Robinhood Plunges After Huge Revenue Miss, Terrible Guidance

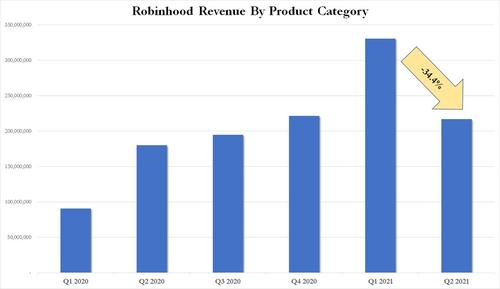

One quarter ago, we had a clear advance notice that Robinhood's payment for orderflow - the company's bread and butter and the bulk of its revenues courtesy of its main client Citadel - would suffer big in Q2 sequentially, because having spread the company's 606 filings previously, we showed a 34% drop in PFOF in Q2 compared to Q1, and an only modest increase Y/Y thanks to a 48% increase in option trading as revenue from orderflow from S&P and non S&P500 stocks was down 25% Y/Y.

The company's Q2 results confirmed as much, showing a big sequential drop in total the top line with revenue from cryptos surpassing stocks and options combined. And unfortunately, the company this time has not been able to make it 606 filing in time, so all we knew heading into Q3 earnings was Robinhood's own warning that results would be ugly, to wit: "for the three months ended September 30, 2021, we expect seasonal headwinds and lower trading activity across the industry to result in lower revenues and considerably fewer new funded accounts than in the prior quarter."

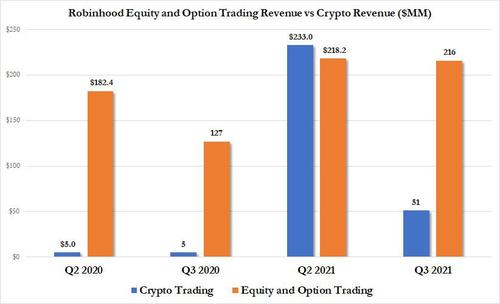

In retrospect, investors should have paid attention because moments ago Robinhood posted Q3 results and they were atrocious as total revenues collapsed from Q2, the core transaction business failed to grow (and is actually stuck at Q3 2020 levels), and the end of the Dogecoin frenzy meant an absolute collapse in crypto activity which not only saw crypto revenues collapse 78% to just $51MM in Q3 but led to a plunge in cumulative funded accounts.

- Net Revenue $364.9M, huge miss to estimates of $423.9M

- Net loss of $1.32 billion, or $2.06 a share.

It just gets worse from there:

- Transaction-based revenue $266.8 million, down 41% q/q; of this Crypto revenue was $51 million, down a huge 78% from $233MM in Q2. So much for the dogecoin mania.

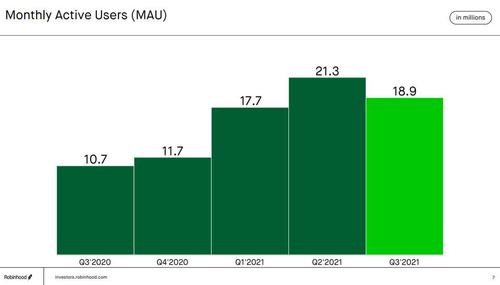

- Monthly active users 18.9 million, down -11% q/q

- Funded accounts 22.4 million, a slight decline from the end of the previous quarter.

- Net cumulative funded accounts 22.4 million, also down -0.4% q/q

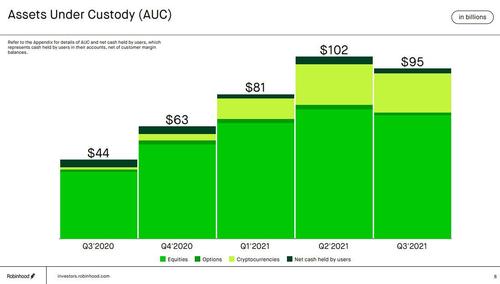

- Assets under custody $95 billion, down 6.9% q/q

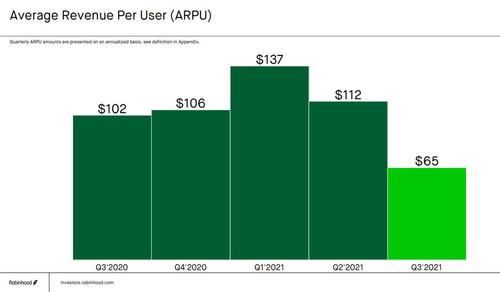

- Average rev. per user $65, down 42% q/q

- The company did beat on Adjusted Ebitda, which came in at $84 million, beating consensus estimates of $18.8 million, but nobody cares.

The charts are in a word, horrific, starting with MAU which have now peaked...

... going to Assets under custody:

ARPU was an unmitigated disaster, dropping to the lowest level in the past year.

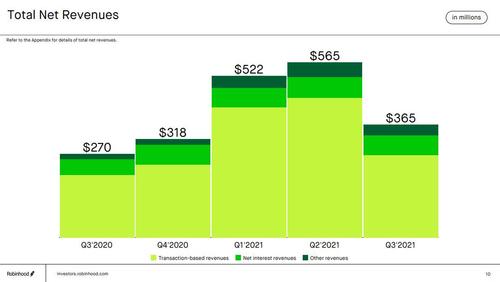

Fewer users and lower ARPU means just one thing: a collapse in revenue, which is now less than the price of a Ken Griffin apartment:

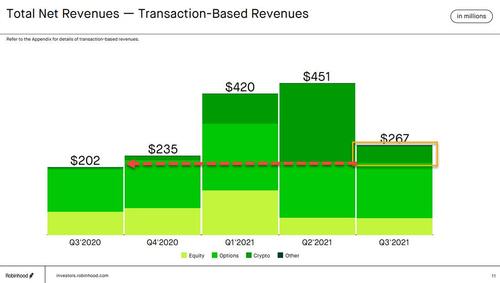

Believe it or not, it actually gets even worse, with the company's transaction based revenue (i.e., what it actually does) down to $267 MM, or almost down 50% from Q2. But wait, because if one excludes $51MM in crypto revenue, one gets just $216MM in total transaction based revenues, flat since Q3 2020 and below the Q4 2020 total.

And another way to visualize the stagnation in the company's core PFOF business:

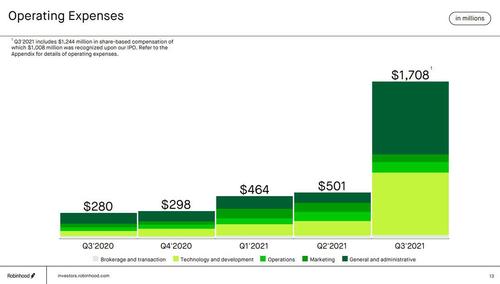

That said not everything was plunging: operating expenses more than tripled.

Some commentary on what was the ugliest quarter in HOOD's post-IPO history:

- Crypto activity declined from record highs in the prior quarter, leading to considerably fewer new funded accounts, a slight decline in Net Cumulative Funded Accounts

- Tranche I note investors agreed not to sell 50% of the Conversion Shares until the 28th day after the Resale S-1 is declared effective, with the understanding that the other 50% is not subject to any lock- up

- No sales have ocurred under resale s-1 because we Robinhood issued a customary suspension notice to prevent its use pending the company's earnings announcement

- Robinhood launched crypto recurring investments, allowing customers to automatically buy crypto, commission-free, on a schedule of their choice. Guess what: they aren't doing jack shit.

- Robinhood is cancelling the Suspension Notice effective one full trading day after today's earnings release

- As a result, those same Conversion Shares that are currently unlocked will also be eligible for sale under the Resale S-1, starting with the opening of the Nasdaq market on October 28

- The company said crypto activity declined from record highs in the prior quarter, leading to considerably fewer new funded accounts, a slight decline in Net Cumulative Funded Accounts, and lower revenue in the third quarter of 2021 compared with the second quarter of 2021

- Regarding other IPO lock-ups, Robinhood says market-price conditions were not met, so those early lock-up releases will not occur; those holders' shares will remain subject to the lock-up agreements through the close of trading on Nov. 30

Of course, CEO Vlad Tenev tried to spice up the doomsday atmosphere but... he failed:

"This quarter was about developing more products and services for our customers, including crypto wallets," said Vlad Tenev, CEO and Co-Founder of Robinhood Markets. "More than one million people have joined our crypto wallets waitlist to date. With 24/7 live phone support, we believe that Robinhood is becoming the most trusted and intuitive platform for retail and crypto investors. And looking ahead, we're committed to delivering taxadvantaged retirement accounts to help everyone invest for the long term.”

But wait, there's much more and yes, it's all ugly: in an echo from 3 months ago when HOOD warned Q3 would be ugly and nobody believed it, this time the company's terrible guidance will be taken much more seriously:

- Sees 4Q No Greater Than $325M, a huge miss to the est. $500.7M

- Sees Year Rev. Less Than $1.8B, far below the est. $2.03B

- Sees 4Q New Funded Accounts About 660,000

While hardly necessary, a hot take from Hugh Tallents, senior partner at consultancy CG42, confirmed that the situation is catastrohic and getting worse:

- The comparisons between Q3 2021 and Q3 2020 are convenient but misleading as the bulk of the growth they are recognizing here happened pre-IPO in the first half of the year when individual investing saw an unprecedented level of growth.

- The decline in crypto revenue is also a concern even as they launched their crypto wallet. Coinbase and others appear to be the place for crypto traders to go and this presents a material risk moving forward.

- The guidance moving forward touts a host of new services and education tools. These are a step in the right direction, but they are certainly inferior to what the more established brokerages offer and are unlikely to stem the flow of higher balance customers leaving.

In light of all the catastrophic numbers above, it is a miracle that the stock is down only $3 or 8% after hours. In any case, it's down to the lowest level since the IPO and just shy of breaking the all time low of $34.82.

... which is hardly what Cathie Wood wanted to see.

https://ift.tt/2XLVtZV

from ZeroHedge News https://ift.tt/2XLVtZV

via IFTTT

0 comments

Post a Comment