $41.60B

- Q4 iPad Revenue $8.25B, beating Est. $7.16B

- Q4 Mac Revenue $9.18B, missing Est. $9.31B, which nonetheless was an all time high

- Q4 Products Rev. $65.08B, missing Est. $68.72B

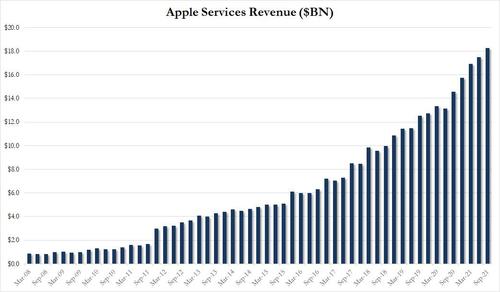

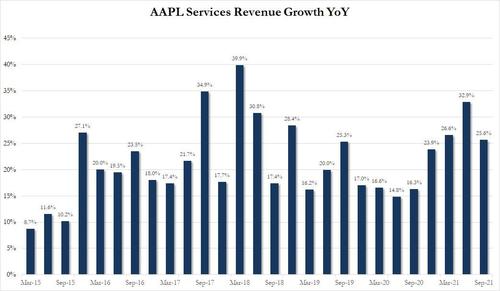

- Q4 Service Rev. $18.28B, missing Est. $17.57B, also an all time high

- Q4 Wearables, Home & Accessories $8.79B, missing Est. $9.28B

Earnings snapshot:

Unlike pre-Covid times, Apple once again did not give guidance for the coming quarter. While the market appears to have become accustomed to this, but given the fact that most other technology companies have continued to offer an outlook, some are wondering when will investors call them out on this?

In any case Investors will surely demand some guidance about Q1 given the issues in Q4. Right now, nearly every major Apple product is weeks or a month-plus away from shipping. It’s not a good situation right now.

Commenting on the quarter, Apple Chief Financial Officer Luca Maestri said that "we fully expect to set a new December quarter record for revenue" but cautioned that "we also expect the supply constraints will be greater than the $6 billion....We expect most of our product categories to be constrained during the December quarter."

Maestri also said that Apple was busy returning cash to investors in the quarter: "The combination of our record sales performance, unmatched customer loyalty, and strength of our ecosystem drove our active installed base of devices to a new all-time high. During the September quarter, we returned over $24 billion to our shareholders, as we continue to make progress toward our goal of reaching a net cash neutral position over time."

And speaking of which, the company declared a 22-cent a share dividend for this quarter. That’s in line with what it’s been paying for a while so no increasing handout for investors.

Predictably, Tim Apple was somewhat more upbeat, saying that “this year we launched our most powerful products ever, from M1-powered Macs to an iPhone 13 lineup that is setting a new standard for performance and empowering our customers to create and connect in new ways. We are infusing our values into everything we make — moving closer to our 2030 goal of being carbon neutral up and down our supply chain and across the lifecycle of our products, and ever advancing our mission to build a more equitable future.”

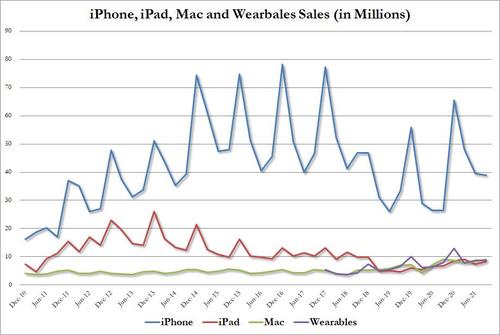

As noted above, AAPL unexpectedly missed on iPhone revenues, which came in at just $38.87B, missing estimates of $41.60B, as did Mac revenues of $9.18BN, below the estimate of $9.31BN, if still an all time high.

The big miss in iPhone sales is notable because Q4 included the presence of over a week - the biggest one - of iPhone 13 sales whereas the iPhone 12 missed last year’s Q4. In any case iPhone growth represented an additional $12 billion in revenue for Q4 this year.

Apple's wearables and accessories segment also disappointed generating just $8.79BN in revenue, below the $9.28BN expected. On the wearables side, it is important to remember that the Apple Watch Series 6 last year launched during Q4, whereas the Apple Watch Series 7 didn’t go on sale until the current quarter. These misses were somewhat offset by $8.25BN in iPad sales which came in above the $7.16BN consensus.

The big miss in product sales was offset by yet another record quarter for AAPL's Services division which rose to $18.28BN, beating expectations of $17.57BN...

... and up 25.6% from the $14.55 a year ago, a slight drop sequentially from the 26.6% increase last quarter.

Summarizing revenue growth by segment:

- Total revenue grew 29% Y/Y

- iPhone sales up 47%

- Mac up 1.6%

- iPad up 21%

- Wearables up 11.5%

- Services up 25.6%

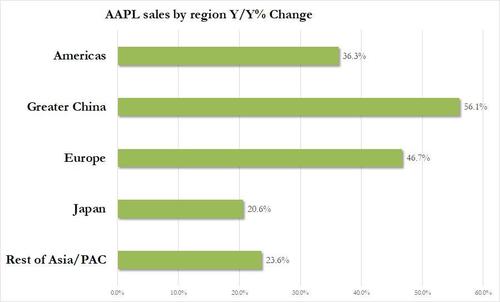

The geographic breakdown was solid even though it was largely due to the base effect from last year's big drop in sales. It was also a notable slowdown from the near triple digit surge in Great China and "rest of Asia/PAC" sales.

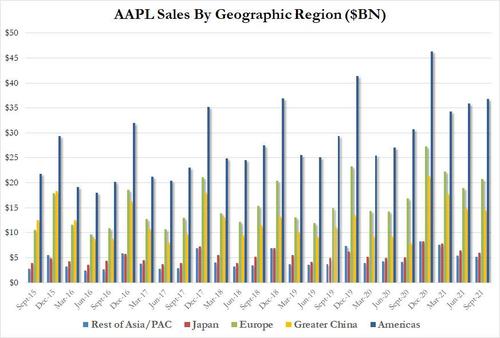

And in dollar terms:

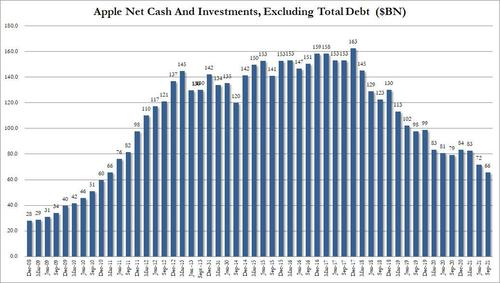

A quick look at the company's gross and net cash showed another drop in net cash, which dropped to just $66BN, down from $163BN in Dec 2017, and back to levels last seen in March 2011.

The reaction to the shocking revenue miss was even more painful than Amazon's, with the stock tumbling some 5% after hours.

Putting the after hours plunge in Apple and Amazon in context, the two are down nearly $170B after the close, which as Larry McDonalds writes is the equivalent of GM and Ford going to zero, and throw in the entire uranium equity sector as well.

Heading into the earnings call, Bloomberg notes that analysts will want to hear how big of an influence shortages of components had on the reported quarter which was strong, just not a strong as some had projected. Does that, or the debut of the new iPhone model and some other devices, explain why we didn’t hit the heights that some had estimated?:

https://ift.tt/3bl2Haz

from ZeroHedge News https://ift.tt/3bl2Haz

via IFTTT

0 comments

Post a Comment