WTI Shrugs Off Huge Crude Inventory Build, Cushing Draws Continue

Oil prices fell modestly today after the Biden admin hinted at more SPR releases and the algos auto-reacted. When asked if the US considering another release of the SPR to stem rising gas prices given the Ukraine crisis, White House Press Secretary Jen Psaki said “that is certainly an option on the table.”

“What we’re trying to do and focus on is take every step we can working around the world with our counterparts and partners to minimize the impact on the global energy market,” Psaki said.

The other side of the market was also making news today as Iran’s foreign minster said on Wednesday that it wants to settle the remaining issues in the coming days, but that it won’t concede on its red lines “under any conditions.” Any restoration of Iranian barrels to the global market would help ease tightness.

Obviously, geopolitical tensions are dominating price action in the energy complex but any notable surprise from inventories may be enough to trigger the next leg one way or another...

API

-

Crude +5.983mm (+767k exp) - biggest build since Oct 2021

-

Cushing -2.066mm - 7th straight weekly draw

-

Gasoline +427k

-

Distillates -985k

Crude stocks rose dramatically last week according to API, building almost 6mm barrels relative to a modest 767k expectation...

Source: Bloomberg

WTI did rally after the settlement today and was hovering around $92.25 ahead of the API print and dipped below $92 after the data hit then bounced back...

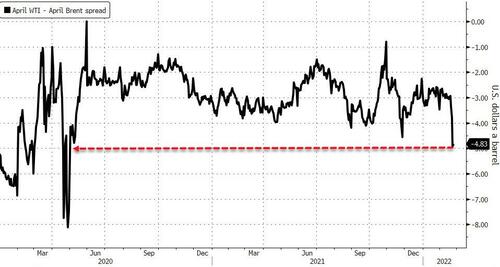

Brent crude’s premium to U.S. oil futures surged to nearly $5 a barrel, the most since April, 2020. The international benchmark is getting stronger from the fear of possible disruptions of energy supplies as Russia-Ukraine tensions escalate, said Spencer Vosko, director for crude oil at Black Diamond Commodities LLC.

“Here in the U.S., WTI is somewhat shielded from it since North American production is seen as growing once again,” added Vosko.

Of course, as we have noted previously, the post-SPR release drop was almost entirely driven by the emergence of the Omicron wave (and the Powell Pivot) and now prices are way above pre-SPR release levels... and set to rise...

Source: Bloomberg

Biden, speaking from the White House, said the administration is “closely monitoring” energy supplies and is preparing to coordinate with big oil producers to secure supply and “blunt” gas prices.“I want to limit the pain the American people are feeling at the gas pump,” he said.

Assuming Russian escalation is coupled with an Iranian deal, JPMorgan Chase & Co. said Brent is likely to average $110 in the second quarter.

You may want to look away Mr. Biden.

https://ift.tt/rtOcxJS

from ZeroHedge News https://ift.tt/rtOcxJS

via IFTTT

0 comments

Post a Comment