Morgan Stanley: Tapering Is Tightening... And Dip Buying Is Starting To Fail

By Michael Wilson, Morgan Stanley's chief US equity strategist

Our US equity strategy process has several key components. Most importantly, we focus on the fundamentals of growth and valuation to determine whether the overall market is attractive and which sectors and styles look the best. The rate of change in growth is more important than the absolute level, and we use a market-based equity risk premium framework that works well as long as you apply the right regime when using it. In that regard, we’re avid students of market cycles and believe that historical analogies can be helpful. For example, the mid-cycle transition narrative that has worked so well since March came directly from our study of historical economic and market cycles.

The final component we spend a lot of time studying is price, i.e., technical analysis. Markets aren’t always efficient, but we believe that they are often very good leading indicators for fundamentals – the ultimate driver of value. This is especially true if one focuses on sector and style leadership and relative strength of individual securities. In short, we find these internals to be much more useful than simply looking at the major averages.

This year, we think that the process has lived up to its promise as the price action has lined up nicely with the fundamental backdrop. More specifically, cyclicals dominated growth stocks in the first quarter during the most accelerative phase of the early-cycle recovery. Large-cap quality leadership since March is signalling what we believe is about to happen – decelerating growth and tightening financial conditions. The question for many investors now is whether the price action has already discounted these fundamental outcomes. The short answer, in our view, is no.

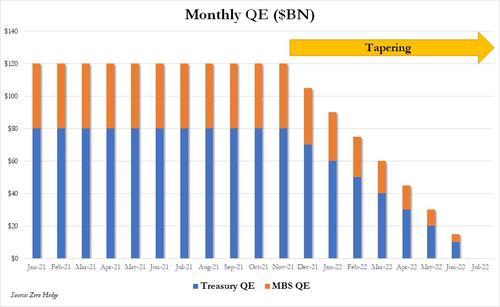

Equity markets sold off sharply two Mondays ago on concerns about an Evergrande bankruptcy. While our house view is that it won’t lead to major financial spillover, it will weigh on China’s growth. This means that the growth deceleration we (and the markets) were already expecting will likely be worse and is probably not fully priced in. The other reason why equity markets were soft a few weeks ago had to do with concerns about the Fed articulating its plans to taper asset purchases. The Fed did not disappoint, as it essentially told us to expect the taper to begin this year. The surprise was the speed with which it expects to be done tapering – by mid-2022. This is about a quarter sooner than the market had been anticipating and increases the probability of a rate hike in 2H22, a clearly hawkish shift.

After the Fed meeting on Wednesday, real 10-year yields were up 12bp in two days and are now up 31bp in just eight weeks. In addition, the US dollar was stronger. Both weighed heavily on equity markets. In other words, tapering is tightening for stocks even if it isn’t for the economy – the more important consideration for the Fed. In short, higher real rates should mean lower equity prices. Secondarily, they may also mean value over growth even as the overall equity market goes lower. This makes for a doubly difficult investment environment given how most investors are positioned. Finally, the most powerful offset to a material correction in the S&P 500 this year has been the extremely resilient buy-the-dip mentality among retail investors, a strategy that is now being challenged. After the Evergrande dip and rally, stocks have probed lower and taken out the prior lows, making this the first time that buying the dip hasn’t worked, simultaneously violating important technical support.

For the past month, our strategy has been to favor a barbell of defensive quality sectors like healthcare and staples, together with financials. The defensive stocks should hold up better as earnings revisions start to come under pressure from decelerating growth and higher costs, while financials can benefit from the higher interest rate environment. On the other side of the ledger are consumer discretionary stocks, which remain especially vulnerable to a payback in demand from last year’s over-consumption. Within that bucket we favor services over goods, where we think there remains some pent-up demand. The risk to earnings may also be higher than average for some tech stocks levered to the work-from-home dynamic that is now fading. Within the sector, we are most concerned about semiconductors and neutral overall.

https://ift.tt/3B6Upy9

from ZeroHedge News https://ift.tt/3B6Upy9

via IFTTT

0 comments

Post a Comment