Netflix Surges After Smaller Than Expected Subscriber Loss, Warns Soaring Dollar Is Hammering Results

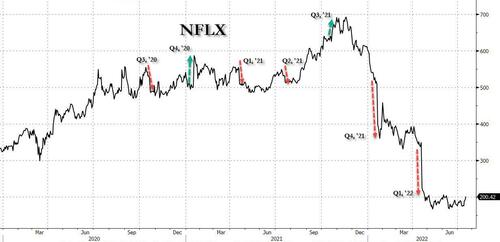

Recent earnings reports from streaming giant Netflix had been a veritable horroshow: the stock tumbled just under two years ago when the company reported a huge miss in both EPS and new subs, which at 2.2 million was tied for the worst quarter in the past five years, while also reporting a worse than expected outlook for the current quarter. This reversed six quarters ago when Netflix reported a blowout subscriber beat and projected it would soon be cash flow positive, sending its stock soaring to an all time high - if only briefly before again reversing and then tumbling five quarters ago when Netflix again disappointed when it reported a huge subscriber miss and giving dismal guidance, leading to the second quarter when Netflix slumped again after the company missed estimates and guided lower. This again reversed three quarters ago when Netflix soared after it blew away expectations and guided to a blowout Q4, only to plummet two quarters ago when the company's stock crashed after NFLX reported a dismal subscriber miss for Q4 and gave horrific guidance for the current quarter. Finally, one quarter ago, the stock absolutely imploded, plummeting 20% in seconds after the company reported the loss of 2 million subs in Q2 and forecast catastrophic earnings.

In short, the shares tumbled on 5 of the past 7 earnings releases, and have lost 67% of their value YTD, which is why many said that purely based on statistics, NFLX is long overdue for a bounce today.

They were right: moments after the close, NFLX reported mixed results for Q2 and a somewhat weak outlook but because the company finally beat its dismal streaming subs outlook, and reported stronger than expected Q2 subs, the stocks surged after hours.

Here are the details (from the letter to shareholders):

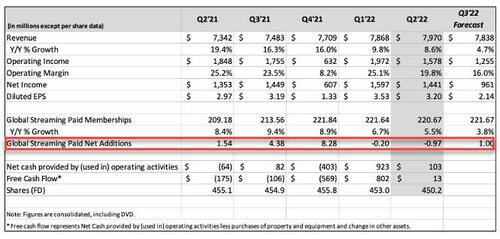

- Q2 revenue $7.97BN, missing the Exp. $8.04BN

- Q2 EPS $3.20, beating the Exp. $2.91

- Streaming paid net change -970K beating the Exp. -2 MM

- US/Canada streaming paid net change -1.30 million vs. -430,000 y/y, missing the estimate -1.2 million

- EMEA streaming paid net change -770,000 vs. +190,000 y/y, beating the estimate -783,122

- LATAM streaming paid net change +10,000, -99% y/y, beating the estimate -623,742

- APAC streaming paid net change +1.08 million, +5.9% y/y, beating the estimate +516,152

- Streaming paid memberships 220.67MM, +5.5% Y/Y, beating the exp. 220 2MM

- Operating margin 19.8% vs. 25.2% y/y, estimate 21.4%

- Operating income $1.58 billion, -15% y/y, estimate $1.72 billion

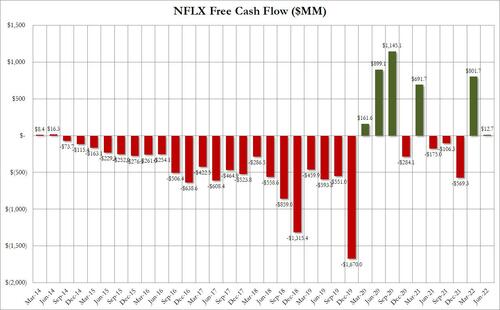

- Free cash flow $13 million vs. negative $175 million y/y

The good news: after losing just shy of 1 million subscribers in Q2, NFLX pleasantly surprised investors who had expected It to lose 2 million.

More importantly, after shedding subscribers for two quarters in a row, Netflix forecasts that it will return to growth in Q3 and add 1 million subscribers. The bad news: Consensus expected a 1.8 million increase in Q3 subs, although judging by the move higher in the stocks, the market is willing to call a mulligan on that as even more bad news had been priced in.

Looking ahead the company also expects the following Q3 metrics:

- Q3 revenue $7.84BN, Exp. $8.1BN

- Q3 EPS $2.14, Exp. $2.72

The bottom line here is that while Netflix believes that already endured the worst of the subscriber losses, it isn’t projecting a return to rapid growth any time soon. The company expects to sign up 1 million subscribers in the current three-month period -- essentially reversing the losses of the first half. That’s well short of the 1.83 million analysts forecast this period.

Going back to the results, netflix’s said Q2 was “better-than-expected” on subscriber growth, but foreign exchange -i.e., the soaring dollar's negative impact on sales - was worse-than-expected:

“Our challenge and opportunity is to accelerate our revenue and membership growth by continuing to improve our product, content, and marketing as we’ve done for the last 25 years, and to better monetize our big audience. We’re in a position of strength given our $30 billion-plus in revenue, $6 billion in operating profit last year, growing free cash flow and a strong balance sheet.”

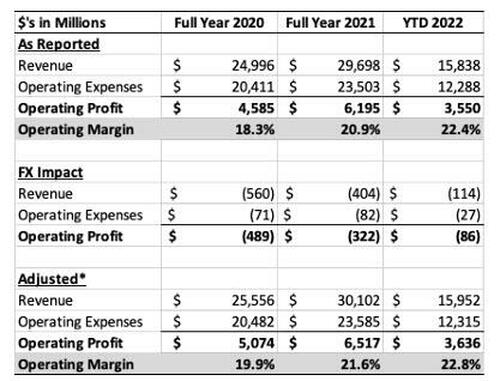

What is particularly notable is that according to the investor letter, the company's revenue grew 9% in Q2 year over year - and would have grown 13% excluding a -$339 million foreign currency impact - driven by a 6% and 2% increase in average paid memberships and ARM , respectively. Excluding the impact of foreign exchange (F/X), ARM rose 7% year over year.

Echoing IBM, NFLX laments the surge in the USD, and says that "the appreciation of the US dollar (USD) vs. most other currencies since our April earnings report was the primary reason for the variance to our revenue guidance forecast." The company also admitted that it "slightly under-forecasted global paid net adds in Q2 (-1.0m vs. -2.0m forecast and compared to +1.5m in the year ago quarter)."

The strong dollar will also be an issue going forward with Netflix saying the stronger US dollar is affecting its revenue and profits.

"We have high exposure to this unprecedented appreciation in the USD because nearly 60% of our revenue comes from outside the US and swings in F/X have a large flow through to operating profit as most of our expenses are in USD and don’t benefit from a stronger USD."

There's more: to demonstrate the impact of the soaring dollar, NFLX included a section titled "F/X Neutral Operating Margin Disclosure" in the investor letter in which it writes that going forward it will "disclose our year-to-date (YTD) operating margin based on F/X rates at the beginning of each year. This will allow investors to see how our operating margin is tracking against our target (which was set in January of 2022 based on F/X rates at that time), absent intra-year fluctuations in F/X (which have been substantial in 2022). As can be seen from the table below, F/X-driven changes to our revenue have a high flow through to operating income (the operating profit impact ranges from ~75% to 80%+ of the revenue impact). This is because the bulk of our expenses don’t change with F/X fluctuations."

NFLX also took a machete to comp, saying that it has adjusted its cost structure for our current rate of revenue growth: "This resulted in approximately $70 million of severance costs and an $80m non-cash impairment of certain real estate leases primarily related to rightsizing our office footprint." Bottom line, excluding these items totaling $150 million, and the F/X impact of the stronger US dollar since our April report, operating profit and operating margin are slightly ahead of the company's guidance forecast.

Some more details on its roster of movies: the 4th seasons of “Stranger Things” generated 1.3 billion hours of viewing in its first four weeks, Netflix said of its biggest English-language season ever. The season reignited interest in prior episodes, which saw a greater than five-fold increase in viewing. The combined Twitter posts around the show were more than “Obi-Wan Kenobi” and “Top Gun: Maverick.”

As an aside, a decade into Netflix’s march into original programming, Netflix said that 60% of the titles on its balance sheet are ones it produced itself.

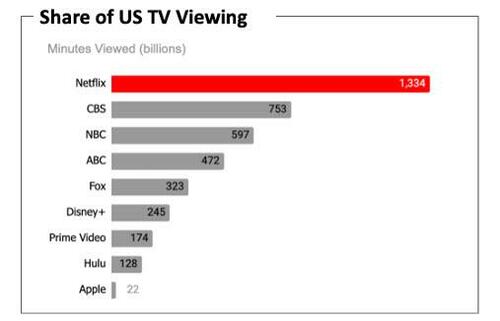

Netflix also said that its share of TV viewing grew to an all-time high of 7.7% in June. At 1.3 billion minutes, that’s nearly as large as the next two media giants, CBS and NBC, combined.

As for the company's entry-level, ad-supported tier, Netflix appears to be delaying the start of this ad-supported offering a bit. The shareholder letter released as part of its second-quarter earnings report said it will be introduced “around the early part of 2023.” The company had previously said it would launch this year, although the language does give some wiggle room on the start date

Turning attention to cashflow, NFLX generated +$13 million in FCF in Q2, compared with -$175 million in Q2’21. Cash declined $190m sequentially, primarily due to the company's Next Games acquisition ($69m) and the F/X impact on cash ($145m). The good news is that NFLX (remains) self-funding, and for the full year 2022, the company expects FCF to be approximately +$1 billion, plus or minus a few hundred million dollars (assuming no material further movements in F/X).

Here, for the first time NFLX shared some interesting details: NFLX expects annual positive FCF going forward (with substantial growth in FCF in 2023 vs. 2022) "due to increasing revenue, solid profitability, and the successful multi-year evolution of our content model."

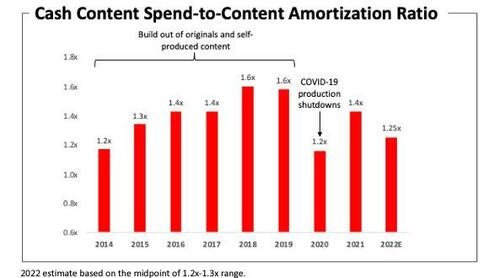

We’re now more than a decade into transforming our service from licensed second run content to mostly Netflix originals - including more than five years into building out our internal studio to produce the majority of our original titles (60% of our net content assets on our balance sheet are Netflix-produced). We’re now through the most cash-intensive part of that transition.

As a result, the company's cash content spend-to-content amortization expense ratio peaked at 1.6x (along with peak negative FCF of -$3.3B in 2019) and is expected to be about 1.2-1.3x in 2022 and to decline going forward, based on current plans, which assume no material expansion into new content categories in ‘23.

A quick snapshot of the balance sheet: gross debt at quarter end amounted to $14.3 billion, and with cash of $5.8 billion, net debt totaled $8.5 billion, or 1.3x LTM EBITDA. Nflx writes that its capital structure policy remains unchanged.

The first priority for our cash is to reinvest in our core business and to fund new growth opportunities like gaming, followed by selective acquisitions. We target maintaining minimum cash equivalent to roughly two months of revenue (eg, about $5.3 billion based on Q2 revenue). After meeting those needs, our intent is to return excess cash to stockholders through share repurchases).

What about the crackdown on freeloaders? The letter touched on them as well, saying that NFLX is in "the early stages of working to monetize the 100m+ households that are currently enjoying, but not directly paying for, Netflix" with the company seemingly targeting Latin America most of all, to wit:

We know this will be a change for our members. As such, we have launched two different approaches in Latin America to learn more. Our goal is to find an easy-to-use paid sharing offering that we believe works for our members and our business that we can roll out in 2023. We’re encouraged by our early learnings and ability to convert consumers to paid sharing in Latin America.

In kneejerk reaction, NFLX shares, which rose 5.6% into the close following today's blistering session, jumped as much as another 10% before paring the gain modestly as investors finally breathed a sigh of relief. If this gain holds, it will be the streamer’s first gain in the session after earnings since January 2021...

That said, despite the modest beat in current quarter subs, there really isn't much to cheer in these earnings. As Bloomberg Intelligence writes, "guidance for 3Q was weaker than consensus, and the lack of any major catalysts till 2023, combined with foreign-currency pressures, will fan a bear thesis of rising competition and elevated churn amid economic pressures.”

Meanwhile "what the market is looking for is clarity not just on the subscriber growth trajectory but also on other metrics. How are they going to drive ARPU [average revenue per user]. How are they going to drive margin? If you look at the margin guidance for the third quarter, it’s 16%, well below the 19-20% that they’re guiding to for the full year."

None of this matters for now, however, as the stock is solidly in the green. Don't expect that particular euphoria to last.

https://ift.tt/Mq5Po9m

from ZeroHedge News https://ift.tt/Mq5Po9m

via IFTTT

0 comments

Post a Comment