This Is What It Looks Like When Bears Cry...

Authored by Sven Henrich via NorthmanTrader.com,

Bears are crying as markets are again making new highs following the September trend breaks. Yet perhaps they should be rejoicing for crying bears and a backtest of a broken trend is a classic bear set up. That is if the backtest fails and the new highs get rejected.

For context: In early October I shared the ‘make bears cry’ scenario:

You can see the context of the discussion here:

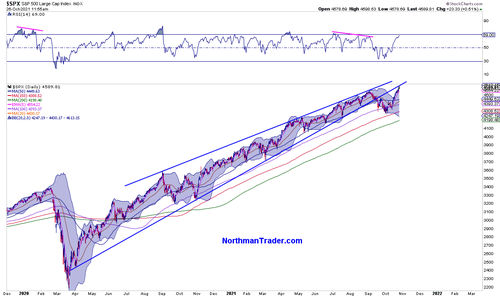

Here now is the updated chart:

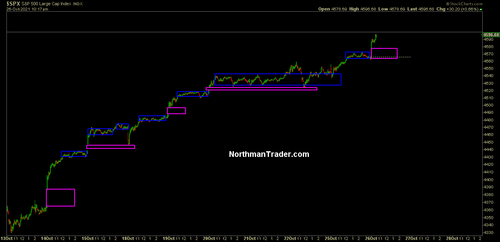

Go figure. So I submit that this rally so far has really not been a surprise although one could argue it is again all gap, ramp & camp-driven with little organic 2 way price discovery:

Which makes the action again very suspect frankly as too many open gaps are begging for filling.

Why is the backtest scenario potentially bearish? Because it’s still a broken trend and we’ve seen these type of retests before. Q4 of 2018 on $NDX was such an example:

Broken trend, then a back test that produced new highs and everyone got bullish again just before a 20% drawdown in $SPX into December 2018.

Back then of course the Fed was tightening and its balance sheet roll off on autopilot, this time around the Fed hasn’t even started yet, although expectations are the Fed will at least finally announce a taper next week.

Sell offs in the final quarter of the year are extremely rare, the years 2000 and 2018 really the only examples in recent decades, hence it’s no wonder that everyone again has embraced the bullish narratives no matter how absurd the trading action may be. Fairy tale market cap appreciations out of thin air after all:

Today $TSLA has gained $100B in market cap on a $4B revenue order while Elon Musk has added $29B to his personal wealth as a result.

— Sven Henrich (@NorthmanTrader) October 25, 2021

Alexa: What part of the cycle are we in?

But as long as markets don’t mind valuations don’t matter.

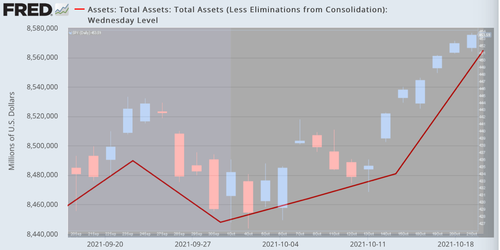

For participants have caught on by now that the only time markets truly correct on a quarterly time frame is when QE ends somewhere:

Only to start QE again on a quarterly red candle. That is the well established track record. And even if the Fed tapers it’s still running QE into at least the middle of next year. So based on that one could argue the party will keep going no matter the valuations disconnect between fantasy and reality:

Highest market valuation ever: $47.23 trillion.

— Sven Henrich (@NorthmanTrader) October 21, 2021

Widest disconnect from the economy ever: 207.7% market cap vs GDP. pic.twitter.com/r3CWma5BoA

For the only thing that matters at the end of the day is Fed liquidity which again drove the latest rally:

Yet the charts keep raising concerns as to the veracity and durability of the latest set of new highs.

Consider how weak the data prints are on the MACD histogram on new highs:

Usually new highs bring about some positive readings even if these highs are divergent and indicative of a potential intermittent top. These readings here are pitifully weak & negative compared to prior highs.

Also of note is the $VIX. Crushed to a pulp in recent days to the lowest levels since February 2020 it nevertheless has been defending its up trend so far:

$VIX defending its uptrend while $SPX is backtesting its broken trend? Could make for a powerful rejection story. But for this to be evident we would need to see $SPX show a confirmed and sustained drop below 4550, the September highs, and then evaluate how the price action evolves.

On that note, some of you may have noticed I’ve been publishing less public market analysis in recent weeks. This is because I’ve moved my public charts and public commentary to my news letter which you can subscribe to via Twitter for free here:

This is where I keep highlighting charts of various asset classes and discuss observations of note.

Bears are currently crying, but then they always cry when new highs are made, but many times new highs, in the right circumstances, have set up for some of the best selling opportunities. Time will tell.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

https://ift.tt/3jGddOe

from ZeroHedge News https://ift.tt/3jGddOe

via IFTTT

0 comments

Post a Comment