Enough With The Focus On Jobs: They Will Tell You Nothing About The Recession

Yesterday we joked that the same economists who a year ago were droning on that inflation was transitory are the same ones who now claim that there is no recession.

All of the economists who one year ago promised inflation was transitory agree: this is not a recession

— zerohedge (@zerohedge) July 28, 2022

And while this topic has become absurdly comical...

A recession is two consecutive quaters of negative growth IF the sitting POTUS is a Republican. Otherwise much like gender, a recession is fluid and can't be defined in static binary terms.

— Adrian .T (@lokergnome) July 29, 2022

... it's dead serious to those millions who are about to lose their jobs.

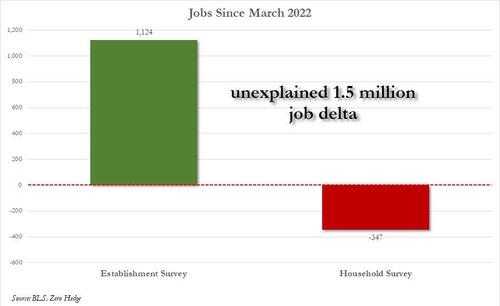

So playing devil's advocate for a second, what is the overarching argument of the perpetually optimistic "team transitory no-recession"? Well, in a nutshell it is that jobs are nowhere near low enough to justify a recession, and while that may be accurate at the establishment survey level, it is certainly not the case at the Household survey as we first pointed out several weeks ago...

... and as Goldman subsequently piggybacked.

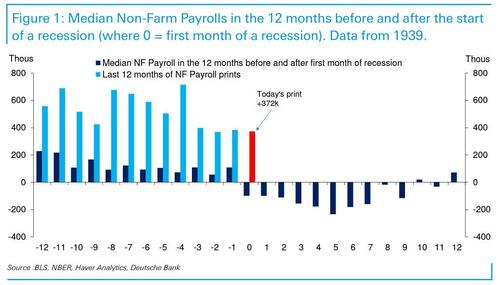

But there is a much simpler reason why the "jobs, jobs, jobs" defense is silly to the point of being amateur hour. And that is that jobs are a lagging indicator. Deeply lagging. Furthermore, as we pointed out recently, the median payroll 10 months before a recession is the same as the final month before a recession with little sign of a trend in the months between!

In other words, jobs have precisely ZERO signaling power ahead of a recession.

But while we felt like we were taking crazy pills there for a while, where supposedly all the "smart experts" were supposed to realize that jobs are lagging and have zero bearing at all on recession timing, on Friday afternoon Bloomberg Markets Live commentator Vincent Cignarella reassured us of our sanity when he wrote an article titled "Enough with the focus on jobs. They're a lagging indicator... It’s econ 101."

And yet, it appears that nobody has taken Econ 101, especially the so-called experts. As Cignarella points out "from the Fed to the Treasury Secretary to just about every analyst on the Street, there seems to be a consensus about a tight labor market necessitating monetary tightening. That’s like wishing you were still back in high school." We couldn't have said it better ourselves, so we give the mic to Vincent for the balance of this post:

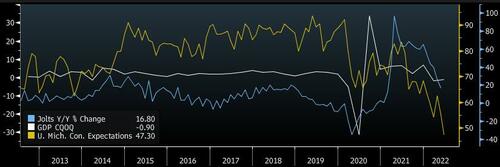

Don’t buy the jobs hype. JOLTS began to decline on a year-over-basis some five months after the economy started losing steam and will continue to lag, offering no real clues for changes in monetary policy.

The University of Michigan expectations index is a much better leading indicator of where the state of the economy is headed. It leads the drop in GDP by some seven months and is still falling, according to Cignarella.

So what does that say for risk assets?

For Vincent, it means the Fed is going to overshoot the runway and pull back on rate hikes much sooner than markets are pricing in. That’s very bullish for stocks and bonds. A continued flattish-to-lower expectations index will likely lead to a risk rally from now until at least year end.

https://ift.tt/VjvFSwG

from ZeroHedge News https://ift.tt/VjvFSwG

via IFTTT

0 comments

Post a Comment