Sinking Estimates Are Music To Ears Of S&P Bulls

By Lu Wang, Bloomberg Markets Live commentator and reporter

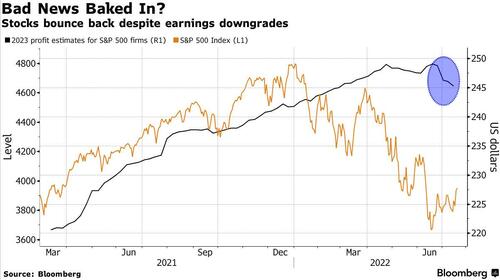

Wall Street is slashing 2023 profit estimates and positive earnings surprises are dwindling, yet stocks are holding firm. To some strategists, it’s a sign that the market has priced in much of the gloom.

After sticking to their rosy outlook during the first-half equities selloff, analysts are now trimming their numbers. Profit projections for next year for S&P 500 Index firms have fallen for four straight weeks, sliding almost 2% to $245.30 a share, according to Bloomberg Intelligence. That’s the fastest downgrade since the data began in early 2021.

Against the souring earnings backdrop -- likely spurred by a drumbeat of firms citing pressure from the surging dollar, mounting costs and recession fears amid Federal Reserve tightening -- stocks have managed to advance. The S&P 500 has gained more than 4% since July 14, when big banks unofficially kicked off earnings season.

Underlying the resilience is the fact that investors saw it all coming. Money managers have spent all year selling stocks and raising cash, reducing equity exposure well before this reporting period. To strategists at JPMorgan Chase & Co., the move by holdout analysts to finally join the crowd of skeptics is the latest evidence of a sentiment washout that could lead to a sustained market recovery.

“A reset of earnings expectations could be taken as a positive as investors stop seeing estimates/guidance as being behind the curve,” JPMorgan strategists including Marko Kolanovic wrote in a note this week. Stocks have tended to “trough ahead of the earnings trough, and weaker guidance could open the doors for the Fed to pivot and tempt investors to step in the market, looking for the inflection point.”

In some ways, analyst downgrades reflect what’s been a relatively weak start to the reporting season. Firms that exceeded Wall Street expectations by a wide margin in the aftermath of the pandemic are having a hard time repeating that success.

About 72% of S&P 500 firms that have reported results this cycle as of Wednesday have topped profit estimates. While that’s in line with the historic norm, it trails the average of 80% in the last two years.

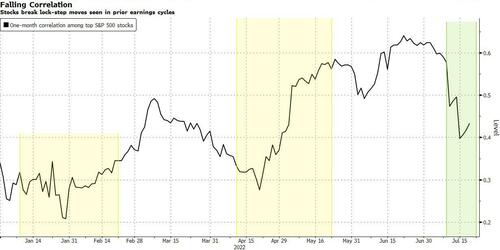

There may be another silver lining for stock pickers: This earnings season appears to be reorienting investor attention to the fundamentals of individual companies.

Unlike the last two reporting periods, when the overwhelming grip of larger economic forces spurred lockstep moves across equities, realized correlationamong S&P 500 shares has fallen this time, a sign of easing concern over macroeconomic uncertainty.

To Chris Senyek, chief investment strategist at Wolfe Research, the earnings downgrade cycle is just getting started. Inflation will stay hot, forcing the Fed to raise rates for longer than anticipated, he said.

“We still expect a demand-driven U.S. recession to hit in 4Q22 or 1Q23,” Senyek said. “EPS expectations have to come down at least 15%.”

How the market would handle that is the key question. With the S&P 500 down 17% this year, a lot of bad news is baked in.

However, seen through the lens of valuations, the view is less clear. At 16.6 times predicted earnings, the multiple is roughly 5% above the 20-year average.

https://ift.tt/R4UdWy1

from ZeroHedge News https://ift.tt/R4UdWy1

via IFTTT

0 comments

Post a Comment