"Unexpected" Collapse Of Chinese Property Developer Pushes China's 2021 Default Total To Record High

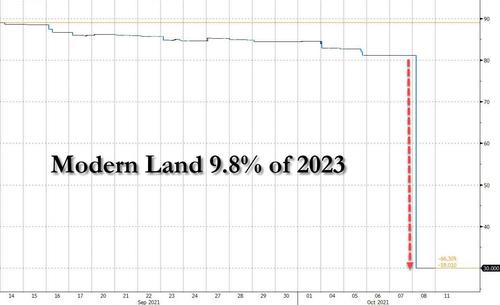

The first time we mentioned the smaller rival of China's giant property developer Evergrande, Modern Land, was two weeks ago when we reported that the developer of real estate projects that use green technologies asked investors to push back by three months a $250 million bond payment due on Oct. 25 in part "to avoid any potential payment default" (just days later, the company scrapped the plan to seek investor consent to extend bond maturities by three months, saying doing so was not in the best interests of it and its stakeholders, because maybe bankruptcy was in their best interests.) This - we noted - was not expected, and Modern Land's various bonds immediately plunged more than 50% to 30 cents on the day.

In retrospect the sharp plunge in Modern Land bonds on October 8 saved bondholders some pain today because, after investors refused to push back the company's coupon due on Monday, the company today defaulted on said bond payment, becoming the latest Chinese property developer to do so, adding to worries about the wider impact of the Evergrande debt crisis and weighing on shares in the sector.

Having already plunged earlier this month, there was little more for Modern Land's bonds to drop, and its 11.8% February 2022 bond was down 1.6%, a discount of over 80% from its face value, yielding about 1,183%.

Beijing-based Modern Land said in a filing on Tuesday that it had not repaid principal and interest on its 12.85% senior notes that matured on Monday due to "unexpected liquidity issues." (as a reminder, "adverse liquidity issues" are never expected). The bond, as noted above, had outstanding principal of $250 million. Modern Land is working with its legal counsel Sidley Austin and expects to engage independent financial advisers soon, the filing said.

Fitch Ratings downgraded Modern Land to restricted default from C late Tuesday following the payment miss. Like Evergrande, the developer tried divestitures, borrowing and adding strategic investors and like Evergrande, it failed to succeed in any of its last ditch ventures before not making the payment, reported Chinese financial platform Cailian. It last week terminated a proposal to extend the bond’s maturity by three months.

The news of the latest default hammered shares of property developers, which were also hurt also by concern over China's plans to introduce a real estate tax over the next five years. China's CSI 300 Real Estate Index fell 2.8%, and the Hang Seng Mainland Properties Index dropped 4.3%. The broader Hang Seng index edged down 0.4% while China's CSI300 index slipped 0.3%.

The prospect of contagion and more defaults have weighed on the sector in a major setback for investors: Chinese Estates Holdings Ltd said it would book a loss of HK$288.37 million this fiscal year from its latest sale of bonds issued by Chinese property developer Kaisa Group Holdings Ltd

This latest failure means that Chinese borrowers have now defaulted on a record $9 billion of offshore bonds this year, with the real estate industry accounting for one-third of that amount. That’s come as authorities clamp down on excessive leverage in the real estate sector amid a crisis at China Evergrande Group that has left many investors around the world on edge.

A bulk of 2021's defaults took place in the past month, although the biggest risk, Evergrande, made a last minute coupon payment last Friday just hours before the grace period expired. Still, Evergrande’s creditors are bracing for an eventual debt restructuring that would rank among the largest ever in China.

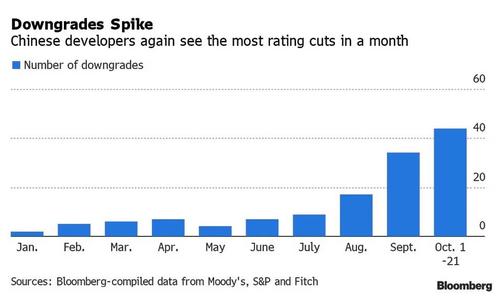

One thing is certain: many more defaults are coming. Rating agency downgrades of Chinese developers have accelerated further in October, hitting a record high for a second straight month and as the chart below shows, there were 44 cuts in the sector by Moody’s Investors Service, S&P Global Ratings and Fitch Ratings as of Oct. 21, after 34 downgrades for all of September, according to Bloomberg-compiled data.

Ratings reductions surged in the third quarter as Evergrande's troubles fueled broader debt-related worries. Ongoing downgrades, occurring as developers face heavy operational and refinancing pressure, “will worsen their capability of raising funds,” said Ma Dong, a partner with Chinese bond firm BG Capital Management.

This month, Fantasia Holdings Group defaulted on a maturing dollar bond that heightened concerns in international debt markets, already roiled by worries over whether Evergrande would meet its obligations.

To be sure, Beijing is trying to prevent a default avalanche (and while it has talked up a strom, it has actually done far less than many have expected). Earlier today, we reported that in a radical "modest proposal" to restructuring the restructuring process itself, Chinese authorities told billionaire Hui Ka Yan to use his personal wealth to alleviate Evergrande’s deepening debt crisis.

Separately, China's state planner, China’s National Development and Reform Commission, called on companies in "key sectors", which according to Reuters included property firms, over their foreign debt holdings asking them to "optimize" offshore debt structures and prepare to repay interest and principal on foreign bonds. So China is now suddenly worried about non-repayment of foreign creditors? We somehow doubt it.

Alas, what China's companies desperately do need - more liquidity - they can't find. Hindering their capital-raising, and their ability to roll over existing maturities, is the surge in yields on Chinese junk-rated debt, which recently reached their highest in a decade at 20%. As a result, China's property developers now make up nearly half the world’s distressed dollar bonds. Still, a media representative for Ronshine China Holdings told Bloomberg that the developer paid the $30.2 million of interest due Monday on a dollar bond. Peer Agile Group Holdings Ltd. said it has sufficient funds to meet upcoming debt maturities.

Of course, the real question is not if but when Evergrande will fall. The giant developer, which narrowly averted a costly default last week, is reeling under more than $300 billion in liabilities and has another major payment deadline on Friday. The company said on Tuesday it would deliver 31 real estate projects under construction in China's Pearl River Delta region by the end of 2021. That number will rise to 40 by the end of June 2022, Evergrande said in comments to Reuters. Evergrande had said on Sunday it had resumed work on more than 10 projects in six cities, including Shenzhen in southern China, after earlier halting them because it was unable to pay contractors. The developer has some 1,300 real estate projects across China in total.

Speaking to Reuters, an investor with exposure to Chinese high-yield debt, said that developers are defaulting "one by one", adding that "the question is always, who's next?"

We don't know, but here is a convenient list of every developer that has an upcoming debt payment:

October

- Yango Group Co. bond with 941 million yuan outstanding, Oct. 22

- Modern Land China Co. note with $250 million outstanding, Oct. 25

- Redsun Properties Group Ltd. bond with $97 million outstanding, Oct. 30

November

- Central China Real Estate Ltd. $400 million note, Nov. 8

- Zhenro Properties Group Ltd. $200 million bond, Nov. 18

- Agile Group Holdings Ltd. $200 million note, Nov. 18

- Yango Group Co. bond with 603 million yuan outstanding, Nov. 19

- Zhongliang Holdings Group Co. $200 million note, Nov. 22

- Rongxin Fujian Investment Group Co. 2 billion yuan note, Nov. 28

December

- Ronshine China Holdings Ltd. $150 million bond, Dec. 3

- Kaisa Group Holdings Ltd. $400 million note, Dec. 7

- Guangzhou Hejing Holding Group Co. bond with 2.26 billion yuan outstanding, Dec. 17

- Jinke Properties Group Co. 800 million yuan note, Dec. 25

- Guangxi Construction Engineering Group Co. 800 million yuan bond, Dec. 28

January

- Xinyuan China Real Estate Ltd. 600 million yuan note, Jan. 4

- KWG Group Holdings Ltd. $250 million bond, Jan. 11

- Yango Justice International Ltd. $200 million note, Jan. 11

- ZhenAn Glory Investment Ltd. $100 million bond, Jan. 13

- Easy Tactic Ltd. $725 million note, Jan. 13

- Fujian Sunshine Group Co. 400 million yuan bond, Jan. 15

- China Aoyuan Group Ltd. $188 million note, Jan. 20

- China Aoyuan Group Ltd. $500 million bond, Jan. 23

- Guangzhou Times Holding Group Co. 1.1 billion yuan note, Jan. 25

- Zhongliang Holdings Group Co. $250 million bond, Jan. 31

February

- Ronshine China Holdings Ltd. $200 million note, Feb. 1

- Jinke Properties Group Co. bond with 350 million yuan outstanding, Feb. 9

- China South City Holdings Ltd. note with $348 million outstanding, Feb. 12

- Yango Cayman Investment Ltd. $110 million bond, Feb. 20

- Modern Land China Co. $200 million note, Feb. 26

March

- Ronshine China Holdings Ltd. bond with $488 million outstanding, Mar. 1

- ZhenAn Glory Investment Ltd. $50 million note, Mar. 6

- Agile Group Holdings Ltd. $500 million bond, Mar. 7

- Greenland Global Investment Ltd. $350 million note, Mar. 12

- Yango Justice International Ltd. $300 million bond, Mar. 18

- Yango Group Co. 500 million yuan note, Mar. 22

- Fujian Sunshine Group Co. 500 million yuan bond, Mar. 22

- Yango Group Co. note with 1.47 billion yuan outstanding, Mar. 24

- Guangzhou Tianjian Real Estate Development Co. 600 million yuan bond, Mar. 28

- Fujian Sunshine Group Co. 500 million yuan note, Mar. 29

https://ift.tt/3nwBU0z

from ZeroHedge News https://ift.tt/3nwBU0z

via IFTTT

0 comments

Post a Comment