Morgan Stanley: The Amount Of Hiking Needed To Contain Inflation Will Soon Stall The Economy

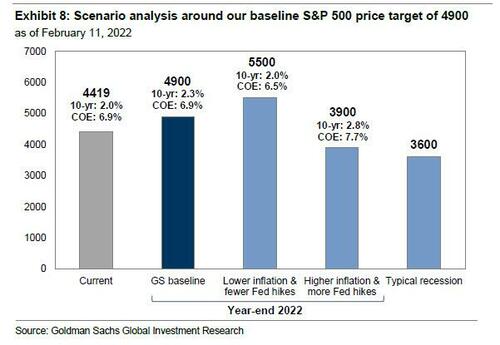

Last week, for the first time since the current tightening frenzy began, Goldman warned that the Fed's aggressive tightening may could to a hard landing. Not surprisingly, just a few days later, the bank slashed its year-end S&P target and now warns that in a recession the S&P could tumble to 3,600.

Now, it's Morgan Stanley's turn as the following Sunday Start note by the bank's Chief US Economist Seth Carpenter, reveals.

Rising Inflation, Rising Risks

Over the past half year, we and many central banks have serially revised our inflation forecasts higher. As inflation has continued to surprise to the upside, markets have priced in more rate hikes and an earlier onset of hiking by many DM central banks. How much is too much? That question needs to be asked for both market pricing and the economy.

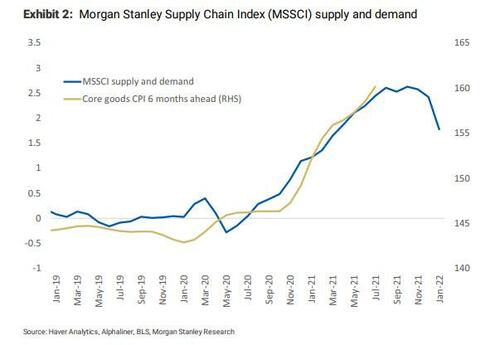

Last week’s US CPI print was the most recent of these upside surprises. Of course, auto prices softened amid mounting evidence that supply chains are slowly normalizing, but on the heels of the CPI report, our US team revised up its inflation forecast for three reasons:

- The first is a simple mark-to-market of an upside surprise.

- Second, the annual revision to the weights for the price index means that our forecast for the components of inflation will result in a higher index.

- And finally, rent inflation has stayed high, and in our forecast we have extended the timeline for that pressure. This third reason is particularly important because it reflects macro, cyclical inflation that will not recede with healing supply chains.

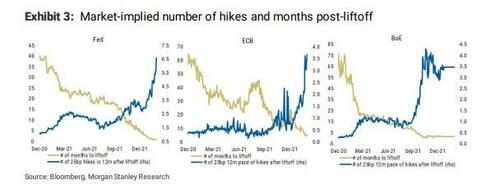

The upside surprise to CPI means the risks to our Fed call are even more skewed to further hiking. The US team’s baseline call is for four 25bp hikes and the initiation of quantitative tightening (QT) around mid-year. So why not build in more hikes? Our central bank forecasts result from overlaying our reading of the policy reaction function on our economic forecasts – especially for inflation. Consider the typically hawkish Esther George, who said that QT should allow for a flatter path of rate hikes. The market is pricing an even chance of a 50bp hike at the March meeting, a view that we have resisted. Front-loading the tightening has appeal with inflation risks skewed to the upside, but much Fed communication has tilted away from such a move, echoing the cautious tone that Chair Powell struck at the last press conference.

The Bank of England has already hiked twice and initiated its QT, but markets still expect more hiking than we do. The markets have priced in roughly 85bp of hikes over the next 12 months, while we expect somewhat less. Of course, we could be wrong, and markets could continue to be right. But most of the excess inflation in the UK remains in core goods, and if supply chains are normalizing as our index implies, inflation should underperform market expectations later in the year. The BoE appears to share our view, as its latest inflation expectations based on market pricing show inflation undershooting its target. The uncertainty surrounding inflation, however, skews the risks to more hiking rather than less.

The ECB was the last of this group to execute a hawkish pivot. Our European economics team revised its ECB call last week, forecasting an end to QE by September and rate hikes starting in December that bring the deposit rate to zero in 1Q23. The persistence of the inflation overshoot drove the pivot, and while continued upside surprises could lead to more, for the ECB there is another consideration. Negative rates in the eurozone impose costs on banks and are politically unpopular. Hiking from negative to zero has a lower threshold than hiking above zero, so getting to zero could happen faster than we expect. Regardless, we expect the ECB to pause at zero as the uncertainty settles down. If our forecast for goods inflation proves right, and if oil and gas prices stabilize, that pause in 2023 could last for some time.

It is hard to argue that risks are not still skewed to the upside. Even if market pricing has not gone too far, before long we will have to confront the risk I noted in the Sunday Start two weeks ago. The amount of hiking needed to bring inflation down will soon approach the amount that stalls the economy.

https://ift.tt/bacYJi8

from ZeroHedge News https://ift.tt/bacYJi8

via IFTTT

0 comments

Post a Comment