What's Spooking Credit Markets

By Vishwanath Tirupattur, head of Quantitative Research at Morgan Stanley

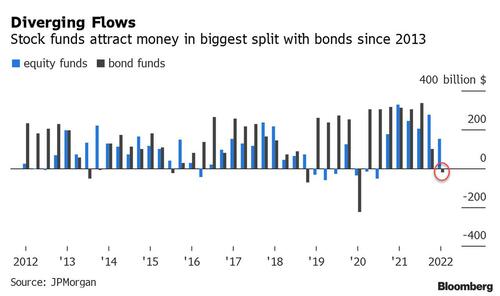

It has been a rough start to the year for markets. The central banks’ hawkish shift towards removing policy accommodation, the significant bear flattening of yield curves that followed, rising geopolitical tensions, fading prospects for fiscal support, and growing concerns about stretched valuations have all combined to spawn jitters in financial markets. Corporate credit has been no exception. After two years of abundant inflows, the narrative has turned to outflows from credit funds. In conjunction with negative total returns, these outflows conjure up painful memories of 2018, the last time credit markets had to deal with substantial policy tightening.

Let us focus on the source of negative total returns in credit – sharply higher interest rates and duration versus concerns about credit quality and defaults. Consider leveraged loans, floating-rate instruments that have credit ratings comparable to HY bonds, which are fixed-rate instruments. Since the beginning of the year, leveraged loan spreads have widened by 11bp versus 80bp for HY bonds. Year-to-date, total returns for leveraged loans are at -0.5% versus -4.3% for HY bonds. According to weekly fund flow data from Emerging Portfolio Fund Research, leveraged loan funds have recorded $12.3 billion of inflows in 2022 in contrast to the $14 billion of outflows from HY bond funds. Even among fixed-rate credit bonds, with a total return to date of -6.8%, longer duration (IG) has underperformed lower quality (HY). Clearly, it is duration and not fear of a spike in defaults that is at the heart of credit investor angst.

Of course, this could eventually turn into a quality challenge. Let us consider corporate credit fundamentals. The median sub-IG corporate is in better shape going into this hiking cycle than any of the last four cycles. For companies in our HY and loan fundamentals database, median net leverage is at the lower end of prior policy inflection points (adjusted for ratings mix) and cash-to-debt is at the high end. Maturity walls are also more back-ended than in prior hiking periods, limiting the need to refinance at unfavorable terms and/or during periods of volatility.

The low-duration credentials of leveraged loans (and floating-rate assets) do not come free of cost. Higher rates eventually matter for borrowers across the board, but unlike the HY bond market where the transmission to borrower fundamentals happens at refinancing, the transmission into leveraged loan fundamentals is much quicker – interest costs go up immediately. Therefore, rising rates could ultimately turn into a fundamental headwind, depending on earnings growth. The timeline to this tipping point may be much shorter this time around.

Analyzing the impact of rate hikes on interest coverage ratios (ICRs) for leveraged loan borrowers, my credit strategy colleagues, Srikanth Sankaran and Taylor Twamley, note that what matters more for ICRs is the point at which higher rates become a headwind for earnings growth. Loan ICRs have historically improved early in a hiking cycle as interest expenses are offset by growth in earnings. But eventually, as tighter financial conditions weigh on corporate earnings, coverage ratios inflect sharply to the downside. A steeper trajectory of rates not only results in a rapid rise in interest expenses but also narrows the window of further earnings-related improvement in ICRs. Their analysis shows that median ICR levels may drop from 4.7x currently to 4.0x under a 150bp rate increase, assuming no earnings growth. If the current market consensus earnings growth (+9%) is realized, median ICR levels only drop slightly to 4.5x but fall to 3.8x if earnings growth turns negative (-5%). I draw comfort from this evidence that corporate fundamentals in this cycle are better positioned to deal with our economists’ base case of six 25bp rate hikes this year, unless earnings growth turns sharply negative – not our current view.

While credit fundamentals look fine, valuations do not. This is where the rubber meets the road. Despite widening year-to-date, credit spreads are still well below long-term average levels, let alone at the onset of a policy tightening cycle. Quantitative tightening will pressure credit spreads as central bank-provided liquidity is gradually drained from the market. We expect that the portfolio rebalancing channel will work its way through the widening of MBS spreads into the corporate credit space, with IG spreads in focus (see Not Giving Credit to MBS (Yet)). So, our stance on credit markets remains the same. We prefer taking default risk over duration and spread risk, and continue to favor leveraged loans over HY bonds over IG bonds.

https://ift.tt/SudiDZL

from ZeroHedge News https://ift.tt/SudiDZL

via IFTTT

0 comments

Post a Comment