Morgan Stanley Warns "Tactical Rally" In Stocks Ending In March As "Ice" Narrative Kicks In

By Michael Wilson, Morgan Stanley Chief US equity strategist

Investing capital can be an exhilarating and humiliating experience. Anyone who has chosen this as a career has experienced both, sometimes in the same week, like the one just past. While the investment landscape is always filled with uncertainties, today’s backdrop seems dotted with more than normal. When faced with such an environment, it’s often helpful to lay out the big factors affecting asset prices and then try to determine what you think you know or can analyze, and what remains hard to determine so it can be properly handicapped – i.e., priced.

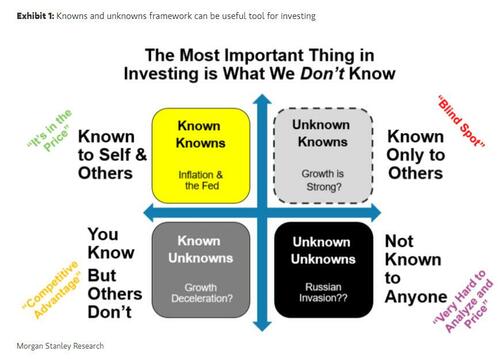

For this exercise one can use the Johari window, a tool originally developed by psychologists to help people better understand how they are perceived by others relative to how they perceive themselves. If done openly, it can facilitate better interactions, and communication in particular becomes more effective. This tool was later used by military strategists and became famous after former US Secretary of Defense Donald Rumsfeld’s famous speech about known unknowns.

Adapting the known/unknown framework may be useful for investing in the current environment. Last September, we introduced our 'fire and ice' narrative to address some risks we felt were either known unknowns or unknown knowns at the time. The fire narrative was meant to highlight that inflation was unlikely to be transitory and the Fed would have to respond to it in a way that markets were not pricing. The tipoff for us was the Jackson Hole summit in August, which was then confirmed at the September FOMC. From our perspective, this was a known unknown – something we thought we knew but the consensus did not – in contrast to an unknown known, when the consensus knows something and we fail to see it. An example of this last fall was the consensus view that still strong liquidity would offset the Fed pivot. That turned out to be true, at least for the S&P 500, and therefore we were wrong.

At this stage, we would argue the 'fire' (higher inflation = Fed tightening) is now a known known even if it’s not fully priced, in our view. While we do think it may be more fully priced into the bond market, we believe when the Fed actually tightens it will weigh further on equity multiples. In S&P 500 terms that’s still 7% lower for forward P/Es (18x versus the current 19.3x). However, it’s fair to say we’ve made a lot of progress from 21-22x back in mid-November when we published our 2022 outlook.

At the end of January, we turned our attention to the next known unknown – our belief that earnings growth would decelerate more than expected – i.e., the 'ice' in our narrative. Based on our conversations with many investors, this greater deceleration in growth has received even more pushback than our view on the Fed and valuations last fall. Of course that doesn’t mean we are right. To the contrary, we have to ask ourselves whether this is another known unknown (we are right) or an unknown known (the consensus is right).

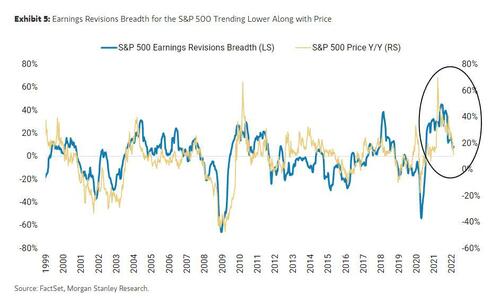

Obviously, we think our view is correct or else we wouldn’t be propagating it; however, we are always looking for evidence that either supports or refutes it. In fact, we backed off the ice portion of our call last October when we saw little evidence that earnings momentum was slowing. As a result, we pushed the timing of ice out to 1Q. Evidence is now building that earnings forecasts are increasingly at risk. First, the negative-to-positive guidance ratio during 4Q earnings has spiked to 3.6x – the highest since 1Q16, when we were mired in a global manufacturing recession.

At no time during the Covid recession did we see a ratio this high. Earnings revision breadth is also falling fast and approaching negative territory, which leads next-12-months EPS forecasts. Bottom line, we see evidence building that we are right and the consensus is wrong, but it’s fair to say we can’t yet put this in the known unknown box – which also means it’s not yet priced if we’re right.

Finally, the Russian invasion of Ukraine fits into the unknown unknown box, along with most geopolitics. While there are many people who know quite a bit about such matters, geopolitics are very difficult to analyze and therefore very difficult to price. Instead, this invasion simply adds another risk to the mix that’s unlikely to disappear quickly. In a world where valuations remain elevated and earnings risk is rising, last week’s tactical rally in equities will likely run out of momentum in March as the Fed begins to tighten in earnest and the earnings picture deteriorates.

https://ift.tt/lnZ7Nto

from ZeroHedge News https://ift.tt/lnZ7Nto

via IFTTT

0 comments

Post a Comment