Facebook Swings Wildly After Revenue Miss, Poor Guidance But Announces $50BN Buyback

After a firehose of bad news in recent weeks for the world's largest social network unleashed by a whistleblower and former employee, who is doing everything in her power to get the government to regulate and break up the world's largest distributor of news with a steady leak of damning reports about the company's internal practices, and which culminated with Facebook being ignominiously displaced from its spot as the 5th largest US company by Tesla, as MAGAT is now bigger than FAAMG...

... some were expecting a "kitchen sink" quarter from a company whose every disclosure is now under the microscope, including not just a big miss to expectations, but also a sharp drop in users as the company is finally forced to disclose its true user base (see the recent WSJ report that Internal Facebook research found "that new users with multiple accounts are undercounted, ‘very prevalent’). That said, FB did close the day modestly higher, and after starting deep in the red it closed +1.3%.

A quick look at market expectations: Facebook is is expected to report Q3 EPS of $3.19 on revenue of $29.45 billion, which would amount to growth of 37%, a drop from the 56% Y/Y growth in Q2, which however lapped a quarter heavily impacted by Covid lockdowns.

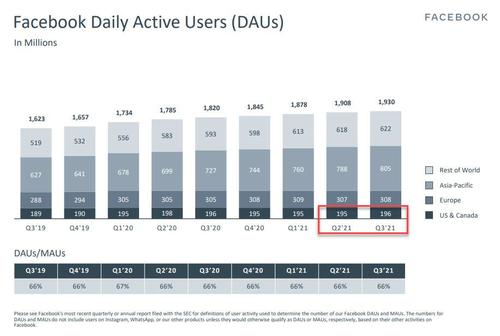

Analysts also are not expecting much user growth sequentially. Estimates for Facebook’s daily and monthly active user totals for its “family” of apps are the same as they were the previous quarter, or 2.77 billion daily users (up from 2.76 billion), and 3.52 billion monthly users (up from 3.51 billion). Growth in the U.S. and Canada for the core Facebook social network is expected to remain unchanged at 195 million daily users; that as Bloomberg notes, would mark the fourth straight quarter without growth in the most important market.

Looking at the press release, analysts will be focusing on two big story lines: Apple’s ad-tracking changes (which recall sent SNAP stock crashing last Friday), and global supply-chain issues. Indeed, Facebook has warned for months that Apple’s ad-tracking changes would impact revenue during the back half of the year.

So with that in mind how did Facebook do? Well, the "whispers" were half right, because Facebook while Facebook reported that it missed on revenue and Monthly Active Users, even if EPS and DAUs came in line. Also, the company's guidance was disappointing as was its CapEx.

Earnings:

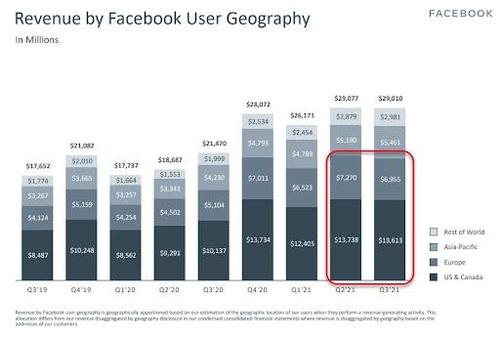

- Q3 Revenue $29.01 billion, +35% y/y, missing the estimate $29.45 billion

- Advertising rev. $28.28 billion, +33% y/y, estimate $28.99 billion

- Other revenue $734 million vs. $249 million y/y

- 3Q EPS $3.22, beating estimates $3.17

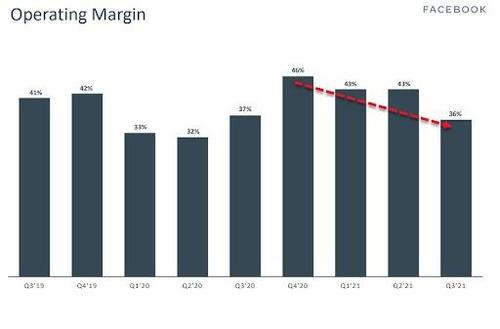

- 3Q Oper Margin 36%, missing estimates of 37%

Subscribers metrics:

- Monthly active users 2.91 billion, +6.2% y/y, missing the estimate 2.92 billion

- Daily active users 1.93 billion, +6% y/y, beating the estimate 1.92 billion

- Monthly active people (MAP) totaled 3.58 billion, beating the estimated 3.52 billion.

The projections were also lousy:

- Facebook Sees 4Q Rev $31.5B to $34B, missing estimates of $34.8B

- Facebook Sees FY Capex $19B, saw $19B to $21B, missing estimates of $20.29B

Addressing the weak revenue guidance, Facebook said what it has said for months: Apple’s iOS 14 changes will create headwinds. It also mentioned “macroeconomic and Covid-related factors” but did not mention the “supply chain” specifically.

Digging in the earnings slideshow we find that US DAUs did post a modest increase to 196MM from 195MM in Q2, with total DAUs up 22MM to 1.930BN.

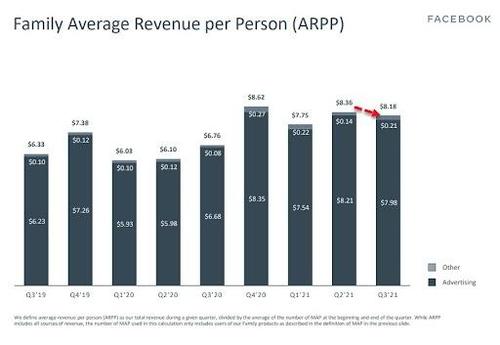

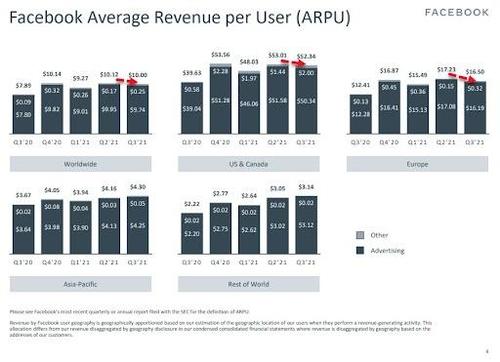

Despite the increase in total MAUs, total revenue per user was down sequentially.

Operating margin continues to decline:

More ominously, there was a drop in US and Europe revenue...

... as a result of a drop in ARPU:

The press release was quick to address the elephant in the room:

- “Our outlook reflects the significant uncertainty we face in the fourth quarter in light of continued headwinds from Apple’s iOS 14 changes, and macroeconomic and COVID-related factors.”

The company also noted that capex for 2021 will be $19 billion - the low side of the range - which is concerning: is the company not seeing enough demand to build out growth? In 2022, CapEx will be “in the range of $29-34 billion." Facebook said investments in “data centers, servers, network infrastructure, and office facilities” will drive that.

The company warned that it will see a $10 billion reduction in operating profit this year for investments in Facebook Reality Labs. That’s the company’s “future” division that includes augmented reality, virtual reality and the metaverse which is clearly soaking up a lot of R&D to fulfill Zuckerberg’s metaverse vision. Commenting on its future projections, Facebook said that it is "committed to bringing this long-term vision to life and we expect to increase our investments for the next several years.”

Realizing that earnings may be frowned upon, Facebook also bought back more than $14 billion worth of shares in the third quarter and has approved $50 billion more in buybacks, as well.

There was also a surprise announcement in the report: starting with results for the fourth quarter of 2021, FB plans to break out Facebook Reality Labs, or FRL, as a separate reporting segment to the core Family of Apps (FoA), which includes Facebook, Instagram, Messenger, WhatsApp and other services. By splitting the reporting, investors will be able to see the costs and revenue associated with its AR/VR efforts separately from its core businesses.

As we have discussed, we are dedicating significant resources toward our augmented and virtual reality products and services, which are an important part of our work to develop the next generation of online social experiences. The new segment disclosures will provide additional information on the performance of FRL and the investments we are making.

Under this reporting structure, we will provide revenue and operating profit for two segments: The first segment, Family of Apps, will include Facebook, Instagram, Messenger, WhatsApp and other services. The second segment, Facebook Reality Labs, will include augmented and virtual reality related hardware, software and content. We expect our investment in Facebook Reality Labs to reduce our overall operating profit in 2021 by approximately $10 billion. We are committed to bringing this long-term vision to life and we expect to increase our investments for the next several years.

One thing the release did not touch upon is a corporate name change or a rebranding. As Bloomberg notes, "we may need to wait until later this week for that news."

Commenting on the earnings, Vital Knowledge's Adam Crisafulli wrote that "overall, we don’t think this is a great print from FB. It’s clearly better than SNAP and the firm is an economic marvel (less than a handful of firms on the planet have this combination of scale, growth, and margins), but we think there will be a bigger washout within tech before this downdraft is complete."

The kneejerk reaction in the stock was to slide on the miss in revenues and poor guidance, but it has since rebounded and was trading near session highs, as investors welcomed the buyback announcement.

The company's earnings presentation is below:

https://ift.tt/2ZjsrBw

from ZeroHedge News https://ift.tt/2ZjsrBw

via IFTTT

0 comments

Post a Comment